Step trading is the most common trading method used to extract value from stock purchases. In fact, the “buy low sell high” strategy is also derived by a simpler method of step trading. However, this method is not simply buying low and selling high but instead to try and balance your holdings in case of unexpected price movements. In today’s post, we will go straight into the effectiveness of this trading method and how we can use it ourselves when trading stocks.

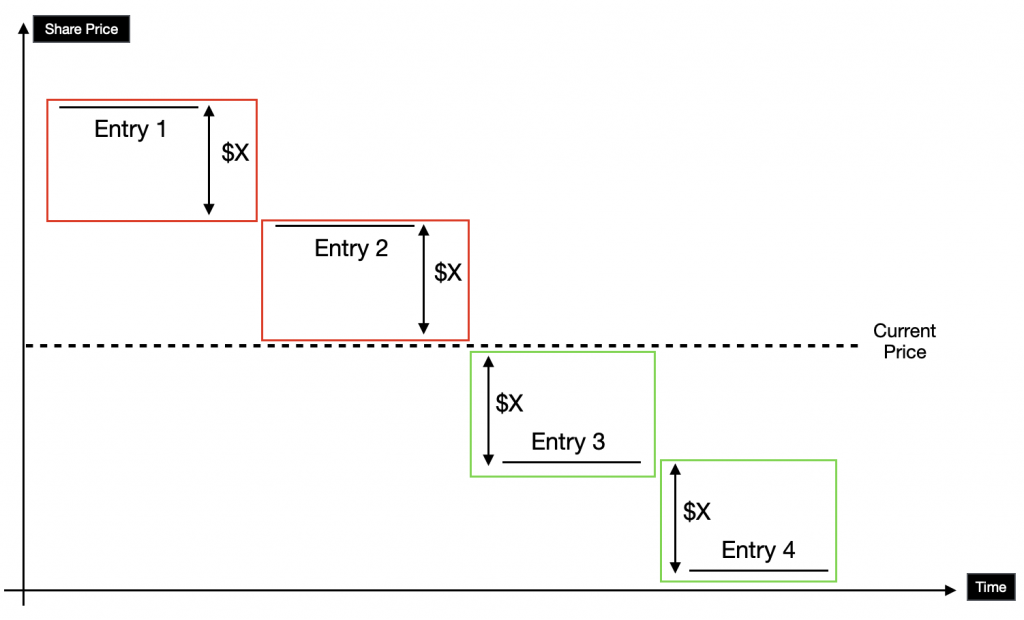

Step Trading requires a “standardised” price gap between trades

When using the step trading method, traders will have to identify a suitable price gap between trades to execute it properly. Basically, it is for easier tracking over time as you might be trading multiple stocks. For example, when trading stocks valued below $1, your price gap per trade might be around 5 cents or 10 cents depending on the size of each tranche. This makes it easier for you to sell at a profit as you have a clear idea of your “cheapest” tranche as well as the most “expensive” tranche.

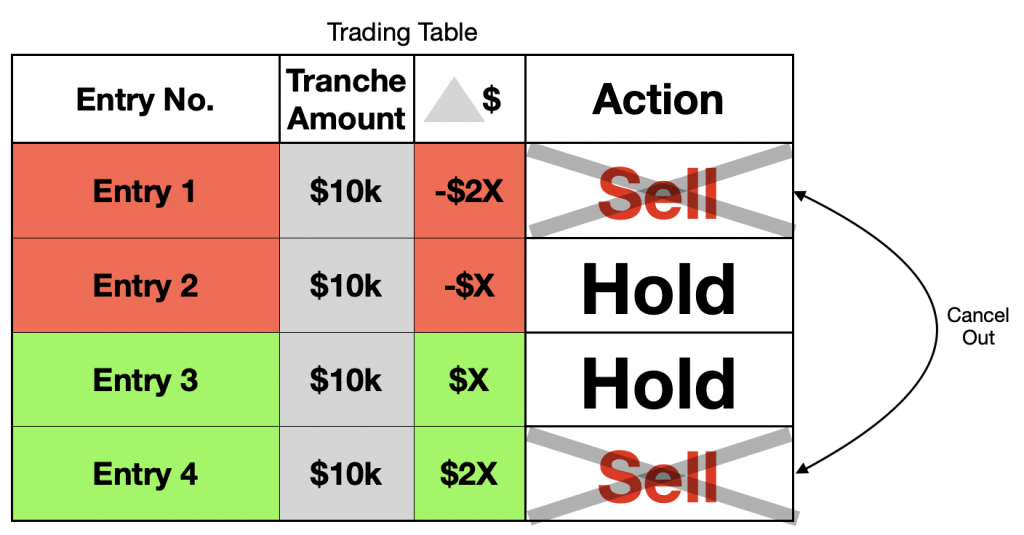

Step Trading “cancels out” losses

As mentioned earlier, when purchasing a stock, it usually does not go upwards immediately. Therefore, by executing step trading, you will be able to cancel out losses by buying lower when the price hits. The above table attempts to show that you can sell the tranche purchased at Entry 4 to cancel out the losses from entry 1 because the profit of “2X” cancels the loss of “-2X”. The resulting stock will be equivalent to the average price of that particular counter.

Difficulties using Step Trading

- Prices do not always move drastically in a short period of time (high opportunity cost)

- You might need more than 4 tranches of capital to cancel out losses (Expensive)

- Commissions might be too high if your tranche size is relatively small

- Does not work if the stock price does not recover from the trough (L shape curve)

Closing Thoughts

Step trading basically provides structure to your trading strategy. This allows you to monitor your holdings at any given time and decide if there is a selling opportunity either to cancel out losses, take profits, or even to average up. That said, this method is dependent on price volatility, tranche size, cost of commission, and more importantly the amount of capital you have in order to execute this adequately. Stay tuned for the next trading method for more ideas on how to maximize profits and minimizing capital risk.