MMT continues in view of poor economic data

As the COVID-19 situation progresses, we can expect more stimulus from the US, subject to both the senate and congress sentiments and approval. At the moment, Trump is acting up again with regards to the blame game and pointless flaunting. On the other hand, China has been playing a more mature character in recent months when other countries blame them for the pandemic. From my point of view, blaming a superpower in the world is not going to be effective. At most, there can be some diplomacy achieved but overall it does not solve the program, as with any “blame game” situations. In the coming week, the US will be announcing more plans for stimulus to help the economy and America and that might lead to another week of low volatility consolidation for STI.

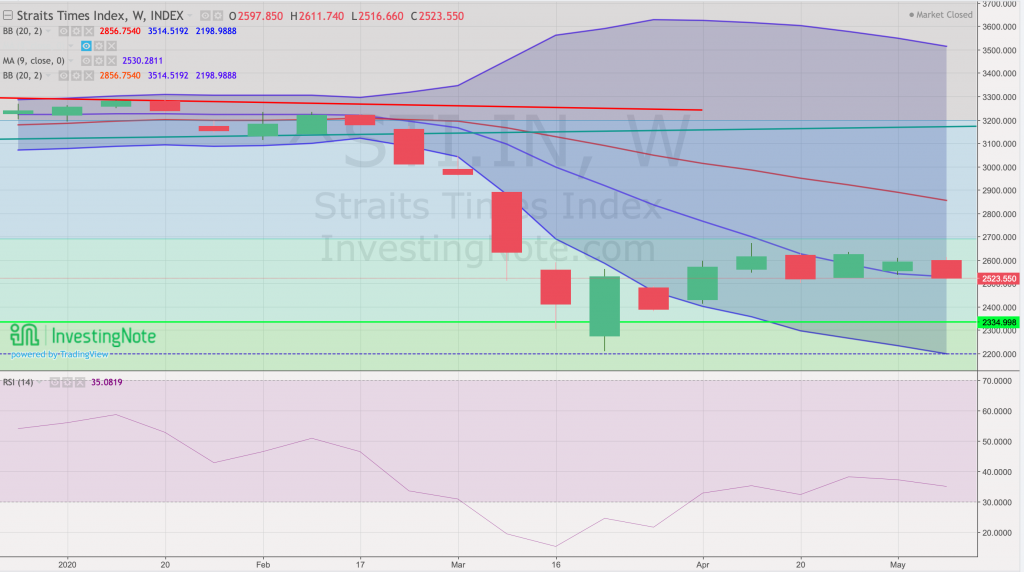

STI – Updated Weekly Chart

STI has been laying low for the past 5 weeks as shown on the weekly chart. At the moment, I do not expect a huge reaction coming on Monday morning. However, the trend for the rest of the week will be dependent on the developments of the virus in SG (especially for MWs) and also the announcements for easing of CB measures.

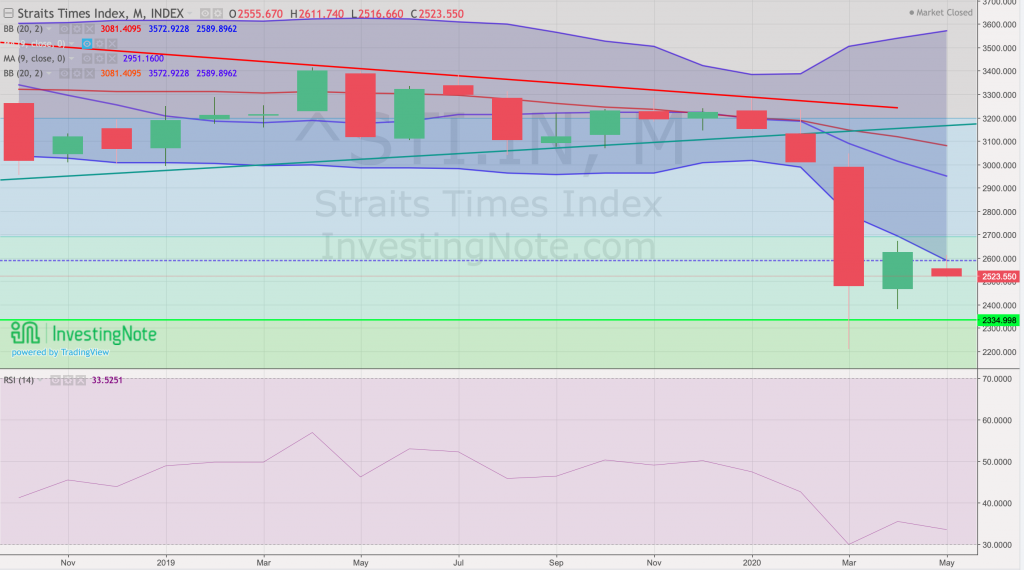

STI – Updated Monthly Chart

On the Monthly chart, we are still seeing the same scenario since April, and that is the lower Bollinger bands is still acting as a strong resistance for STI. As such, there is no sign of recovery at the moment and the next support level is still around the range of 2500 (+/- 30 points). On monthly RSI, STI is trending towards oversold territories again and hence there is no reason to buy in bulk at the moment.

Author’s Call as of 17th May 2020

- The market is cooling down and bears and coming back into the picture

- The US might inject more stimulus in the economy and for its people

- Supply and demand shocks continue to haunt the global economy

- SG has stabilized community spread and will resume businesses in the coming weeks

- Buying in bulk is highly discouraged at the moment and there is reason to believe that markets will consolidate for the coming week.

Author’s Call as of 10th May 2020

- Fed’s unlimited QE and 2.3 trillion dollars is working well in stabilizing the global markets (US indices also closed at a month’s high of 2929)

- There is a detachment of economic data and the stock market at the moment

- STI is likely to open with a gap up on 11th May 2020

- As asset prices stabilize no matter how strong bear investors are, bulls will return aggressively

- Averaging up is a reasonable strategy at the moment but do expect VIX to return to 30 points in the coming weeks