New year rally met with immediate resistance

STI had a slight surge towards 3260 on 3rd Jan 2020 and yet it bounced back immediately showing many short term traders taking profit from it. In the short term, we can still see quite a bit of resistance as we approach China New Year period. Next important news that might affect STI will be the Singapore Budget on 18 Feb which is still more than a month to go. In the mean time, consolidation likely to persist for STI.

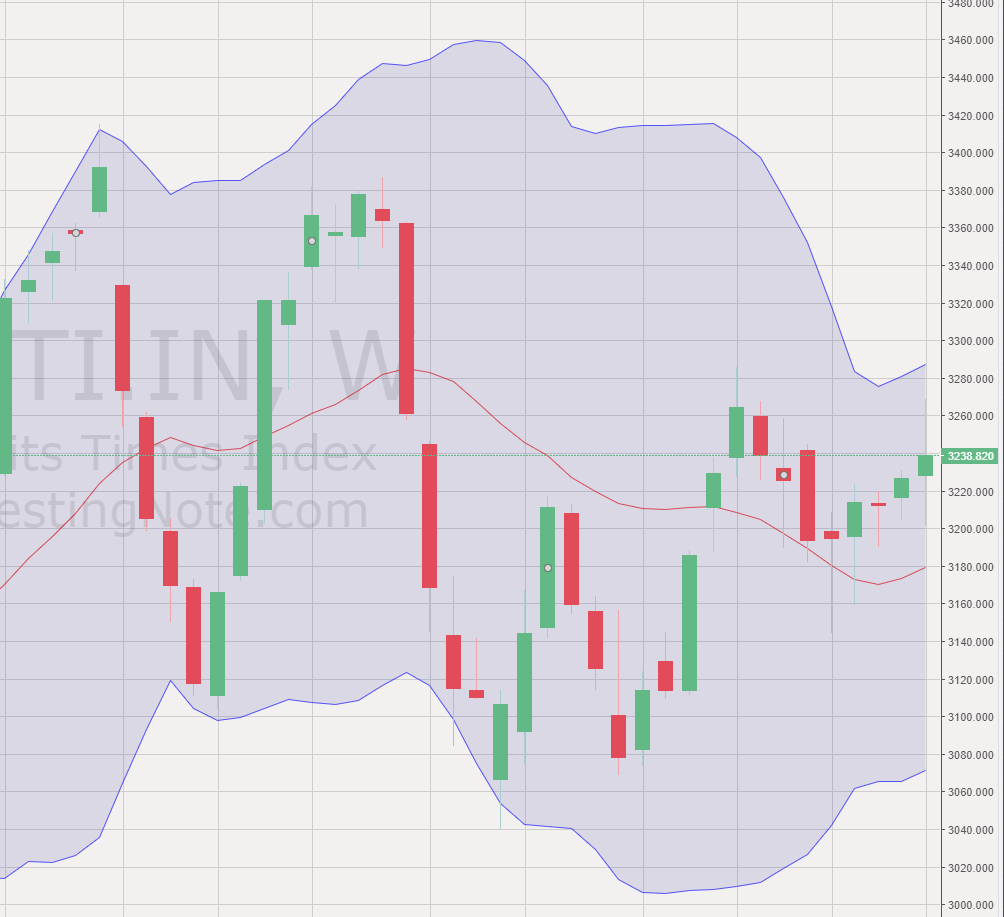

STI – Updated Weekly Chart

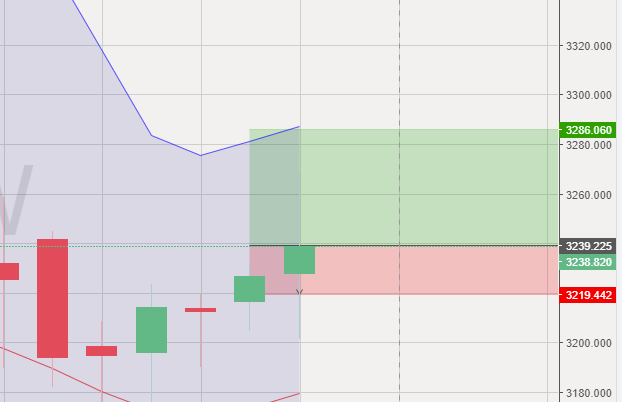

STI proceed to challenge 3250 last week in the attempt to hit upper bollinger range of 3280 but did not manage due to profit taking. As volumes returns in the coming week, we will have a clearer indication of how STI will fare in the coming weeks. If STI pushes through 3280, then 3320 will be challenged eventually but there is still a long way before selling pressure decreases.

Author Call

- STI has left 3220 and is headed towards 3285 resistance

- Budget on 18 Feb 2020 will be the last of the 5 Year budget (15 Billion in excess)

- STI will be boosted by Budget’s support led by HSH

- US toned down in the past weeks and might see some correction from All time highs.

Author Call (As of 29 December 2020)

- Maintain that STI will rally towards 3250 then 3280 (Limited by Bollinger upper limit)

- STI has much less trades done due to the festive period

- Market activity should rise once everyone is back in the market

- 2019 has been a good year in general for traders and it seems like it will continue for STI in 2020