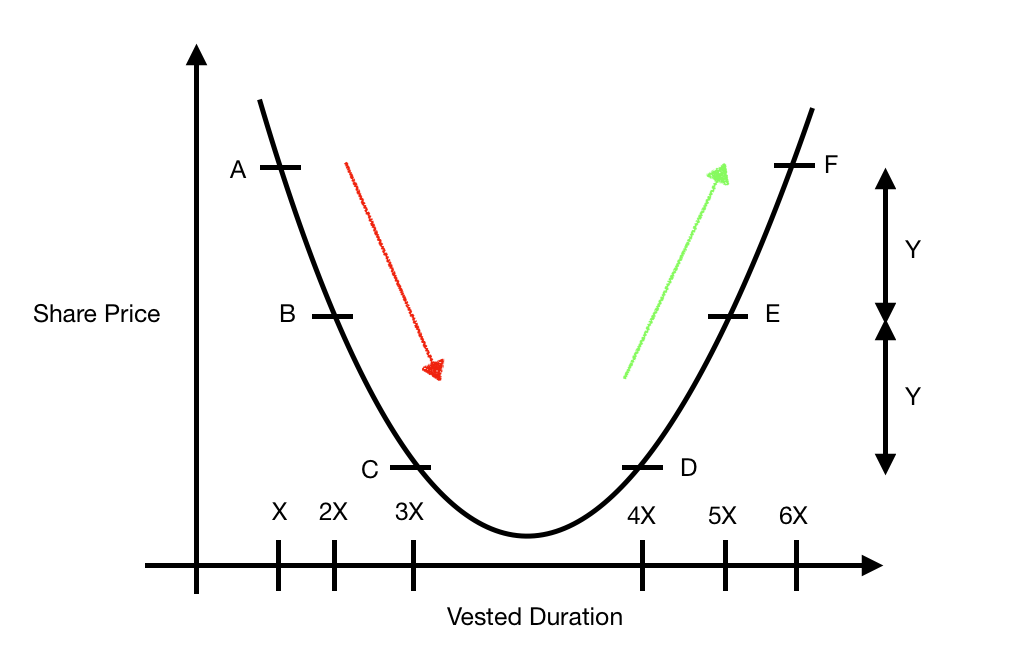

Investing is primarily about buying low and selling high. Many people understand that logic but often overlook the next important logic. That logic is about the vested duration, as it determines both your potential profit/loss and opportunity costs.

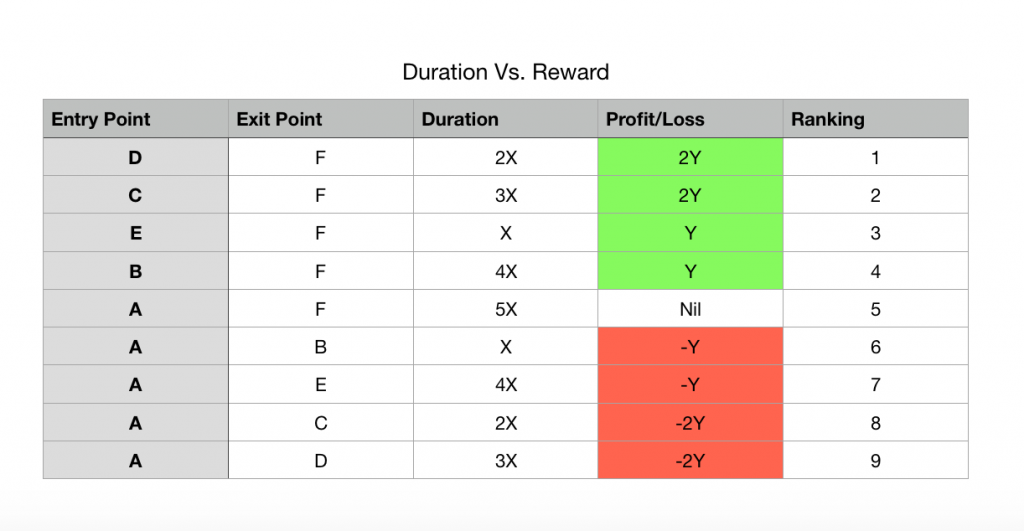

From the above table, the highest-ranking trade is made with the highest profit and shortest duration. Conversely, the lowest ranking trade is also due to the highest loss and longest duration. These scenarios reveal the reality of how trading can turn from lucrative to ludicrous at times. Using the logic behind duration vs rewards, we will be summarizing the learning points below.

Buying only at the sign of recovery

Everyone is tempted to buy at the lowest possible price but no one can be sure that it is at its absolute lowest. In the chart above, we did not label the trough simply because we can only see the trough in retrospect. Many traders use MACD and RSI to sport the trough but even so, the “trough” on the daily chart might not be visible using the weekly chart. That is why we discourage buying at the supposed bottom. Rather, we promote buying in when there is a sign of recovery. This might cause some losses as we will be buying at a slightly higher price. However, in the process, we will also be saving some time and increasing confidence in our purchase.

Averaging down rather than selling to cut loss

If you entered at A and subsequently realize that the support broke, find the next support and purchase at the sign of recovery at D. Common mistake would be to cut loss when support broke right after the purchase. Over time, such mistakes will take its toll on your overall profits. This is why some traders are able to make highly lucrative trades without a significant net profit. If you add up all the scenarios above, you will realize that the total yield (not factoring commissions) is 0. The moral of the story is to trade wisely rather than actively or out of impulse.

To that, we recommend to again purchase shares in trenches. This is will provide you with a safety net to average down and potentially break even earlier.

Duration matters but do not rush

In all of our trading journeys, we will be tempted to exit early to reinvest in another company because there is loads of attention on it at the moment. In such cases, our suggestion is to stay put as long as there is still a reasonable room for upside. It does not even matter if you have broken even because the overall cost of chasing trends is sometimes time rather than cost. While we cannot guarantee which will be more lucrative but we know for sure that in the long run, those who remain steadfast to their own plans yield more.

Closing Thoughts

Special thanks to suggestions from readers to make our post less “deep.” We sincerely appreciate your feedback and we look forward to making content to suit your needs. Thanks.

This post is to value add to the conventional target setting methods to find the lowest price to buy and the highest to sell. We hope to inform you guys about the value of time and strategies to save time while maximizing profits. Though it will potentially cause us to make small losses in the form of opportunity costs, the overall reward will add up and be worth it.