It is an option for people to use part of their CPF OA to buy shares under the CPF investment scheme. (35% of your investable savings) In this post, we will be sharing a strategy on how to use CPF funds to reduce the risk of shares purchases using cash.

The scenario is as follows, you plan to buy 2 trenches of stock A using cash and you have available CPF funds to buy 2 trenches of stock A as well. You happen to buy your shares just before it broke support levels with cash. What can you do to reduce risk?

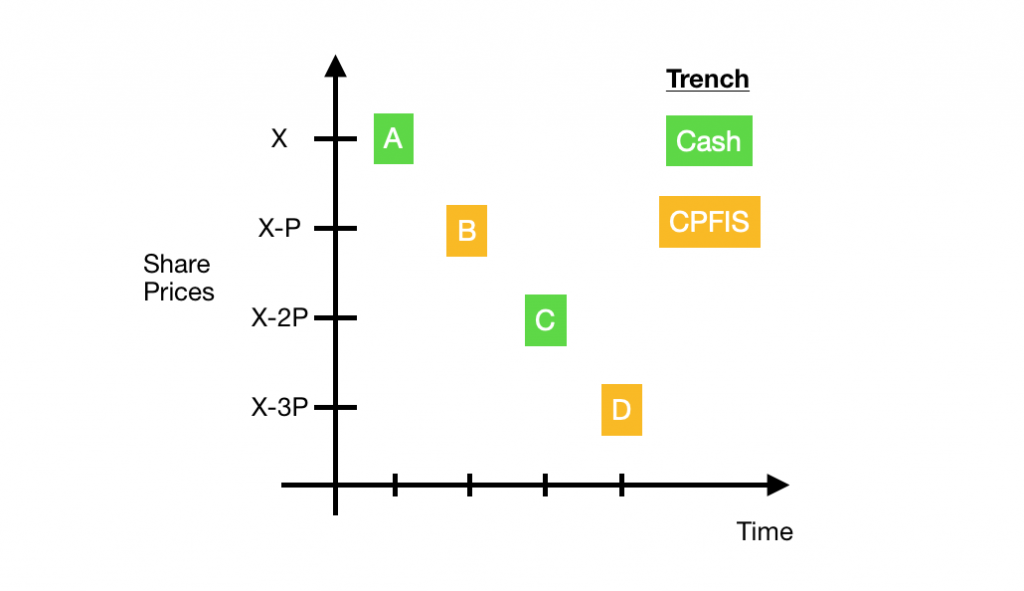

Scenario while buying using Cash and CPF

Breakdown of scenario

- Buy an equal amount of shares at A, B, C and D

- Buy shares with Cash at A and C

- Buy shares with CPF at B and D

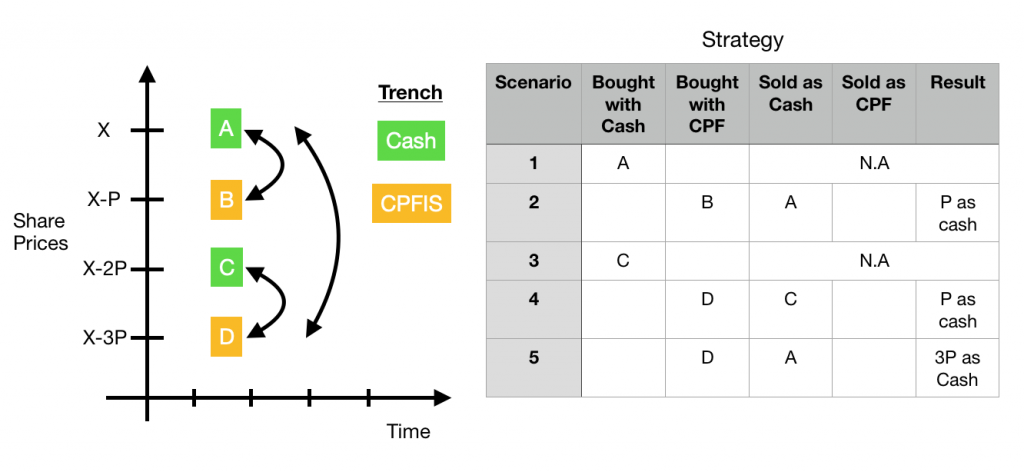

Buying with CPF, Selling as Cash

Extract CPF stock profits as Cash (Leverage Risk on CPF funds)

- “Swap” shares bought with Cash with shares bought using CPF

- Sell Cash Shares using CPF shares entry price

- Keep CPF shares with higher Entry price for longer-term investments

Evaluation of strategy

As shown in the above strategy, we can utilize CPF shares to decrease the risk involved when trading and investing in shares. The reason why we are more willing to leverage on CPF rather than cash is that CPF funds are locked up in assets (Home or in OA) until at least 55 years old. This is coherent with the understanding that the risk of shares investments decreases over time. As you can afford to wait longer for trend reversals when investing using CPF. Thus this is a potential strategy to allow us to trade with less risk as compared to using purely cash to purchase shares.

Surely, this is not a flawless strategy as well. Potentially, the share counter can continue to plunge and does not recover over a long period of time. Therefore, presenting no possible exits to use this strategy. Nevertheless, there is still merit in using a combination of cash and CPF to reduce capital risk and the strategy above is viable for those of us who face a similar scenario in the future.

Closing thoughts

At Loopholes Singapore, we are constantly finding new ways to share on reducing risk and maximizing profits for our readers and ourselves. All of these strategies and loopholes contribute to the arsenal of strategies that we can use when the time comes. Hope this sharing spurs us to think more about utilizing different types of capital to increase our options and how we invest.