It is pretty apt to bring this topic up at the current juncture because there is increase volatility in the global financial markets due to the upcoming US elections. With higher volatility, it increases the uncertainty of our entry points because the likelihood of an investor buying at a wrong price can occur at a much higher rate. This generally discourages investors from jumping in, in fear of making a wrong move. However, this issue can be circumvent with an adequate time horizon built into the overall action plan. Therefore, it would be important to understand how our time horizon affects our investments especially during turbulent times.

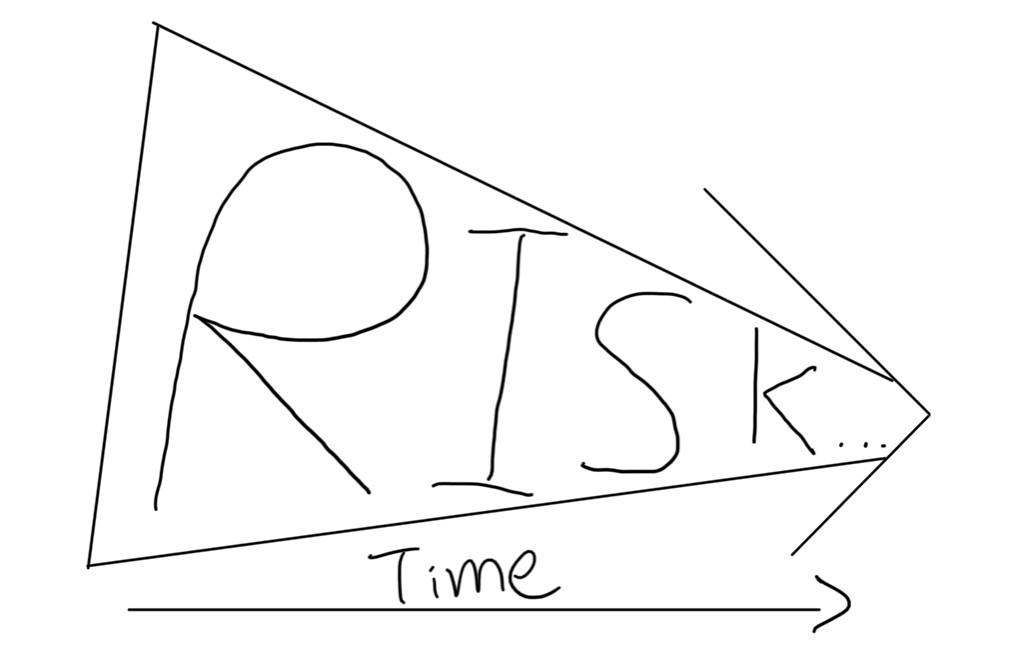

Risk decreases over time (for most quality companies)

It is true that if you would have bought into a company which performs poorly consistently for many years, you would have suffered increasing amounts of paper loss. However, if you would have invested in a company that earns a decent amount of profit after taxes every year, then the stock would have performed relatively well over time. Although you might have bought into the stock when it was not any where near the bottom, history have shown that stocks of quality companies tend to remain stable for dividend paying companies and a higher share price for growth stocks. This is why time might be in most cases a necessary ingredient to reducing capital risk.

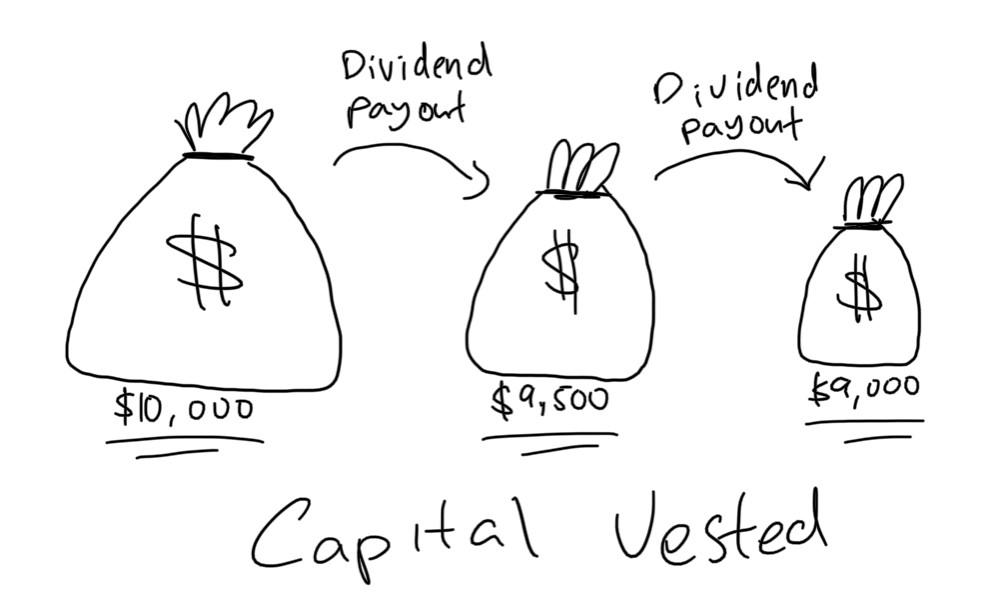

Dividends return you parts of your original capital

It has been mentioned before that dividends are like rebates rather than interest payments. Regardless of the share price, dividends does reduce the capital exposure of your initial investment. Therefore, your average share price would have decreased over time after each dividend payout. This rebates allows you to reinvest further when rebalancing or divesting into other stocks and bonds. Either way, dividends payouts help to reduce capital vested and increases yields of payout after each subsequent year if the payout remains the same or increases over time.

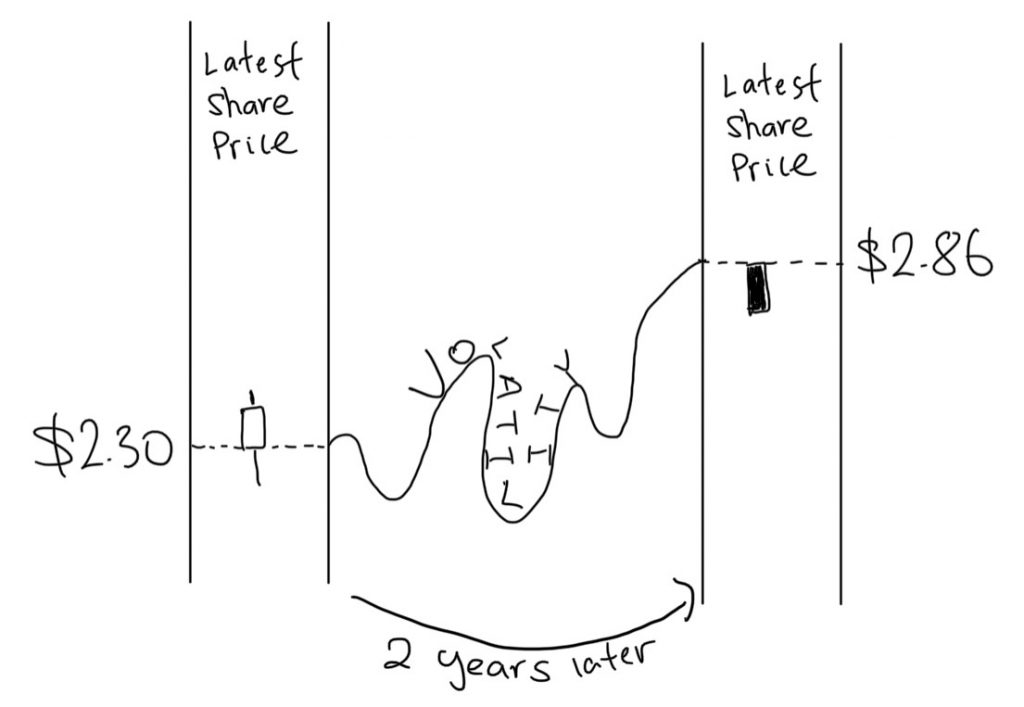

Time allows you to ride the volatility of the market

While it is not recommended for investors to ignore their holdings without anyone monitoring its performance, it is true that a relatively long time horizon helps investors leap pass periods of volatility and eventually if the company continues to perform relatively well, then the investors would have been able to achieve positive yield. Especially if you have invested in stocks during a financial crisis, it will take some time before the market stabilizes at a price reflective of the stock’s fair value.

Closing Thoughts

There is hardly a time to stay out of the market. While in retrospect, we can easily point out when it is the best time to invest our monies in specific stocks but it is almost impossible to tell what the price would be in the future. That is why we should not second guess the markets but instead plan ahead by setting a reasonable timeline for our investments. Having a relatively long time horizon would not only reduce capital risk and increase dividend yields but also allow your holdings to appreciate in value.