Fundamentally, we all know that fear and greed are emotions that we have to avoid when investing. This is especially important during market fallouts because we will be conflicted with both fear and greed at the same time. From a logical standpoint, whenever in doubt of what is to come, we should always take a step back and do nothing. However, as investors, each second could potentially cost us or save us tens to thousands of dollars. Thus the question is how do we then act rationally when fear and greed strikes.

In this post, we will start by identifying the difference between fear and greed and coping mechanisms to manage stress and anxiety during trying times.

Fear

Fear is the automatic emergency brake in our minds. When fear strikes, most people tend to escape and distract themselves from reality. Similarly, in investments, there will also be times when we are “supposed” to make a decisive move to seize the opportunity. This is made worse when the decision we need to make is not to earn more or less but to lose instead. That is exactly the moment when you are trading or “gambling” in the stock market.

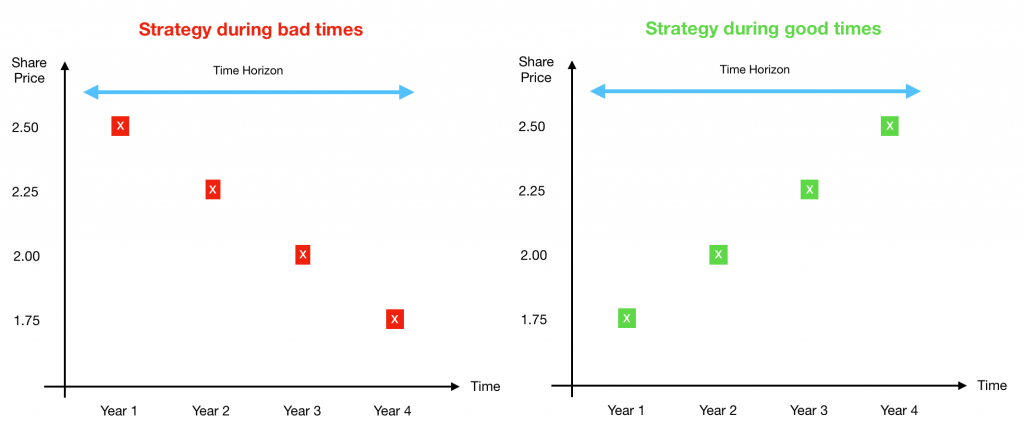

To manage this form of fear, always go back to the basics of why you are doing what you are doing. After all, there is a big difference between trading and investing. When trading, it is imperative to cut losses to maximize your capital to maximize profits. Delaying profits is not an option because these profits are the bread and butter for traders. Whereas for investors, the strategy might switch from yield based gains or capital gains. To elaborate, investors tend to aim for capital gains during good times and yields during turbulent times. The reason behind this approach is to continue increasing portfolio value over the long term rather than withdrawing profits to pay for daily expenses or bills.

To sum up, understand what kind of role are you playing when you entered the market. If your time horizon is short, do take on the trader approach and cut losses when necessary. On the other hand, if you have time and capital to hold, take on the investor’s approach of aiming for yields during turbulent times. Either way, never succumb to fear and switch strategies out of impulse. Always plan ahead for bad times, stay discipline and ignore the overwhelming noise from CNBC and other “experts.”

Greed

In most cases of greed, it never ends well in the long run. This is because greed forces you to act out of an impulse for the purpose of earning more. Regardless of your original intent, greed can turn the tables and make any situation into a potential gamble. This is regardless of whether you earn or lose in the end because making impulsive decisions prevents you from making consistent returns over time. If you are motivated by greed when investing, go to a casino instead.

When managing greed, you first have to be a disciplined person. This involves you spending only within your means and act based on reason. Do not get me wrong when I say this as you might be a high-income earner so you basically can spend on almost everything you want, however, do not go beyond the limit which you set for yourself. Over time, this will translate into resistance towards greed. For example, you will not add to your portfolio for short term gains unless you have planned for it. Compared to a greedy person who will buy on every dip, real investors would do a proper evaluation of the current circumstance before making a move.

So what is the strategy without Fear and Greed?

When times are bad, it is natural to be fearful when prices fall when companies are not performing as well as in previous years. As such, selling pressure will push prices downwards and accumulation will be done as in the above chart. Regardless of whether it is in good or bad times, always consider the maximum time horizon which is different for each individual. Most importantly, only accumulate when you are able to commit to the full term of your strategy, i.e. your time horizon. This consideration is made easier when you are investing for retirement. (Longer time horizon unless you are already close to retirement)

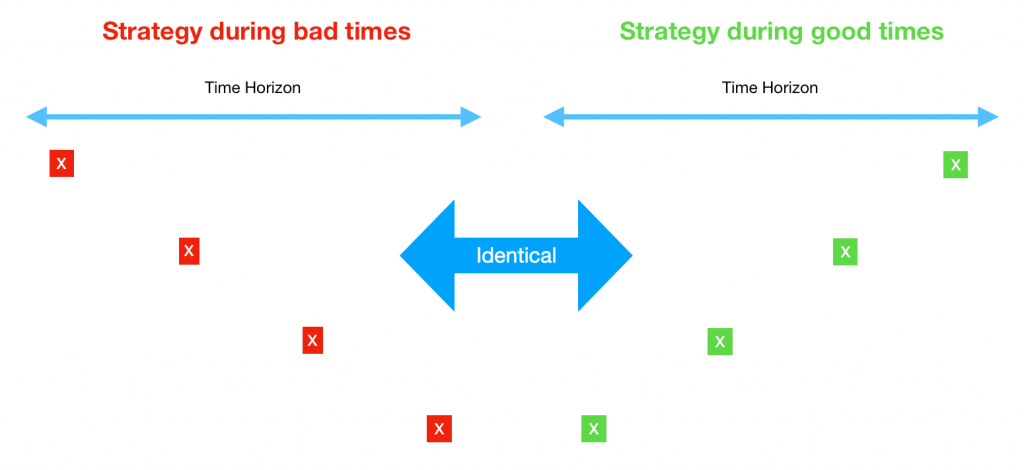

Where are the similarities?

Putting both strategies side by side, you will notice that both strategies yield the same portfolio value and shareholdings. The purpose of using this example is to emphasize the long term view when investing. Rather than focusing on the immediate paper losses or capital gains, we will all have to consider accumulation and thus, we all need to have such mental models to yield consistent results regardless of the conditions of the economy.

Closing thoughts

This post focuses on the undesirable impacts of greed and fear and how you can identify and prevent regrettable actions. During a market fallout, do identify your strategy and role in the market and play it accordingly. In other words, be prepared for all sorts of reactions in the market and act as planned rather than out of impulse and greed. Lastly, always be prepared to hold as long as you intended. It is always a bonus to take profits early but it should never be an expectation.