Many mistaken dividends as interest but actually dividends are more like rebates. Interests are paid based on capital loaned to a company. However, dividend payouts are distributed based on the number of shares owned and not based on the amount of capital invested.

1. Dividends are NOT Interests

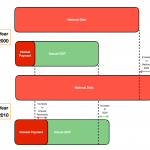

Dividends are majority share holder’s decision to liquidate certain quantity of shares into cash for shareholders. The blue gap shown in the chart below represents the dividend payout.

Dividends will only be useful when the share price after ex-Div is higher or the same as when you purchased your shares. This means that the dividends received is purely surplus rather than rebates from what you originally invested.

2. How to earn dividends the right way?

Dividend shares are not shares which pays you positive returns guaranteed. For example, shares such as Starhub are paying 7-9% dividends per year but their share prices have fell more than their 20% in a year. In such cases, it will not be wise to buy into those shares for dividends just because of the high distribution rate. Instead, look for shares which pays regular dividends and have a relatively stable price range over time. An example is shown below.

Dividends stocks ideally pays annual dividends and its share prices are not on a steady decline over time.

3. Collecting dividends as part of annual returns

As clarified, dividends are rebates from our shares purchases. Therefore, it will be useful to keep some dividend shares in your watchlist or portfolio for regular passive income. Do look at other posts on dividends in this blog for further elaboration on how we can use dividends to reduce or manage risk.

Closing Thoughts

Like all other company stocks, dividend stocks are alike in most ways however, their track record of regular payouts makes it more attractive for investors. Thus, it will be good to have a few of these stocks for annual income. Furthermore, you can always sell when the price is right.