STI euphoria continues amidst “Global” tensions?

It is highly unusual for the STI to perform relatively better during such times when there are US-China tensions and vaccine shortages amongst other significant events happening around the world threatening trade and stability. That inevitably led us to think that the STI is in a state of euphoria for the time being. Perhaps STI’s resilience is resting on the fact that Singapore’s domestic market has began recovering as it is being supported by the overall positive outlook post pandemic as well as Budget 2021. Moving forward, we should continue to take note of non-bank sector stocks so that we can have a better idea of the state of recovery in the Singapore economy.

STI – Updated Daily Chart

The red shaded areas display gaps between STI and the S&P 500 index showing that there is an uneven recovery since the pandemic strike in early 2020. However, after last Thursday, there seems to be a deviation in the STI’s favour which is rare to say the least.

Following last week’s resistance/gap drawn, the STI had a small gap upwards yet again as the US treasury yields continued to increase. As such, companies like banks and real estate will stand to benefit from it thus allowing STI to move upwards on Thursday and Friday when many other indexes dipped.

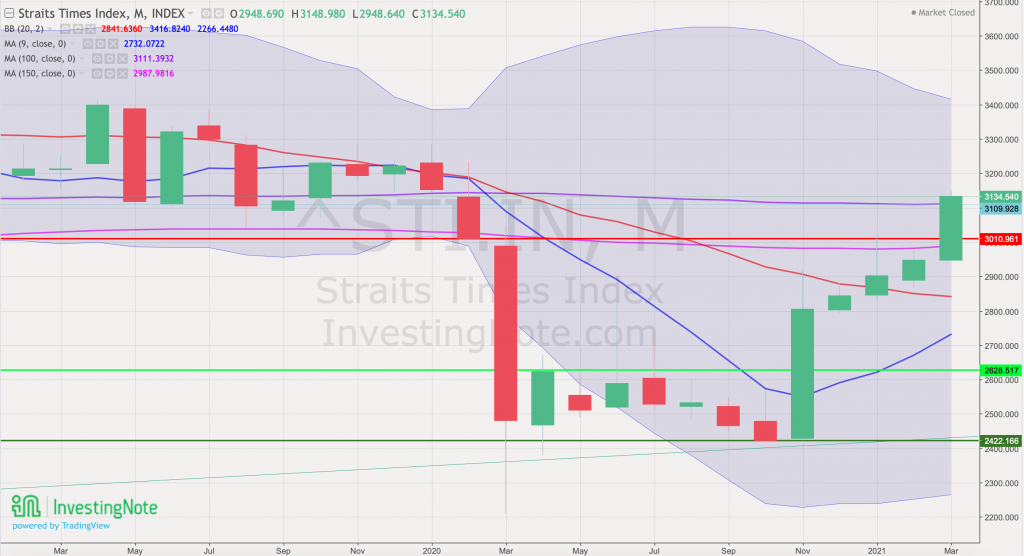

STI – Updated Monthly Chart

On the monthly chart, STI is finally above the 150 months moving average, however it’s crossing might not be permanent unless the index maintains its bullish sentiment and overcome selling pressures in the near term. Shaving of SG stock portfolio’s will be a good time as we can prepare for a possible reentry in the weakened tech sector.

Author’s Call as of 20th Mar 2021

- STI’s resilience is remarkable even as the rest of the world continue to worry about rising yields (threatening risk assets)

- Yield hunters might be taking profit as yields in lower risk securities continue to rise

- Equities in the Singapore markets continue to stay attractive as valuations are still reasonable at the moment

- Taking profit to prepare for reentry in other weakened sectors might be a good move for investors in the SG market.

Author’s Call as of 13th Mar 2021

- STI seems to be kept under 3100 in the past week while other markets continue to stay low until Thursday and Friday

- US 1.9 trillion rescue bill under Biden’s administration will bring about a new wave of confidence for sustainable technologies

- In the near term, investors’ attention might be shifted back to tech and tech related firms

- Optimism in the aviation sector continues to build as Min of Transport stated that leisure travel might resume in 2021 2H