Hitting resistance or losing momentum?

This is a trick question of course. Even though the resistance level was drawn accurately, this loss of momentum is completely understandable as the world is still struggling with the same problems that affects supply chains, relative currency value and consumer spending power. Hence, we should be expecting a loss of around 50-75 points from the STI in the coming week. Currently the 3240 level is quite critical but let’s review other indicators that can hint to us what would technical players in the market do.

STI – Updated Daily Chart

As seen in last week’s market movements, we noticed that technical traders are acting in concert as the retreat was performed almost perfectly. Right now we can expect the market to reach 3180 if the market returns to a gloomy state in the coming week.

STI – Updated Weekly Chart

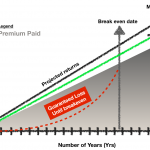

From the weekly chart, we can see that the 20 weeks moving average was too hard to breakout from, meaning that investors are still far from accepting the current situation as a norm. That said, the 100 weeks MA continues to rise steadily above the 200 weeks MA suggesting that the uptrend is still intact at the moment.

Author’s Call as of 30th July 2022

- Market rebound last week but hit a brick wall at around 3240-3245 level

- The uptrend is still intact but expect near term weakness if the market has some new bad news to worry about

- The weekly chart showed that the market is still not confident enough to advance past the 20 weeks MA for now

- Suggest investors to sell and offload some of they excess baggages now if some of your more recent purchases are already in the green

Author’s Call as of 23rd July 2022

- Shaky grounds as the world navigates through inflation and a subtle currency currency crisis

- Most companies will start reporting their earnings in the coming weeks so look out for them closely

- Weekly chart sheds the most light this week as the 100 weeks MA did continue to cross the 200 weeks MA convincingly (for now)

- Do not hold blindly during this period but instead look out for opportunities in the market where the attention is lacking to get better deals