These three counters were featured in my Weekly STI market outlooks, SATS, SIA, Singtel respectively. Although not all of these counters are much ahead in terms of share prices, I feel it is high time that we review our positions since all of their financial reports are released to the public. For those of us who have been looking closely at these three counters and making adequate decisions to average down and trade, I believe you would have benefited massively in the past 2 weeks. Also, if you would like to check out our weekly market outlook, you can click on here for the latest post.

SATS (S58) – Hype or Recovery?

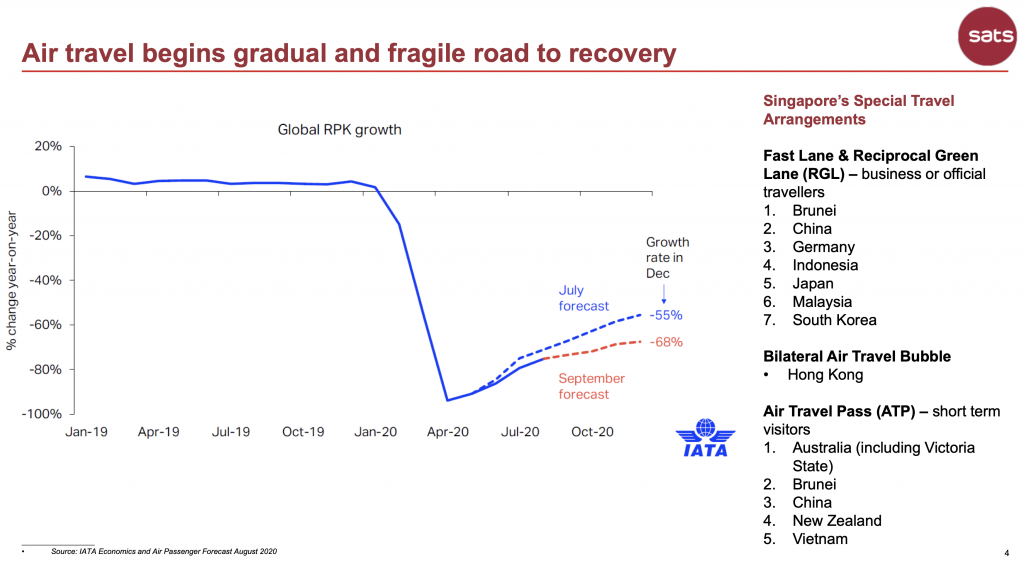

SAT’s projections for the recovery of the aviation industry is in the red as the number of new COVID cases around the world continue to spike. That said, the news on the effective vaccines has nullified the worries of the second and third waves in the world. In addition to that, SATS CEO has also announced that SATS is fully equipped to transport the newly developed vaccine, which has to be transported at -70 degrees Celcius. That news has triggered a new round of buying on Friday however it quickly ended albeit still much higher than the previous closing.

Author’s Call for SATS

- Continue to hold but accumulate if there are sudden dips of more than 10-15 cents intraday.

- Traders are messing with the Last traded Price (LTP) – Good stock to trade in view of higher volatility

- Air travel still modest however SATS is not limited to any airline so every receiving jet will have to pay SATS for supplies

SIA (C6L) – Taking Flight at last?

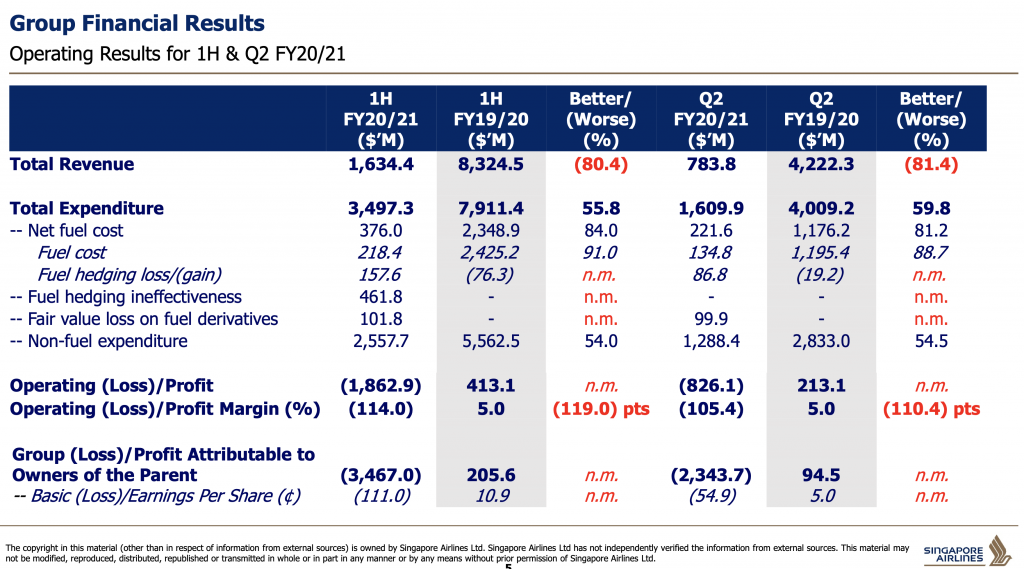

SIA is severely undervalued in the past month because there is seemingly no end to the money burning business trying to sustain talent and their assets (mainly planes and operational assets). Besides that, SIA is also raising yet another 850m of bonds which will automatically convert into stocks when the SIA hits around $5.70. This move by the company is ingenious as the bonds are basically hinting to investors that they should hold for the long term until the price hits 5.70. However, the reality sets in the moment investors realize that air travel at the moment is still far lower than pre-covid times. Not to mention that the convertible bonds are also likely to adulterate the existing share values of SIA.

Author’s Call for SIA

- SIA still a good buy in the long run but the industry does not show signs of recovery in the interim

- Volatility has slowed down and attention has shifted to the new convertible bonds

- The fragile state of the company still haunts the overall outlook of SIA

Singtel (Z74) – Had enough of downsides?

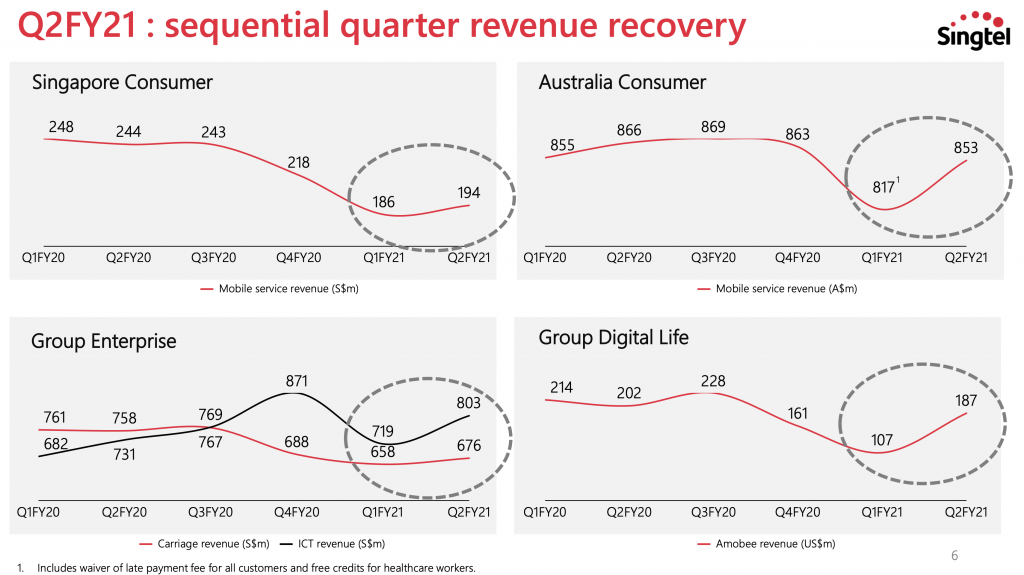

Singtel’s business is referred to as many names, mostly negative but it has been one of the more solid companies in my point of view. The global telecommunication scene is at a crossroads as smaller telcos are fighting for a slice of the pie. That said, telcos are still afloat mainly because the major ones are also managing the overall infrastructure of the business. Furthermore, telecommunication is a national asset that is crucial to the functioning of every nation. In short, the short term weakness introduced by strong competition will not impact the overall business as the future generation of technologies are integrated into various services like drone support and self-driving technologies.

Author’s Call for Singtel

- Singtel’s 30 cents rebound from $2.00 is supported by the 5.1 cent dividend payout in Jan 2021

- though payout ratio is currently at 100%, CAPEX has already accounted for 5G innovations

- ROE will gradually return to around 11 % in 2011 and beyond (especially with the advent of 5G)

- Industry restructuring and hard-hit new virtual telcos might lead to a boost to main telco businesses like Singtel, not to mention its geographical dominance in several countries

Closing Thoughts

I hope the above sharing and insights provided some clarity for those of us who are still unsure of these three companies. Based on your remaining liquid assets, I believe it is crucial at this juncture to prepare for the upturn and not miss out on opportunities regardless of the company or industry.