Its simple, its 50:50 right now and no one is right

The world is confused and sentiments are mixed at the moment. There might be a chance for new drugs to work for some people and also the peaking of cases in the world for important economies. On the other hand, some countries might have under report cases and death due to the lack of infrastructure and transparency. Rightfully speaking the long term recovery is guaranteed but no one is going to invest thinking that far if they are at risk of losing substantially in the near term. That is why going back to the basics is crucial and for my own investing planning, I am currently relying on technical analysis to help me decide on my next move. Dyodd.

STI – Updated Weekly Chart

Looking at this superficially shows that we are on an uptrend but there is no assurance that we will be able to stay ontrack. One comforting fact for STI is for DBS to have surge to $20 right after they declared that they will maintain their dividends despite making lower profits for Q1. This shows that the underlying business of SG still remains strong however temporarily weaken and facing increasing rates of bad debt and defaults.

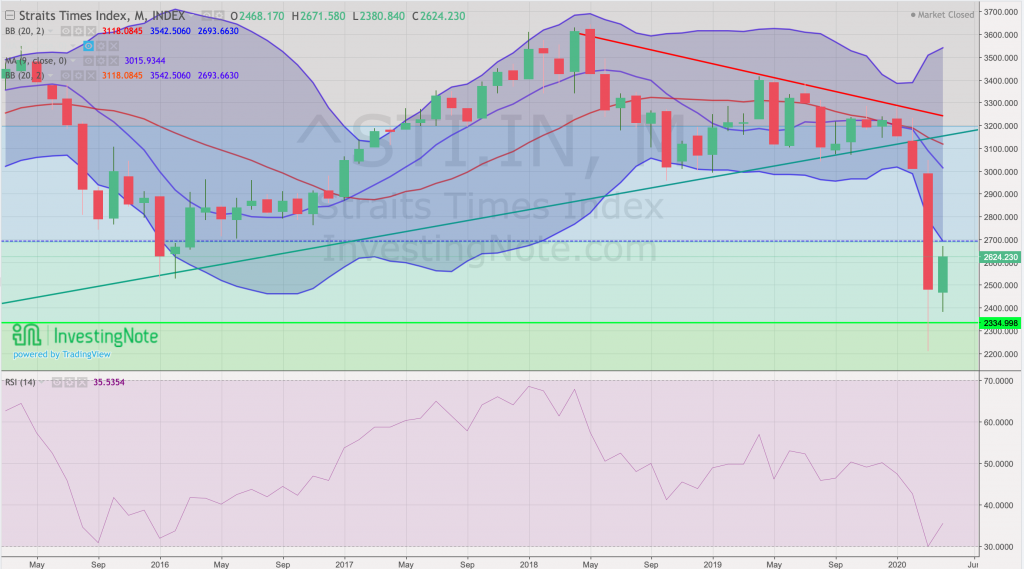

STI – Updated Monthly Chart

Monthly candlestick edging back to lower limits of bollinger, without any confirmation that it will breakout. From the monthly chart and RSI, I am not convinced that there is a full blown recovery at all, however there is no signs of the uptrend slowing in the near term.

Author’s Call as of 3rd May 2020

- Many investors are hopeful because Remdesivir currently being used for some severe cases around the world (one step closers to cure or vaccine)

- US indices closed lower on week’s closing, STI likely to open with a GAP downwards

- Singapore’s economy is showing signs of weakness and investors are unsure if its fully priced in completely or excessively

- US politics are getting increasingly messy again. (Potential conflict with China)

- Money is way too cheap and might be devalued once reality sets in. (Assets might increase in value drastically)

Author’s Call as of 26 April 2020

- The US is desperately trying to reopen its economy and some people are already breaching the lockdown

- US Congress just signed another 690B bill for coronavirus relief (impact always comes later)

- STI will be rather boring in the weeks to come except during their financial report releases and CDs

- Urge investors with sizeable war chests to start setting entry price targets and buy in tranches to prepare for the next upturn.