In Singapore, many of us are spoilt by our parents and school systems until we finally embark on our first job after Poly or University. At that point, we are supposed to start planning for our future having little to no capital and almost zero knowledge on how to amass capital and invest in the financial markets and products.

Some of us rely on the policies our parents bought for us when we are at Age 0, things such as endowment plans which can help to pay off our university bank loans but that’s about it. So how are we going to move on from there? Should we save money, invest or both? How do we do that effectively and safely? Let me share 3 main techniques with you on how to save and invest money.

1. Amassing capital

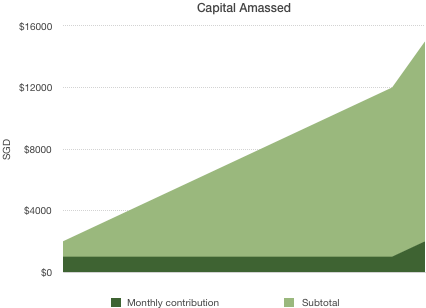

When saving money, the first source is always from the wage or monthly salaries we get from our jobs. As a start, we are more lightly to have around $500-$1000 to save per month if we are frugal. If we take an average of $1000 per month and saving up on bonuses, we will save around $10,000 to $15,000 per year depending on your holiday destinations and spending habits.

One might ask why must we save consistently, well the answer that I will give is that we don’t really have a choice unless we inherit wealth from our parents or relatives. These capital amassed will provide a firmer foundation for you to invest and grow your wealth further which leads us to point 2.

2. Choosing the best bank account

In Singapore, there are several banks which offers decent interest rates so long as you deposit your salary into that account (via GIRO). Let me share with you which bank might be more suitable for you especially when you have just entered the workforce.

For account balance of $1,000 to $34,999

DBS Multiplier Account (Click here for more info on account)

Rationale for using DBS Multiplier account

– Does not have minimum salary requirements unlike OCBC, Standard Chartered accounts

– Have loads of ATMs around Singapore (so Long u are earning a salary paid via giro)

– Many deals available for using their Debit and Credit Cards

– Interest of $650 per annum (Conditions – $2000 monthly salary, $500 monthly spent on credit cards, Bank balance of $35,000

For account balance of $35,000 to $70,000

OCBC 360 account (Click Here for more info on account)

Rationale for using OCBC 360 account

– Basic requirement of $2000 per month salary credited via giro to qualify for Saving Bonus (Find out more on Website)

– Freedom to withdraw paper bills from both OCBC and UOB ATMs around Singapore

– Many deals, cash backs from using their OCBC Credit cards (Click here)

– Interest of $1824 per annum (Conditions – $2000 monthly salary, $500 monthly spent on credit cards, monthly balance increase by $500, Bank balance of $70,000)

If you want to find out more about the LOOPHOLES in these accounts, I strongly suggest looking at the previous post comparing DBS and OCBC’s saving accounts (Click here for more info). The post also informs you on how to park the excess of $70,000 to maximise returns with ZERO RISK!

3. Investing your capital (Basics)

For those of you who want to growth your wealth the smart way, here is how you start in Singapore. Simple steps administratively but you will need to do your due diligence to minimise risk, understand your purchases (Click here), and learn techniques which you can use to maximise profits and come up with strategies to manage your portfolio. For now here are the first few steps for you to get things going.

Steps to set up trading account with DBS Vickers, iOCBC, UOB Kay hian and purchase your first bond or share or ETF

- Set up CDP account with Singapore Exchange (SGX) (Click Here)

- Set up trading account with Brokerage (DBS Vickers, iOCBC, UOB Kay hian)

- Set aside a comfortable amount of capital from your savings and start investing when you are ready!

- Check out Loopholes.sg regularly for bond sale reviews, market trends and stock picks.

I hope that by now you will have a basic idea on finance management if you wish to save and growth your wealth, refer to other posts in the Savings or Investments Tab to find out more loopholes to save faster and growth your wealth easily without paying hefty commissions!