As a swimmer, I once heard a coach say that so long as a swimmer swims faster than everyone else then his or her stroke would be undoubtedly the best of all. I guess this logic is applied in many if not all kinds of careers and competitions as well. In the world of investing, we have people like Warren Buffett, Peter Lynch, Charlie Munger who will probably put many of us to shame as they have almost consistently beat every metric used to measures an investor’s performance. Having said that, does this mean that their methods were also the best possible methods for everyone else? I am afraid that probably is not true, because as investors, we can only use the resources, information that we have access to try and make consistent returns over time. It is our own planning, considerations, and decisions that can ultimately make someone a successful investor or an investor with wishful thinking. In today’s post, I wish to send a heavy-hearted message to investors who have been spoiled by the recent rallies in the US market to realize that that is not nearly as sustainable and that they should seriously reconsider their strategy moving forward.

Your portfolio performance should be justified by market performance

We are still in the midst of the pandemic where millions suffered, lost their jobs, and even some have lost their lives due to the raging virus. Yet, we observed that the US market can climb so vigorously and quickly above pre-pandemic levels. Some explained that this is due to their extraordinary performance even in the midst of the fight against covid but any rational being will tell you that the market has gone way overboard. To say the least, this is definitely hyped with many greedy individuals pushing asset prices higher to create a false sense of security and prosperity. Personally, I never imagined seeing such insane phenomena occur in 2020 and even in 2021, this madness carried on pushing the S&P 500 higher by another 17.9% after artificially inflating the market value by 9% above the peak before the pandemic strike at 3390. To remind some of you, I would like to point out once again that AAPL’s market cap went up more than 100% since pre-pandemic times. I find that there can be no reasonable explanation for any company’s valuation to increase that much when the economy is literally dragging through the mud.

Stay away from things that do not make sense

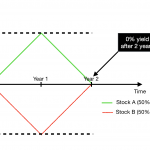

Why does it matter when you are earning so much more in the US market right? Yes, while all might be looking rosy now, you might be looking at the situation through rose-tinted glasses. The truth is that you are currently being trained to think that good investments must and suppose to grow like this In the future. To that I say, not only will you make more mistakes in the future when setting targets for your investments, you will also have to relearn the fundamentals of investing when the world relearns how to evaluate businesses in a logical way. Do not get me wrong, I do agree that some companies are great companies, and their growth over the years is indeed justified but we have to evaluate the situation and consider if the growth since the pandemic started was indeed legitimate. My best advice for investors out there would be to rethink their views about investing and consider going back to markets that still obey the basic rules of profitability and growth.

Sour grape-ing or honest advice?

If you know me personally, you will know that I often speak my mind and believe in making moves only when they make sense. I have made a mountain of errors in my investing journey but never did I fail to admit when I was wrong. To me, investing is a form of art that will ultimately benefit only those who are still sane after participating in one of the most infuriating worlds called the stock market. Even though I still continue to make decent yields in the Singapore market, I do not plan to move my funds to the US any time in the future because I am already terrified at the amount of greed that sustains this market thus far. At the end of the day, I just hope that more people will learn to resist the temptation and exit before it is too late.

Closing thoughts

I do not think that what I wrote will have much impact whatsoever, in fact, I guess that many people will get mad at me for thinking this way or even gang up to ridicule me for a laugh. As a contributor that started this blog for nothing more than sharing my candid views and experience, the only thing I can end this post with is a thank you for your time and effort spent to read what I wrote.