Once in a while, Loopholes Singapore will do one post that is more practical than philosophical and this is exactly what I intend to do today. Furthermore, this post will be Loopholes Singapore’s 200th post so I feel it’s apt to share something which I feel is especially valuable to my patrons.

Today’s post will be focused entirely on the amount of capital you will need to trade and get returns that makes sense. Firstly, I would like to point out that these tips are not foolproof but this is how I trade stocks myself so this is definitely tested and proven. That said, trading is not for everyone, however, for those of you out there who are interested to hear first hand from a trader, you can read on and try to understand as much as possible before you start trading yourself.

What will you gain by the end of this post?

- Why you will never put money into Fixed Deposit or any saving plans which pays less than 3% guaranteed.

- Traders do not always aim for maximum profits

- Traders are not necessarily professional investors, vice versa

- Trading requires more emotional stability than strategy

- Sg stocks are good for trading as well so long as you know your counters well

What stocks to choose and why?

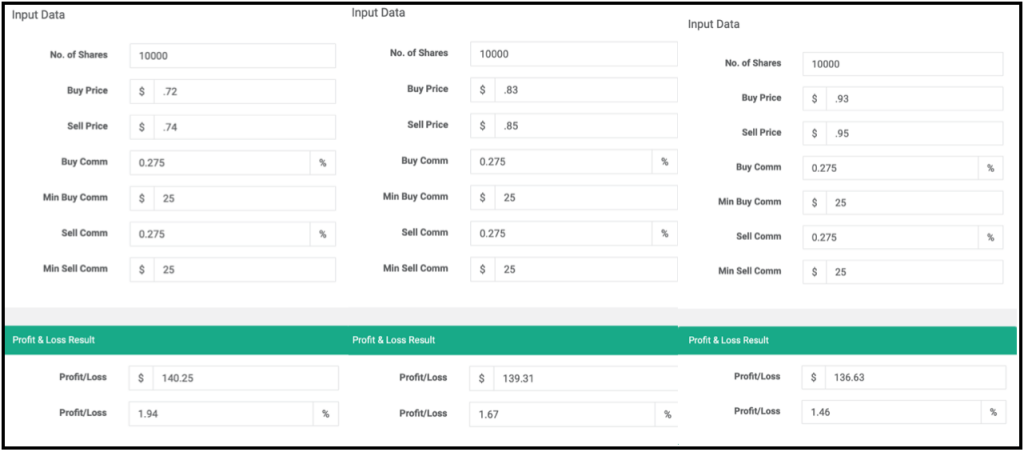

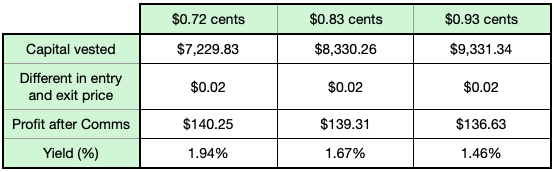

Let’s start with the entry-level requirements so that the examples below can be more relatable. Essentially, people with less than $30,000 to trade should only pick stocks that are less than $1.00 per share so that you can afford to buy 10,000 shares easily with less than $10,000 after factoring in commission. The importance of buying 10,000 shares is so that every cent difference will equate to $100 and this will allow you to breakeven earlier. Also, since the cost of 10,000 is lower than $10,000, you will be paying the least possible amount of commission per trade. So what does the profits look like trading stocks worth less than $1.00? Take a look at the table below.

Sample trading and profit table for the above trades

From the table above, you can see that a mere 2 cents difference in the entry and exit price will yield you around $140.00, and depending on your principal amount, your profits will be around 1.46% to 1.94%. In the next segment of the post, I will be giving you real examples of these trades above and how frequently you will be able to make these trades in the last month or so using YZJ SGD as an example.

Example of using the above trading plan

No doubt, it will be quite difficult to catch every possible opportunity to enter and exit at the lowest price however, it is possible to catch a few of such scenarios of each stock you are familiar with. Furthermore, this trading technique will only require you to have one tranche of capital to trade. If you had multiple tranches at your disposal, you will be able to replicate this manifold and similarly multiple the profits as well as chances to catch such prices. Of course, I am simplifying the steps and downplaying the skills required to achieve such results however, do know that the only way to learn is to try it yourself. Perhaps you might be able to come up with a more suitable trading strategy to suit your own trading style. Personally, I trade stocks at many different price points but it all boils down to the same strategy in mind and that is to minimize punishments from price fluctuations and maximize profits whenever possible.

Closing Thoughts

This post is created to give you a snapshot of how some traders trade in reality. Do take note that this is not the only trading strategy available as there were other strategies mentioned in previous posts as well. However, I guess the above strategy and example captured the principle of trading and that is to seize as many opportunities as possible to maximise profits out of each tranche of capital. I hope my sharing will spur more people to try trading stocks themselves (when they are ready) and not be misled by the things shared by self-proclaimed gurus that generally do not make sense to real traders.