Many of us would question the possibility of not making any losses in their investments. The short answer to whether that is even possible is “Yes it is possible.” The follow up question is how.

Ever since I started trading and investing, I have gathered strategies from many sources. Most of what I came across was “buy and hold” and “value and index investing.” To be frank, I do not believe in neither of the former. So here is what I did to make sure I do not make losses.

Keeping record of your profits for specific shares

This strategy that I use is basically to use previous profits for a specific share for future trades. For example, if I have made 40 cents previously from a share counter, I will buy in and set the net price as “Current Price – 40 cents.” Using this method puts your previous profits at risk instead of your capital. After repeating this method, you will realise that trading does not require timing the market accurately or in any extensive way. This is because you entered the market with a realistic margin of safety, contributed by realised gains from that same counter.

| Name of Share | Accumulated profits (Buffer) | Current Entry Price (Inclusive of Comms) | Net price of entry |

| Company A | $1.30 | $10.66 | $9.36 |

| Company B | $0.23 | $0.93 | $0.70 |

| Company C | $0.90 | $3.44 | $2.54 |

Your accumulated profits will provide buffers for your subsequent purchases and therefore you will feel less fearful when you are punching in an order. The caveat is to never spend your profits once u make them. Otherwise your accumulated profits will be diminished once you make a profitable trade.

Buying in Trenches

Again, there is no one person in the world who can claim that he or she can predict the market actual trends accurately. Therefore, always expect to make mistakes or shortfalls. Coupled with the buffers you have already accumulated from a particular share, you will be able plan for better entry prices and purchase at separate trenches. This is akin to dollar averaging however the difference lies in your price targets, as they are based on your pre-existing profits and technical analysis instead of fear, greed or ignorance.

Never buy based on the fear of losing out

Opportunities come and go for every investor or trader. As such, it will always be wise to sit out of a high volume rushed trade or basically buy or sell based on a simple buy/sell call without proper explanation. My advice to everyone out there is to basically weigh your odds before making a decision. Here is where I would use the “Monty Hall Problem” to explain how an investor should make a decision.

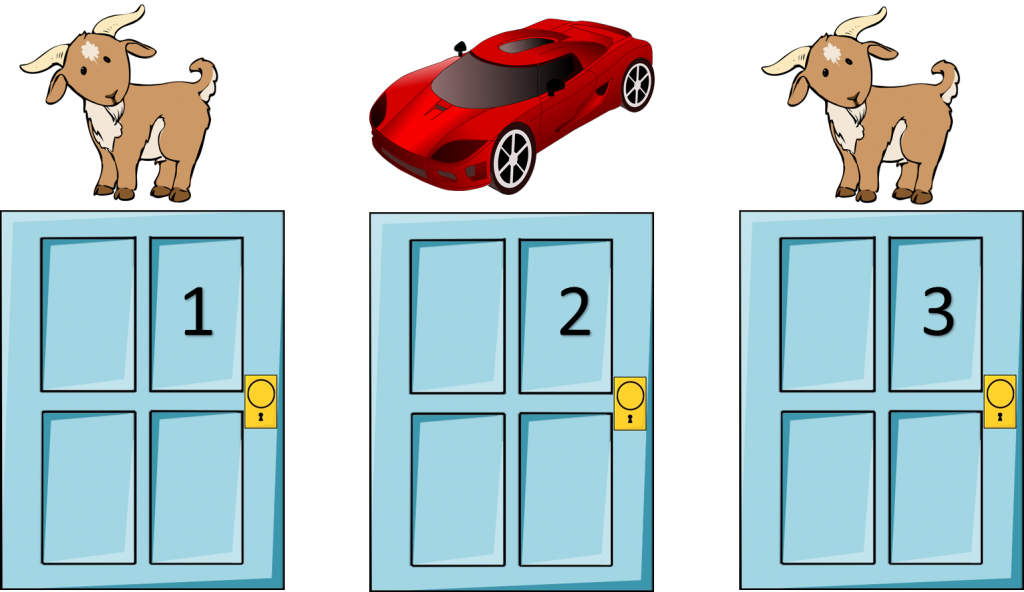

Monty Hall Game Show instructions

- There are 3 doors, in one of the 3 doors there is your dream car in it.

- You are to choose one door 1,2,3

- After you have made your choice, the game show host (who knows which door has the car, opens another door (not selected by you) and reveal a animal.

- The host asks you if you would like to change your option to the “third” unopened door

- Would you do it? Why?

The obvious answer is to swap simply because there must have been some sort of a reasoning for selecting the third door otherwise this will be a lame game show. That said, the actual reason is because if you would have selected the alternative door, you would have had double the probability of getting your dream car. This is because the odds of you getting the car should you stick to the original door is only 1/3. Thus, the other 2 doors will obviously have the remaining 2/3 probability. Do note that even though there is a higher chance to get the car by changing your door, it does not mean you would because there is still a 1/3 chance that your original choice was right.

What has this got to do with investing….

The issue with investments and trading is the fear of share prices going in the opposite direction. Instead of associating peculiar price movements with the “illogical market”, understand that in life, there is only probability and never really certainty. I hope that through these sharing, we can understand how to have a change of perspective when we buy or sell a share. Though there is never really certainty in the market, there is always probability that we can count on to help us reduce risk and maximise profits.

Closing Thoughts

So it all boils down to strategizing our every move in the market. There is always risk but we have to constantly refine the way we calculate risk and that would ensure minimal losses or even zero losses in the long run.