Volume has increased significantly on Thursday and Friday

STI continues its roller-coaster ride in the past week as it rose steadily toward 2570 before retreating back to 2533 on Friday closing. This volatility is partly due to increased uncertainty as businesses continue to see less support from the government yet there is no light at the end of this tunnel for the pandemic. On the US front, we notice that the pre-election polls are tilt towards a Biden win at the moment, resulting in increased volatility for the global stock markets. As we continue to head toward 3rd November, STI will continue to experience higher volatility and erratic price movements.

STI – Updated Daily Chart

The daily chart shows no progress for STI as we continue to stay close to 2533 support. That said, STI did race towards 2570 on Tuesday with 2 solid candles before retreating back to 2520. However, Friday’s pullback to support level is still good news for STI in terms of its resilience despite increased volatility.

STI – Updated Weekly Chart

On the Weekly Chart, STI does not show any significant signs of recovery. At the moment 2533 holds but with US closing flat on Friday, STI is still hanging in the balance if it starts to descend again. Hopefully we can see more obvious signals in the coming week.

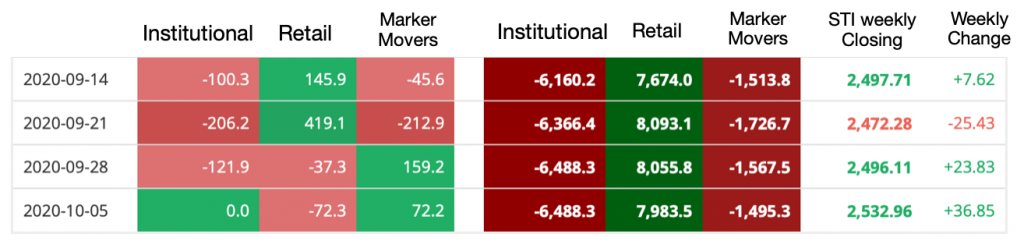

Fund Flow Updates for STI

For the week ending on 11th October, we notice that institutional investors’ selling has come to halt while retail investors continue to take profit. If buying pressure continues to increase for institutional investors, then perhaps we will be able to observe more bullishness in STI in the coming week. At the moment, it is still largely inconclusive.

Author’s Call as of 18th October 2020

- The US election continues to increase volatility for the global markets

- STI closed at around the same support level of 2533 similar to last week’s closing

- Inconclusive evidence on STI’s charts to see if there is a trend reversal at the moment from bearish to bullish

- Fund flows are showing signs of trend reversal however buying volume is still close to 0.

Author’s Call as of 11th October 2020

- US’s drama continues on the presidential and VP debates and US indices continue to head north

- STI’s rebound from the 2450 level was aggressive but still facing selling pressure nearing the end of the week

- Overall uptrend still intact and more companies will be announcing their financial reports in the coming weeks

- Awaiting institutional buyers to come back to the SG market