Money printing has become counter productive

In the past week, we saw the system of currencies go haywire simply because of our abuse on it for the past few years. Rampant money printing in addition to the new craze like cryptocurrency is wrecking the concept of value internationally. With that comes with uncertainty in the market where we dabble with assets that supposedly has value. From reits retreating to stable stocks dipping, I am confident that many people did not really understand many stock price movements in the past week. Nevertheless, when all else fails, we still have our charts so let us take a look at it together for the STI.

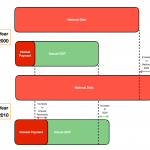

STI – Updated Daily Chart

Lucky guess? The point is not just to get it right but also recognize that the market is governed by and large by some sort of system that might or might not be visible to investors.

The parallel channel also became a helpful reference for the past week. Basically if you held your stocks 3-4 weeks ago, all of your supposed gains would have been pretty much wiped out as well. So please learn to sell if you want to make money out of your capital gains. You might not always be selling at the peak but your gains will definitely be more sustainable over time.

STI – Updated Monthly Chart

The monthly chart also help shed some light on why the dip was so extensive as there were literally no confidence at some point in the past week. right now we are still unsure how low it might go so be patient and place orders in advance rather than hoping to catch the bottom.

Author’s Call as of 15th May 2022

- Hopefully investors will learn that it is unwise to keep holding without the will to sell in the past week

- The charts helped us understand why the dip was so much larger than expected but it should be a good thing to those who have been selling in April

- Buying back is a no brainer at this point as the difference would certainly cover missed dividends

- Investors should shun away from assets that they do not understand.

Author’s Call as of 7th May 2022

- Short week but the overal decline was much more severe compared to previous weeks

- Charts displays a huge dip on friday and closed with a small but solid red candlestick

- Next major support level is at around 3250

- Investors can start buying in the near term but should not over purchase as the decline might continue

- Wait for US to stabilize and see what other moves will the governments make to tame investors