Although the amount of capital is crucial for any investment, what’s usually neglected is the amount of time you can afford to remain vested. Essentially, the amount of time determines both the degree of risk and reward. This means that if you are able to hold for long periods of time before selling, then your potential losses and gains will also be diminished. Having this understanding will allow investors to understand what is the actual profit of your capital investment and how to maximize your capital’s opportunity cost.

The longer you hold, the lesser you lose/gain

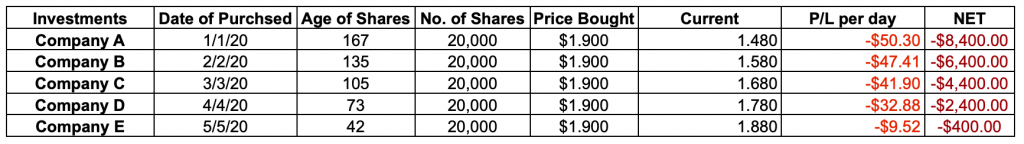

To illustrate my point, I created a table to show how profits can be affected over time. If you notice, the profit and loss (P/L) for Companies A, B, and C are similar despite having different current values. This is because of the age of each investment as shares from Company A were made earlier, therefore the denominator for P/L is also larger, resulting in a lower P/L per day. This is also known as an opportunity cost for some but it is important to witness the importance of holding duration.

On the other hand, having long holding power also helps alleviate losses because P/L will also decrease over time. Therefore, it is mathematically true that having longer holding power reduces capital risk.

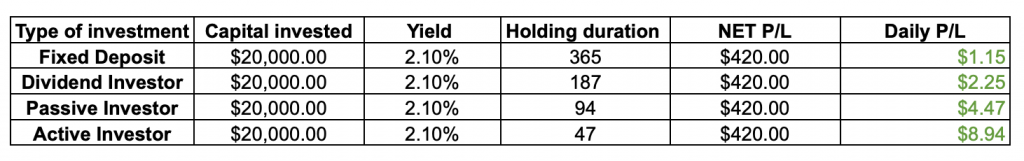

Calculating profits factoring opportunity costs

While focusing on yields are important, we should always consider the actual yields of the investment relative to the duration of the investment. This might come off as a huge bummer for yield hunters that parks cash into fixed deposits and saving plans. While yields can be similar or even identical, the time taken to achieve them matters as well. Refer to the table below for more details.

Holding power gives investors the power to choose

From the examples above, we understand that yields are also affected by the holding duration after factoring opportunity cost. This shows that we should always take into account duration when making an investment. This is especially important when making time deposits and signing policies that last for X number of years so that we can make informed choices when investing. Besides that, remember that so long as you have holding power, then you should consider investing without a lockdown period. This will enable you to divert funds without penalties and at the same time increase your odds of achieving targetted yields sooner or higher yields over time with the same amount of capital.

Closing Thoughts

Through this article, I hope to elucidate the idea of yields after factoring the holding period of a particular investment. As such, investors might want to set profit targets based on realistic daily profits. This will help maximize the opportunity cost of your investments. On the other hand, holding for longer periods of time will also help reduce your daily losses. Last but not least, always consider making investments without a fixed duration to reduce loss due to holding duration.