Capitalism is only possible when people believe that they can possess more private property and capital over time. However, it is not possible for all countries to get infinitely richer simply because money is only valuable insofar as it stays finite. That is why countries have to encourage borrowing from its citizens so that they can add more debt into their balance sheet so that they can afford to continue selling the capitalist narrative. This results in an ever growing amount of debt and higher risk or default as it is getting harder to predict how funds flow from different individuals and entities. In this post, we are going to explain why this vicious cycle persists and how it actually leads to financial crisis from time to time.

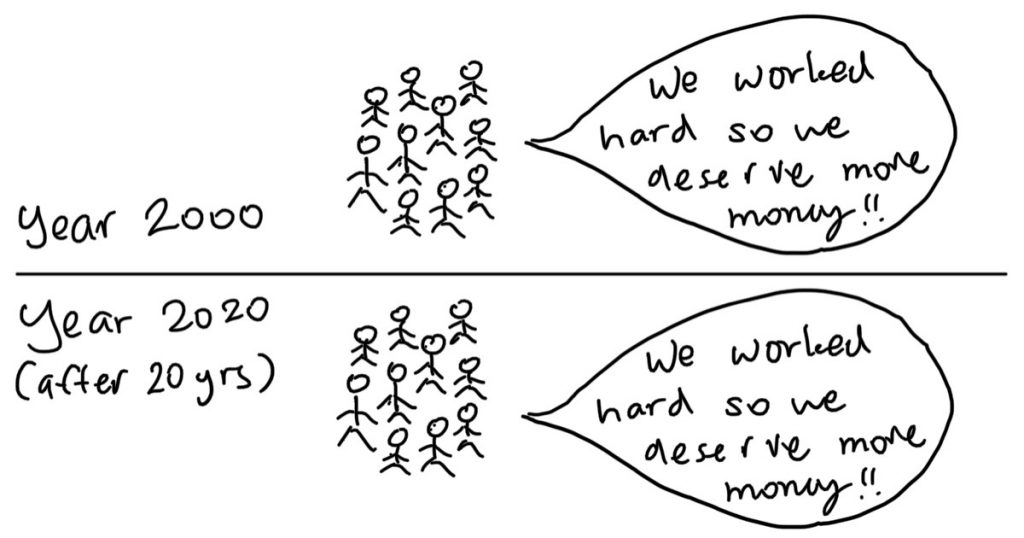

People in capitalist nations constantly expect to get richer over time

One of the few constants in a capitalist society is the endless expectation to get richer. These expectation exists at all levels of society and the most common example would be annual increments when you stay in a company you work in. Although its true that some companies do earn more revenue or profits over time, that increase in income usually are not enough to account for all the additional expenditure and expansion plans. Therefore, it has become increasingly common to see companies take on long term debt or raise funds through bond sales and other credit facilities.

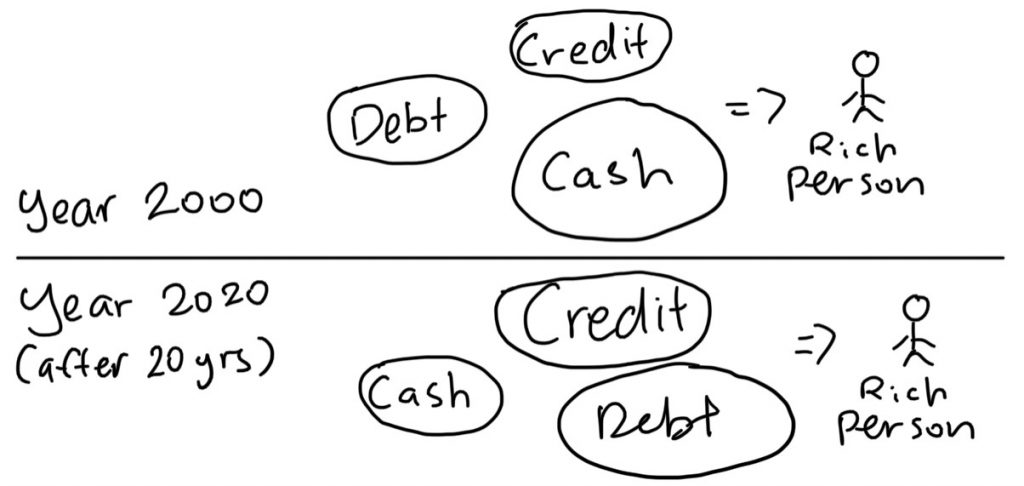

Composition of a person’s net worth might have changed drastically

In the past, debt is something that most people avoid simply because interest rates are just too costly for the borrower. However in modern times, borrowing money might be cheaper in some cases compared to using cash. As such, more people are getting richer not because they are earning drastically more than the past but because they are taking on more debt to invest and purchase assets.

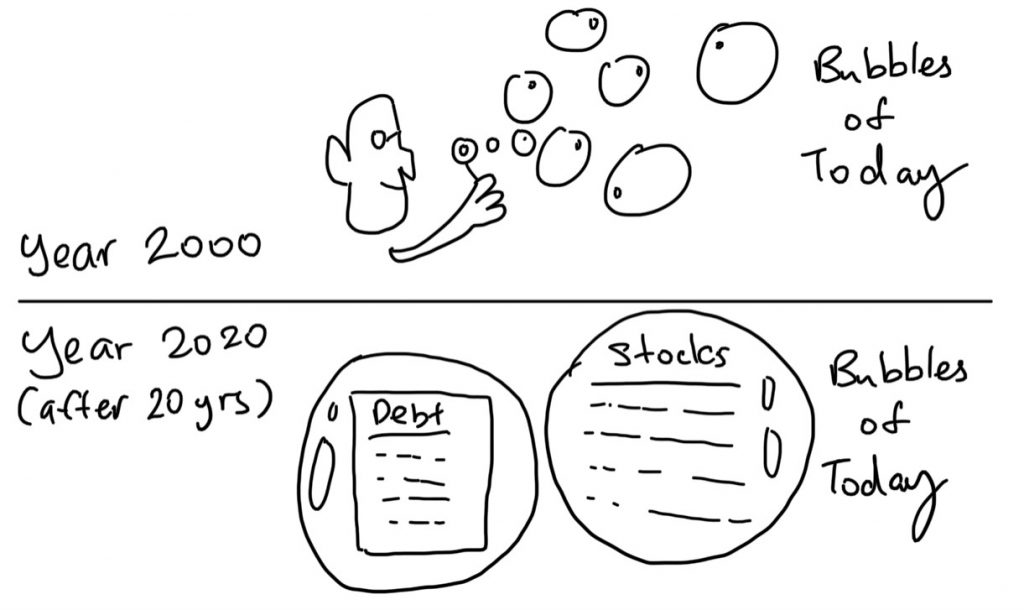

(Debt) Bubbles are becoming more and more common

While this might be a little exaggerating, it is also seriously true that debt and stock bubbles are growing at a much faster pace compared to the past. Judging by how the market capitalization of companies can increase by 100% in less than a year exposes the fact that many equities are way overvalued. And this has been largely caused by the sudden increase in national debt and borrowing caused by the decline in interest rates especially for reputable companies.

Closing Thoughts

With debt rising much faster than we can generate as individuals and as nations, I am not sure if this is sustainable on the long run. I do understand that this phenomena is common around the world but if this goes on, I am afraid that it will become increasing detrimental to depositors and regular citizens working from hand to mouth. Furthermore when inflation catches up with the increase in interest rates, it would not be difficult to imagine the number of loan defaults increasing. At that time, will capitalism survive?