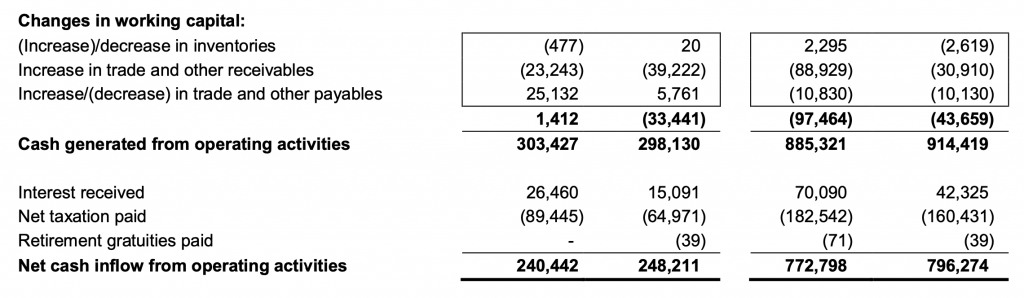

Genting Singapore is part of a larger Genting Group which is based solely in SG for its gaming and hospitality business. Been looking at this stock for a while since its decline from $1.13 as I recall but has since been treading below $1. Looking at the above cash flow statement, I am impressed that they have achieve very similar results from previous year’s Q3 performance. In view of the slowing growth of most economies, Genting SG manages to retain interest in its industry. Contrary to popular belief, the rich do not only patronize high end services only during a good economy, as its akin to going to a cinema for them when they need a breath of fresh air.

General Trend (Weekly Chart)

Based on the weekly chart, Genting has finally broken its down trend. Therefore showing that confidence in the market is recovering from its lows at this gloomy period. Having said that do exercise some level of caution when buying into the stock as it still has some room to grow before recovery is certain.

Looking at how the support held at 0.855 for Genting SG, we can see the stock’s resilience despite having high volumes of trade for many days in the past 6 months. I also included the performance of STI in the background to compare the level of resilience of Genting SG to STI. Overall it is remarkable for this stock to stay above the support line, which many investors where unsure about.

Author’s Call

- Short term outlook stable (Revenue and Profits fell but within expectations)

- Entry point identified at around 0.9 to 0.95

- Strong support at 0.85 in terms of safety margin

- Not recession proof; however if there is further good news from US-China might trigger some additional volatility (potential upside)

- Short levels are miniscule for this particular counter