Bracing for an Endemic in Singapore

As we continue with vaccination efforts and burning cash to try and appease businesses and the markets, we are certainly in the endgame. This likely means that we are going to stop these measures that is ultimately detrimental to more than just physical health. Progressively, I feel that more businesses and travel will be allowed to operate with greater freedom and we will be back to days prior to the pandemic with some obvious changes. Number one, businesses will no longer operate as they used to due to new rules to which forces them to carry out social distancing measures. Number two, office space will be less crowded because people are just less inclined to go to office given the option to work for home. Lastly, transport to and from those less visited areas will probably move towards malls. As investors, we should adjust our portfolios and start moving capital to sectors that are likely to benefit from those above changes.

STI – Updated Daily Chart

STI is currently supported by the 3150 level and will continue so until new back news are announced with respect to newer restrictions. Otherwise, we will expect more sideways consolidation in the near term.

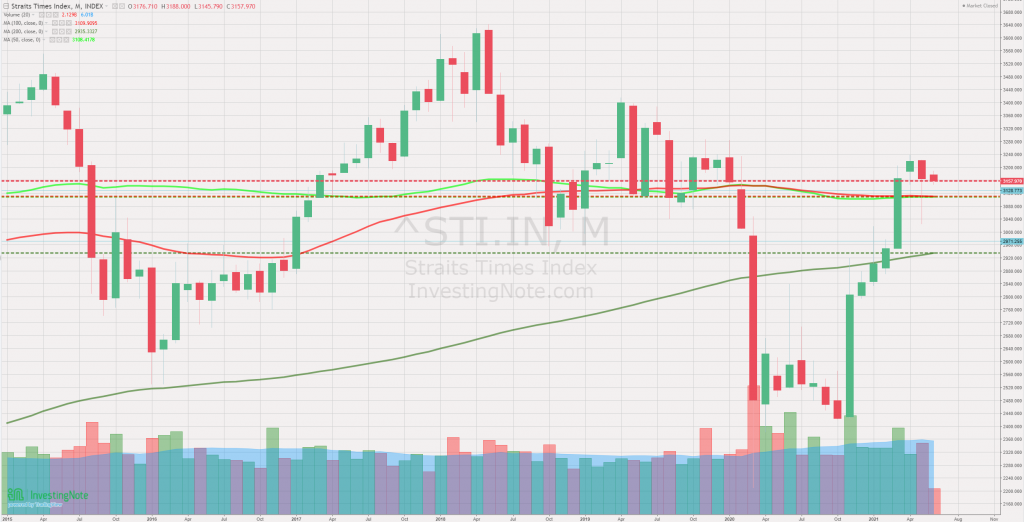

STI – Updated Monthly Chart

On the monthly chart, we are currently hovering above both the 50 and 100 Monthly moving averages. As we pivot towards an endemic in Singapore and carry on with our lives, we will start to see a further uptrend albeit with occasional volatility caused by new developments in the virus stains or government policy adjustments.

Author’s Call as of 12th June 2021

- Singapore might be declaring an endemic on the COVID 19 virus and will likely hope to move on from it

- Sectors affected permanently are expected to recover in terms of sentiments but will take a longer time to attract investors

- 3150 levels are still holding and markets will likely consolidate sideways for the time being

- More shocks can be expected that might cause sudden volatility to the market but otherwise it should be positive for the time being

Author’s Call as of 29th May 2021

- STI should be bullish following Friday’s announcements to aid businesses and reassurance that there will be no CB

- If endemic is declared sooner, investors might rush back into the market and push the market higher than pre covid levels

- More companies in STI will be unlocking its value and pushing asset prices higher

- Accumulating when the price is right is key at the moment, blindly buying with a FOMO attitude will not be ideal