Recently one of my friends asked me about contra-trades, i.e. trades made before settlement and that led me to reconsider if these practices are advisable for the average investor and if it goes against the very principle of investing. From my point of view, I think there are many ways to argue why this practice is either “right” or “wrong” but instead of going that path, let me share with you guys a more objective point of view. Hopefully, after reading this post, you will have a clearer idea of why I am one of those who will sell when there is an intra-day or contra-trade opportunity even though I am a stooge investor myself.

Pump-and-Dumps are never initiated by calm and calculated investors

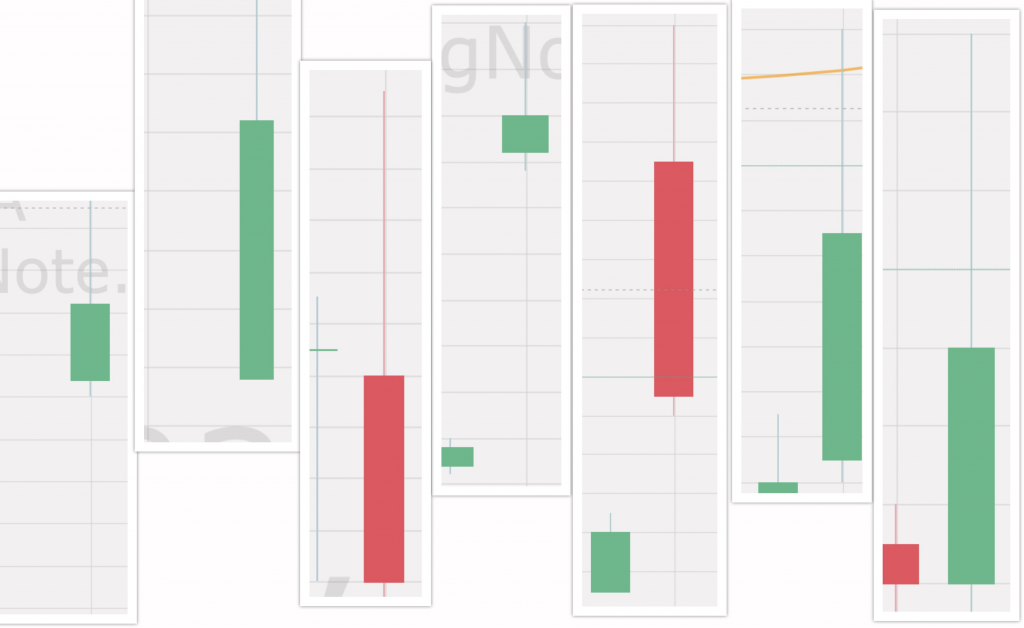

Experienced investors are used to buying when the markets or stocks are still on a decline simply because it makes sense. Being an investor, I am often caught in many situations where paper losses are common and ever-growing. When I start accumulating stock from a company that is undervalued, I usually take a longer-term approach but at the same time, I will plan ahead for such pump-and-dump situations. Usually, when there are news triggers at the end of the day after the market closes, the anticipation and overwhelming optimism will usually lead to a huge amount of buying pressure on the following trading day. As such, it would be common for me to make a profit when there is a significant spike at opening around 9.15 am when the craziness settles and just before the selling starts. While this is not always a uniform event (as the rally might continue after morning), I will usually monitor closely to see how the market is reacting to make follow up buys or to hold until the price retreats.

It is not wrong to punish greedy individuals

A calm and collected investor who has been monitoring a particular stock counter understands not only the company’s potential and value but at the same time is sensitive towards abnormal price movements. Such extreme changes are usually caused by two factors, a pressure release from over-pessimistic outlooks curated by the media and lay investors otherwise it is caused by overwhelming greed. Neither one of the reasons are legitimate reasons to change the valuation of a company to a great extent hence it is also logical to believe that the increase in stock price is temporal. I use the word “punish” but I do believe that it is a familiar situation for many of us as we are all at times, manipulated by our emotions to make decisions out of impulse. In short, if you understand the stock well enough, take advantage of these situations and sell knowing that there will be opportunities to reenter at a later time or day.

Never buy in just to join the ride

The third point is actually mort crucial in this post because as investors we can be opportunistic and wise during pump-and-dump situations but we should never join in the greed train and try and make a quick buck intentionally. I am saying this not because it is impossible to make a quick buck like how traders do it but as investors, we should not be looking out for quick bucks but bigger bucks in the long run. As such, stay away from such situations at all costs if you are training to be a disciplined investor. The bottom line is to never contradict yourself when you are an investor and only act out of logic and reason.

Closing Thoughts

Pump and dumb situations do not come by often but do take advantage of it if you are already vested. Otherwise, do stay out of it and not act based on impulse and green. As investors, we should always focus on making calculated moves and if it makes logical sense and it does not conflate with other tenets of investing, then I should strongly advise you to make the call. At the end of the day, we are all trying to maximize returns and reduce capital risk, so if it is riskier to not sell, then sell first to take advantage of that pump-and-dump situation.