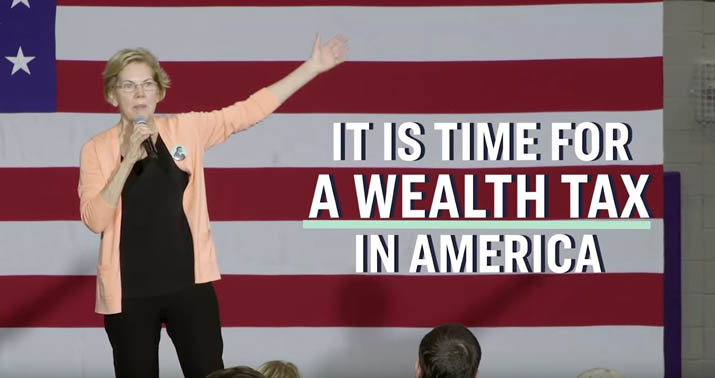

A few weeks ago, Loopholes Singapore shared about populism to explain how inequality between the rich and poor is becoming a reason for outburst such as a protests happening in Hong Kong. On the other hand, populism is also used to pander support for Elizabeth Warren’s campaign. In particular, Warren has plans to suggest a new wealth tax for those who have more than 50 million dollars. These new taxes will be collected to fund universal health care and write off student loans in the US. If we take on the narrow-minded perspective, most of us would think that the rich should just pay more. However, lets also consider the ramifications of Warren’s proposal with a neutral standpoint.

Wealth is the basis of capitalism

Capitalism gives you the right to keep what you earn legally. That is uniform for all who are citizens of a capitalist state. The only exception allowed would be taxation, where money can be extracted from citizens to fund public goods and services. This would naturally result in the rich paying more in absolute terms because they earn more. In fact, many developed countries have already been imposing higher taxes on the rich. At the moment, many rich individuals are still agreeable to the higher tax rate in order to stay as a citizen. That said, many from the middle to lower income would argue that the rich are still paying too little and having too much. That brings us to the point of how did the rich get “too much” wealth?

Wealth exists in many forms

The complications begins when many wealthy individuals continue to grow their wealth in various forms. By converting their wealth into assets such as equity, company shares and real estate, they will be able to grow their wealth much faster than an average person could. While it is not wrong to grow your wealth by investing, there should be a cap on how much one can accumulate in a lifetime. This would help ensure that people do not aim to grow their wealth as an end to itself, which is arguably pointless when it reaches a certain point.

Should wealth tax be imposed?

I believe that wealth tax is not challenging the rich but capitalism itself. This is because no matter how wealthy anyone is, everyone still retains the right to keep their wealth in capitalism. Not to mention that since it only affects the rich, most of them will think of new ways evade them as much as possible. Thus it does not necessarily fix the problem about capitalism because the issue still lies in the fact that one can still get too rich in this world.

Personally, the wealth tax might even worsen the divide between the rich and poor by increasing the sense of entitlement in the lower strata of society.

Solution and Closing Thoughts

Unless a wealth tax or a wealth cap is imposed uniformly around the world, there will never be a successful wealth distribution policy. My unrealistic suggestion would be to go back in time and prevent the accumulation of wealth with no limits. Basically, progress of capitalism has reached a point of no return because the super wealthy has too much power in this world. What do you guys think about the wealth tax? Would love to hear from you.