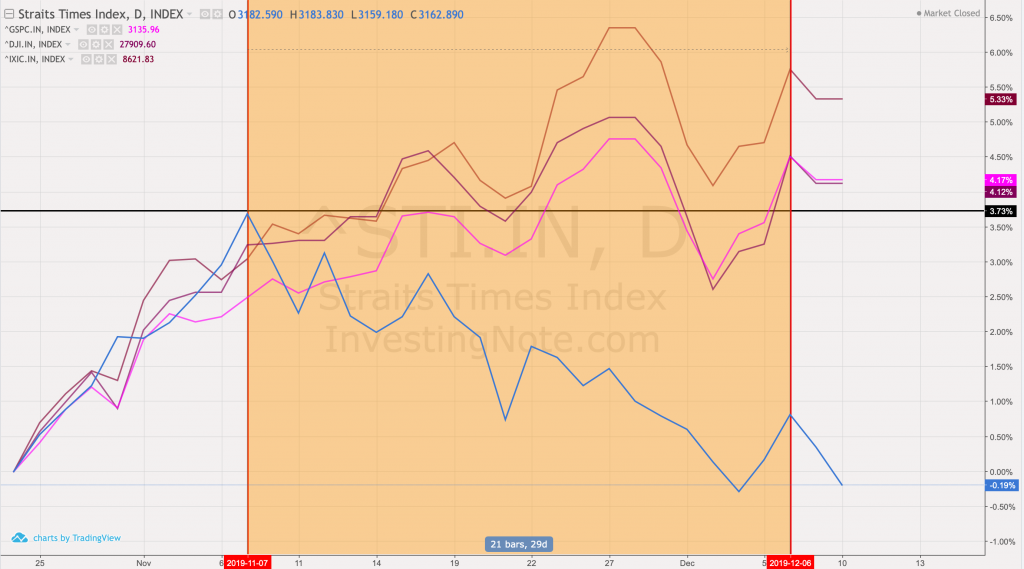

In the recent month was that STI no longer follows the general trend of US. This is peculiar because US markets are able to affect the rest of the world, especially when it comes to trade oriented nations like Singapore. Furthermore there is no way to stop foreign institutions and retail traders from affecting local markets. Therefore the question is why has STI deviated from US trends from 7 Nov?

As shown on the charts, STI begun its decline despite US indices continued ascend into all time highs. The reasons behind this divorce might not be easy to tell especially when issues on trade are usually affairs between private entities. I have summed up the 2 main possibilities and how it could pan out in the end when all of “this” is over.

Artificial spiking of capital into US markets

US markets are highly in question for its growth right now. In the past years, the fed has been affected by the Trump administration despite it being non-partisan. Additionally, the reduction of corporate tax has also spiked the growth of economies. It is like taking a strong Panadol during a fever.

Is this a “calm before a storm” situation right now? No one really knows however we can agree to some extent that no country or company can grow forever in an unsustainable way for extended periods of time.

Recession Looming

While veteran investors might tell you that the recession you fear is already happening, we can never be sure of it. As such, traders and investors of US markets should practice greater caution in preparation of a major correction. As much as this is unfair, STI might also be punished by US’s fall because much of the capital in Singapore businesses are invested by foreign investors.

How will this episode conclude?

There is bound to have a frightening effect at the end of this episode. Albeit the masking of the festive season in many countries, many investors are already holding back. An example of a natural effect is a yo-yo effect, whereby either indices of US or Singapore caving in eventually. It will not be surprising to see US falling back to rejoin STI trend because of the aforementioned reasons. All it takes is a series of news to act as a trigger in US to make this happen.

The silver lining in the matter is that STI is not following blindly. As mentioned in multiple market outlooks, Singapore is playing cautiously, hinting that they are bracing for a gloomy 2020 ahead.