Ever wondered how millionaires live on their portfolios? Some are so rich that they can just wait patiently for dividends but if their portfolios were to be short of a few hundred thousand from their ideal amount, they will usually employ this method of profit-taking to ensure that their portfolios are not “shrinking” but yet they can continue to withdraw cash out of their stocks and bonds portfolio. In this week’s post, I will candidly tell you how I take profit and why this method might make more sense than selling all and buying back at a lower price.

Singtel’s Game Plan

Assuming that there is indeed a continued uptrend for our well beatened up counter Singtel, we can expect 3 major resistance levels in the short to long term. The three Targets as shown by the shaded areas show you the price and the potential upsides from the closing price on 4th December.

Zoom in for clarity

So it might be tempting to sell it all at either of the targets that you set for yourself but bear in mind that the market is not going to play nice with you all the time. It might retrace back to your entry price (if you did nothing) or rally ahead without you (if you have sold it all). To address this, I have prepared a sample profit-taking table and a simple planning process to show how investors can take profit for any counter they are vested in.

Profit table and planning

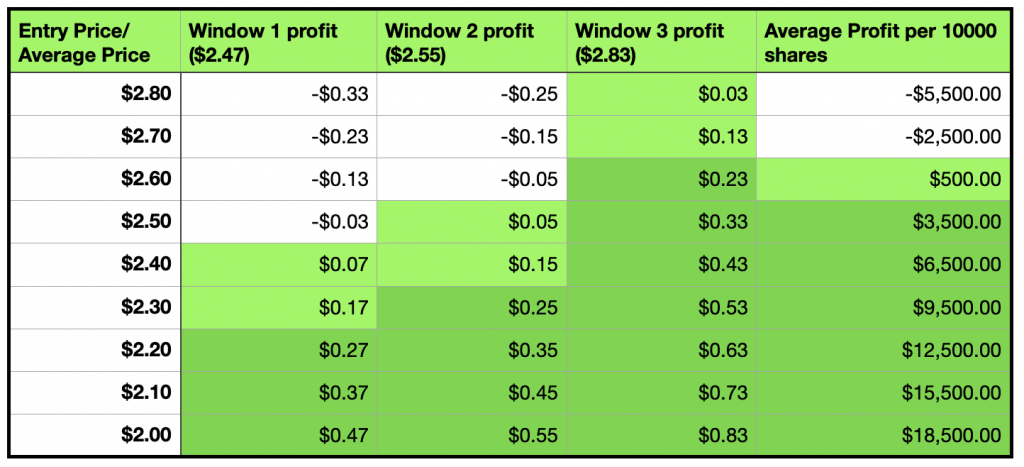

You can look at the above table in a few different ways, for example, if you bought in at multiple entry points, then you can clearly see the profits at any of the supposed targets otherwise you can use the price listed as the average price or entry price to plan ahead at any of the exit targets.

Sample Table (Investor with 10,000 Singtel Shares)

If you notice, I will not sell the majority of my holding nor will I arbitrarily define how much I should keep. With this sample table above, I can plan ahead when the price targets hit. This will allow me to take profit for the short term or for re-entry later on as fresh funds if any of my counter’s price dips after hitting the target. There is never a need to keep a designated amount of funds in a single stock counter hence this strategy support capital reallocation, dollar averaging and “enjoying the fruits of your investments”.

Closing thoughts

The key to successful investing is to always plan ahead and make rational decisions along the way. Taking action is crucial for any investor because making a choice can at times increase your profits (buy) or prevent total loss of upside (sell). Though I might sound like a trader, I do believe that proper planning and taking action is necessary to maintain a healthy stocks portfolio. There is literally no point to buy and hold and let the market toy with your capital. Remind yourself that not every stock will turn out like Tesla, FAANG stocks, iFAST, or even Top glove, so continue to advance your own understanding of investing and enjoy the journey ahead.