I am sure we have been hearing a tonne of online material featuring sustainable technologies. Most noticeably, we have companies like tesla that is the forerunner for electric cars in the United States. Evidently, that stock price has risen more than 200 times in the past 3 years) and it is still rallying at the moment. That said, I feel like while those companies are vested in the whole idea of sustainability, it is not really sustainable investing to me. Personally, sustainable investing is about achieving sustainable yields. In today’s post, I will share my thoughts on sustainable yields and how they will be beneficial to investors who are in them for the long run.

Focused on Fundamentals

The main ingredient for sustainable investing is the confidence you have in your investments. To explain further, the only way you can be a part of a company’s journey for the long haul is because you have confidence in its long-term prospects. As such, we have to keep track of its business trends, cycles, and growth over time. As much as that makes sense, many investors are slowly lured into the herd of social media and stock news followings. This allows stock prices to continue rallying despite having extremely ridiculous fundamentals. To that I say, most investors investing in those companies are more of gamblers than investors and it is not recommended for investors who believe in solid fundamentals.

Objectivity – Not following the crowd blindly

I wrote a post about “How to and why be a contrarian investor” and honestly, I felt like a fool even right now because the market that I felt is led by big boys tugging the market is still on the rise. This makes staying objective even more of a tall order because I do not understand why the market is so bullish despite all the impacts of money printing and the pandemic. Even so, I had to stick to the original strategy and company fundamentals, and thankfully, it was still decent considering that I am only vested in the Singapore market.

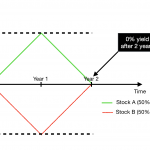

Habitualization – Getting used to high yields leads to future mistakes

This part of the post is going to sound a little odd but basically, we are all creatures of habit. After a year of phenomenal returns, I can only imagine how would investors continue seeking yields in the near future. Right now the economy is definitely overheated hence, there is lightly to be a correction and consolidation immediately afterward. At that time, we will start to see massive volatility in the markets and many confused and agitated investors. On the other hand, those of us who have been investing in the slower markets will be less impacted and more likely to perform better in the years to come.

Closing Thoughts

We can only imagine how it would be like in the future as inflation eats up the profits of companies. If wages of the lower segment of society do not catch up fast enough, we will likely descend into another crisis and at that time, money printing will probably be a bad option considering that it was the main cause of the crisis in the first place. Hopefully, we can start to see a correction sooner than later otherwise the impact of that correction will be amplified. To prepare for this, I have slowly adjusted my strategy to short-term trading rather than longer-term investments. This is to ensure that I will be able to react by selling my holdings faster when the correction happens.