Operating a large fund can sometimes be fun to execute DCA especially when you intend to make short-term trades. That said, the fun quickly dissipates when you are executed DCA too quickly. These mistakes normally follow an expectation for a rebound or stability in stock price. However, prices might always continue to head south rendering all your strategy and composure pointless in the face of a further drop in price and market sentiments. That is why this week’s post will be centered on how to determine the right DCA interval for your own investment planning. I will be providing some simple math formulas that you can take reference from to help you make a more informed decision.

Defining the DCA Interval (share price)

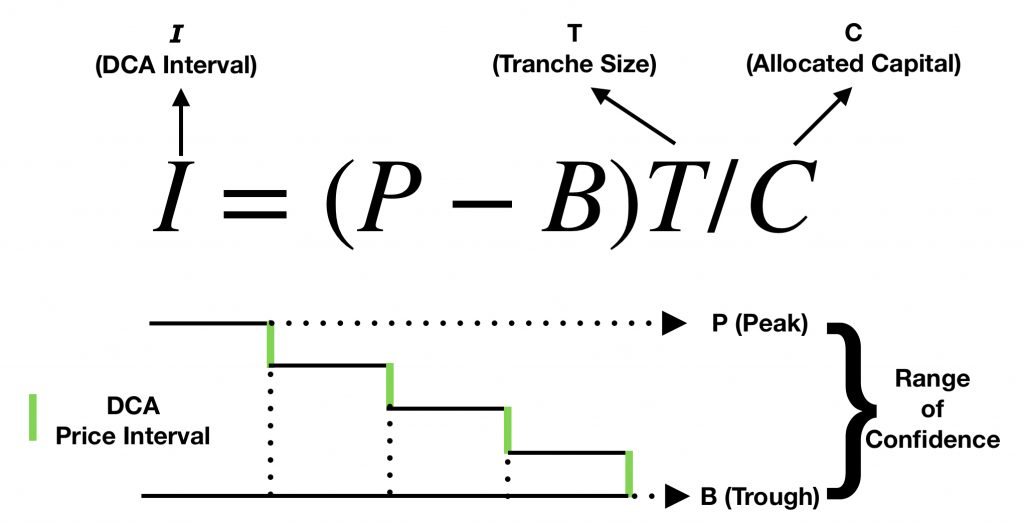

To determine the appropriate DCA interval, you can take reference from the above formula and model, bearing in mind that the above strategy is effective insofar as your peal and bottom prices are accurate. Otherwise, you can just substitute the values of the formula accordingly and find out the suggested DCA interval. For example, if you have allocated $30k capital and have a tranche size of $10k while identifying that the price of a particular will likely be between $1.30 and $1.00, then your DCA interval will be every $0.10 per $10k tranche.

Complicating the matter (Realistic situation)

When practicing DCA, the reality becomes way more complex compared to the above example. That was why I wrote several articles on why DCA is expensive and how DCA can be executed wrongly. Even after all that, I still feel that there is much room for improvement in the DCA strategy, particularly how we stretch out intervals to gain an additional margin of safety. For that, I proposed that you can add a factor of around 0.5 to the formula so that your subsequent entry prices will be 50% farther away. This technique is particularly useful when the market is experiencing a severe downturn. So in short, invest each tranche of capital imagining that it is your last so that you will deploy capital at a more appropriate rate.

Adding a margin of safety during CD

Dividend announcements technically equate to a guaranteed return if you hold shares until the Ex-Dividend date. This also means that you can factor in a premium in the current share price by the announced DPS to lower your next entry price. By doing that, you can aim for a lower entry price as the stock value will likely be discounted by the dividends distributed back to shareholders. For example, if your next entry price is supposed $2.00 before a 5 cents dividend is announced, then technically, you can shift your next entry price to $1,95 instead of $2.00, which will add a margin of safety 5 cents.

Closing Thoughts

DCA planning can be flexible but it cannot be changed out of impulse, the above examples can be references as to how an investor would deploy capital and average down on his or her holdings over time and price fluctuations. With a logical approach, DCA will be able to help investors accumulate shares over time with