Many big Chinese companies are becoming increasingly prominent in the past decade as they mirror the business models of tech companies in the US. However, for many Singapore investors, we might not be as familiar with the tech companies of China due to various reasons. Therefore, I believe that many of us have had some inertia diversifying into the Chinese tech stocks listed on HKSE. The good news is that the Hang Seng Tech Index helps to bridge that gap and allows Singaporean investors to gain exposure in the Chinese Tech industry. In today’s post, I will be sharing some of the slides from the info session on 13 April for those who are interested to invest in the tech sector in China.

HST contains a portfolio of around 30 constituents at any given time

HST handpicks the biggest tech stocks and allocates capital in those stocks appropriately to maximize growth potential for the ETF. This could be an overly simplistic way of explaining but basically, HST contains a basket of 30 of the largest tech companies listed on the HKSE with each counter capped at around 8%. Taking a long-term approach with China’s growth targets still remaining positive for the foreseeable future, the ETF allows investors to ride the ups and downs of the sector without worrying about diversification and optimizing capital allocations.

Strong demand for Chinese Tech Companies in Singapore

The chart above shows the unit of units sold in the past 4 months since inception on 10 Dec. This means that the general sentiments of the ETF are positive despite the correction in the tech sector (including the Chinese Government Anti-Trust Probes). Taking on a longer-term approach, HST is potentially a good way for investors seeking growth. Also, the recent correction also lowered the entry price of the ETF that may be good for investors to buy in or accumulate.

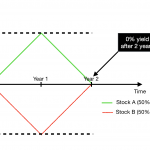

Tracking the Actual Hang Seng Tech index

Like all ETFs and managed funds, there will also be cost involved for fund management. HST is no different however, it has done a good job tracking the performance of the actual Hang Seng Tech index. This means that you are essentially paying a relatively small fee to invest in a diversified and lower volatility financial instrument tracking Chinese tech giants and other promising tech companies.

Closing Thoughts

Since an ETF is not buying a single company with its performance as the main driver of its price, investors can treat this ETF as a bet on the entire future of the Chinese Tech Sector. Honestly, the headwinds now are glaring and to some extent maybe even worrying but since we will never know the bottom of this episode, perhaps buying in tranches might help reduce capital risk if there are concerns raised about the immediate future of the Chinese Tech sector. Nevertheless, I feel that the future of Tech continues to be bright especially when you take into account the size of the Chinese market and its expansionary plans into the middle east and ASEAN.