A few months ago, we did a post on stocks on some stocks that are well positioned for investors to consider investing in. Since then then, the market has rallied significantly in June before retreating back to a low of around 2500 before the rally. As such, Loopholes Singapore will take this opportunity to review positions of some of these counters to see if they are indeed at a prime position for investors to consider accumulating.

Do note that all charts are accurate as of 1 August 2020

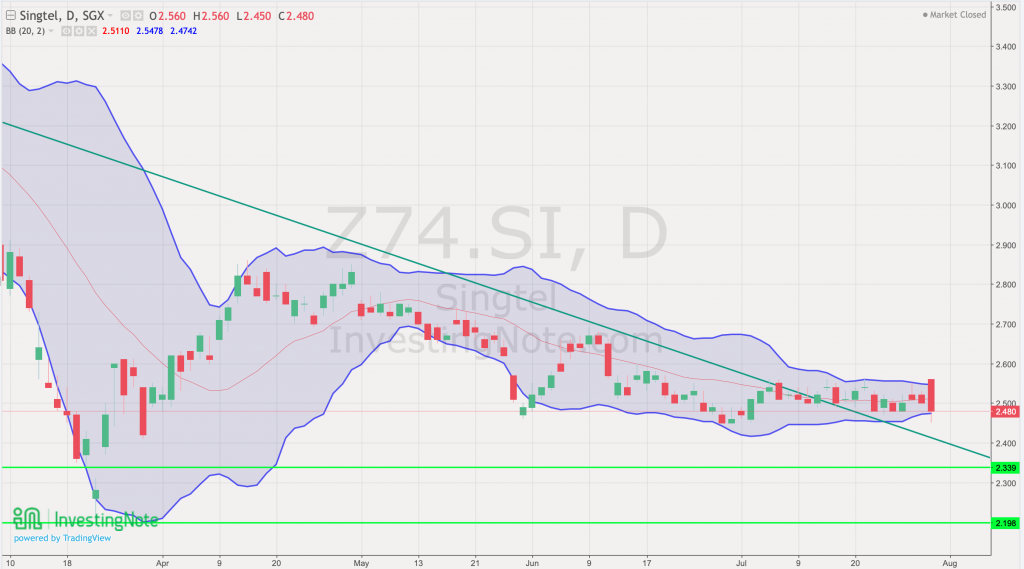

Singtel (Z74)

- Channel narrowing rending on the lower limit at closing

- Resistance turned support level holds above ~$2.40 (after XD)

Genting Singapore (G13)

- Genting Singapore has experienced a perfect storm but yet it continues to consolidate sideways

- Next support at 0.68

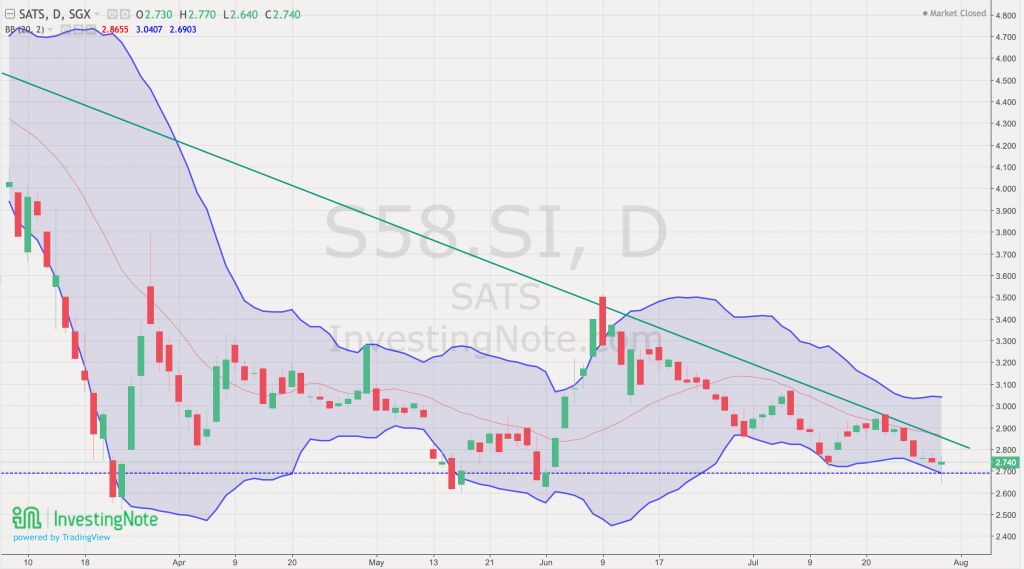

SATS (S58)

- The aviation sector has not seen any noticeable relief at the moment

- Flight numbers continue to stay ridiculously low although some business travel has resumed

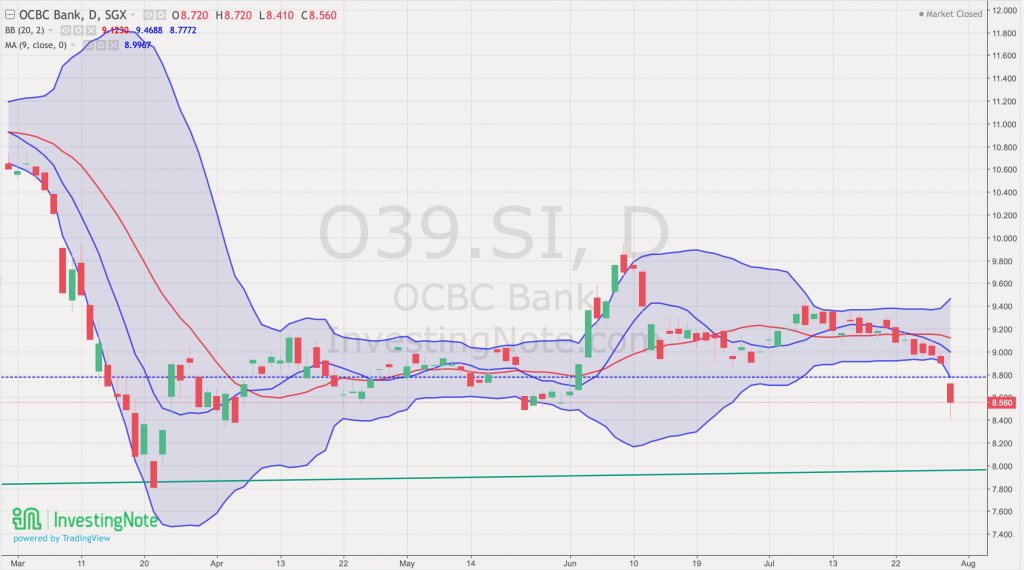

OCBC Bank (O39)

- Banks are secured but are not making huge profits with low interest rates affecting NIM

- Long term uptrend is surprisingly still intact

ComfortDelgro (C52)

- Public and Taxi services resume although WFH practices are still affecting ridership

- Majority share holders are unloading shares at the moment (seems to have bottomed around 1.33-1.34)

Challenger (573)

- Business has resume but next quarter’s performance to confirm if spending has return to pre-COVID levels

- Daily volume continues to stay low as company’s floating shares are relatively low

Capitaland (C31)

- CMT and CCT disappointing results suppressed Ascendas’s performance

- Overall Capitaland land is still experiencing headwinds due to circuit breaker in SG and lock downs in the past months due to COVID-19

Closing Thoughts

STI is at an obvious low according to most of our major components such as Banks, Singtel and Capitaland. This is inline with investor’s loss of interest in Singapore’s market when US stocks continue to receive massive and substantial support from the Feds and the government despite the worrying impacts of the pandemic. It might be the best time to seize the opportunities of the market lows and accumulate more stocks before the next rally starts. Although we are unsure when SG will be able to resume business as usual for tourism and aviation, we have heard and seen enough from the government that support will be given to both sectors to tide past these difficult times.