Optimism is back with good reason?

As we all would have known by now, all central governments and other governments of nation states have been throwing monies back into the economy through various channels in hope to tame the markets and restore optimism to the financial markets. However, the underlying concern remains because money does not solve health problems but it does accelerate efforts to curb the problem, slow down spread and help more people get back on their feet sooner. While many of us are not experts in epidemiology, the only strategy now is to keep diversifying if you have excess funds to tap on the discounted share prices. Additionally, do not wait for the good news because the markets will react way before you can.

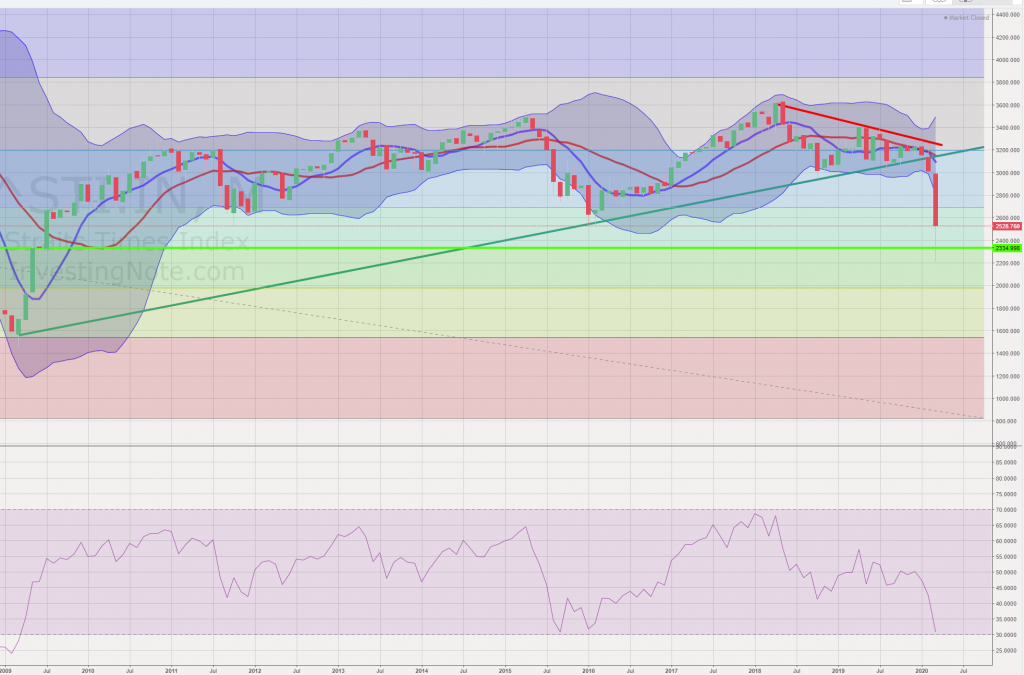

STI – Updated Weekly Chart

Though there is no certainty that this is not a “dead cat bounce”or a bottoming, we should not assume either outcomes because every crisis starts, happens and ends differently. We should only based our views on what is happening and what could possibly upset the markets in due time. Judging by the weekly candlestick from last week, we can clearly see that STI is desperately trying to reject a further downtrend and it won the sentiment at the end of the week.

STI – Updated Monthly Chart

STI will start a new candlestick soon and it will be critical to see where it starts and if the gap is big, positive or negative. With the support from the government guaranteeing measures to help businesses, gig economies and self-employed, it is likely that the optimism runs for a while before attention turns back to major economic news like US, China or Europe.

Author’s Call as of 29 March 2020

- STI supported by fibo retracement levels (SG budget also provided a short term boost)

- Good time to accumulate if the price is right especially for companies affected by Covid-19

- Recommendations to buy in tranches and according to how much paper losses you can tolerate is key

- STI has been modest before the decline so there is lower chance for STI to continue to dive deeper than it did

Author’s Call as of 22 Mar 2020

- Support level at 2335 possible entry point for longer term investors in STI

- Many blue chips are offering high yields at the moment, worth considering

- Plan ahead and purchase according to your time horizon

- Short term plans can be based on previous year yields to set a reasonably advantageous entry point.