STI broke support and is currently retreating to 2436 (Weekly Fibo Support)

STI’s weakness in the past months extends last week as the US continues to shake the Singapore market due to our reliance on trade and geopolitical stability. In addition to that, there has been a surge in the number of cases around the world therefore adding additional pressure on the sectors such as aviation and tourism that have already been treading in deep waters. In today’s STI Market Outlook, we will take a step further and look at fund flows to understand the situation of the SG market and whether there are signs of recovery or trend reversals.

STI – Updated Daily Chart

STI is still trending downwards with slight volatility at the moment. There is little to analyze on the daily chart as the sideway consolidation continues to extend with no specific date or event ahead that can potentially spike the index in the coming week ahead. However, the next wave of financial reports, either Q3 or FY performance might be the next trigger for companies to go up or sharply downwards. Either way, there is a strong belief that so long as international travel continues to stay low, Singapore will stay negatively affected apart from services that can be provided online.

STI – Updated Weekly Chart

On the Weekly Chart, STI is resting above the support level of around 2436 hence that would be our next critical support level. Please also take note that there are many other support levels at this juncture and the lower daily training volume also signals the slowing of trade in our markets, which might be good news as well.

There are often two ways to think when the market is already at a low and that is to continue imagining that it descends or that it is about to bounce. As investors, there is reason to subscribe to both perspectives but the logic for something that is low to go lower is always harder to believe. It is kind of pathetic for us to have such a psychological debate in our minds when businesses and people working in them are struggling to keep their employment and restore business revenues. As investors, I believe that we can occasionally be yield-driven however when markets are down, I believe that we are also supposed to stay confident in the market at our own capacity.

Fund Flow Analysis

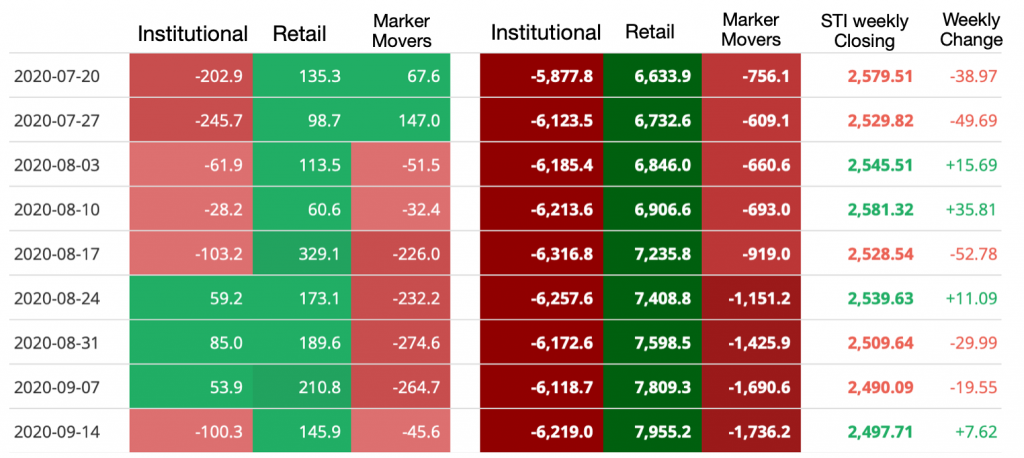

If you compare institutional and retail buy and sell, you would have realized that institutional funds have been exiting Singapore’s market and market movers are doing nothing but following the dominant trend. Retail investors, on the other hand, has been gobbling up the cheaper shares in hope of future yields during a recovery phase. In my point of view, this is positive because institutional investors move funds cyclically to earn commissions and fees regardless of the price of the stocks. Therefore, since there is still future growth despite the impacts of the pandemic, STI’s future value will eventually surface as well.

As for the columns on the right which shows the cumulative trade volumes, the institutional traders are starting to show a less clear trend compared to retail investors who are still consistently net buyers week after week. This means that retail investors are still hopeful about a potential rebound but the big boys are still at an “undecided” state at the moment.

Author’s Call as of 27th September 2020

- The US-China fight continues with a small truce for the TikTok Global deal

- The second wave threatens the market again but people seem to be mentally immune by the news already

- Sectors affected by international travel are still balancing on support levels (SIA, SATS, G13)

- Retail investors continue to buy at low prices while institutional investors continue to sell

- Phase 3 news in Singapore has not impacted the market due to our reliance on tourist spending and prolonged trade tensions

Author’s Call as of 20th September 2020

- STI is immune from recent corrections

- STI continues to receive support from the government for the time being and companies are all on their toes

- Technical analysis shows that moving averages are flat but are still not signaling recovery or further downside

- Singapore continues to extend handshakes with other countries to resume travel