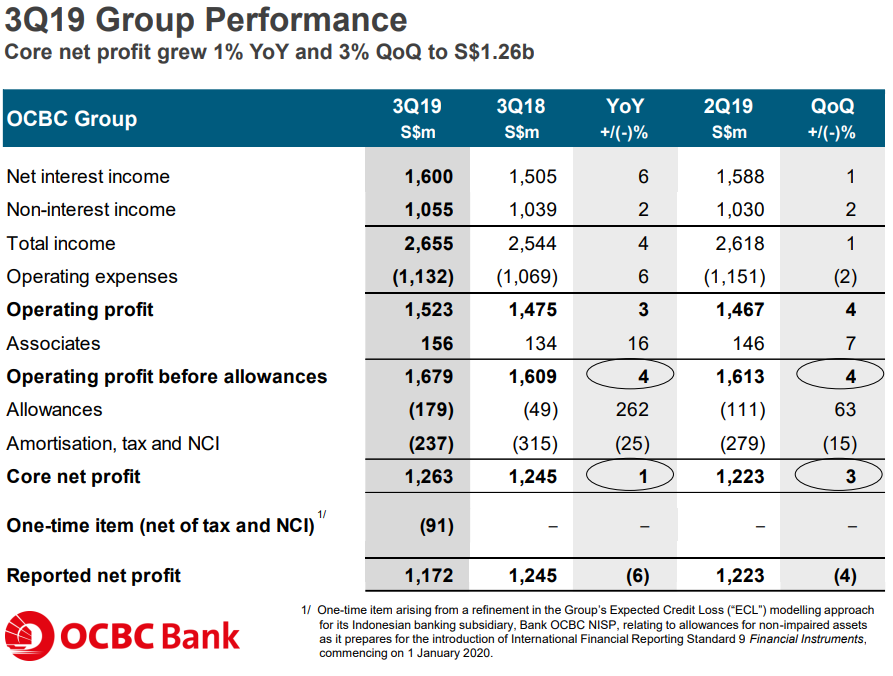

OCBC has remained a strong counter in STI despite its association with China and HK. True enough the number shows that there is a 6% net profit dip YoY. However, there is still a core net profit increase of 1 per cent before the one-time item loss from Indonesian subsidiary Bank OCBC NISP.

US Fed will unlikely cut rates in near future, meaning that the profits for banks are bottoming and its time to re-enter into quality bank counters in Singapore. This is especially so when banks are underperforming for future boost in results.

The overall performance of its other units produce marginal growth and presents a potential discount in the markets until next reporting.

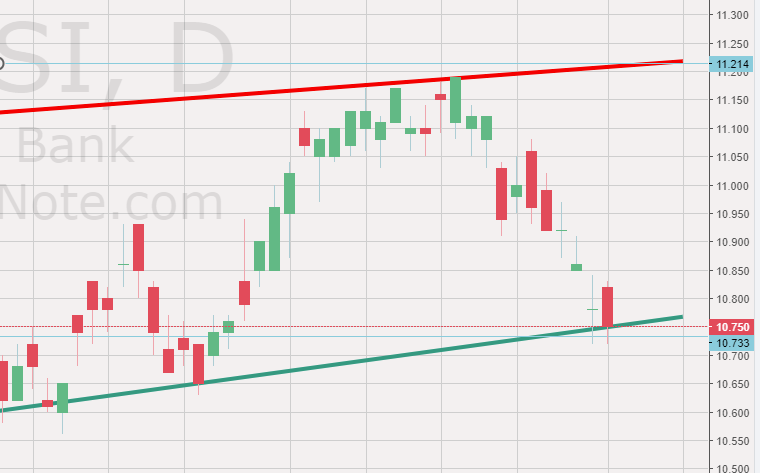

Short term outlook (Using Daily Chart)

Using the daily chart, we can clearly see that OCBC is testing the minor uptrend support at around 10.75 last Friday and on monday. At closing on both days, OCBC closed above the support signalling sufficient confidence from buyers. However if we look back several months, OCBC has trend near 10.6 and below.

Near term Outlook (Weekly Chart)

From the weekly chart, there is still some room for traders to hold their purchases until it hits target at around 10.6. With a drop in net profit, logic dictates that it should trend lower after all the hype from Q3 reports. Do consider buying in trenches again as we do not want to be caught off guard especially when Trump’s impeachment hearings are around the corner that might shake the market.

Author Call (as of 2 Dec)

- Entry points at 10.75 (minor uptrend support) and 10.6 (weekly horizontal support)

- Buy at a price which you are comfortable with rather than timing the market for OCBC

- NAV has rose from Q3 reporting to 10.08 which is a plus point.

- Will advise to buy in trenches rather than lump sum due to uncertainty in US politics

- Fed Rates will not go down any more, signalling Net Interest Margin might go up hence forth

Author’s Call (Compared to 23 October)

- Enter with Caution in near term at around $10.75

- Exit with small profit targets when STI hits 3222 Fibo Resistance

- Enter for longer term only after recovery above $11.40 (updated)

- Long term Uptrend intact (Support is still holding well)

- Strong support at $10.4 (NAV = 1.056)

- 3rd Quarter report release on 5th November (Will update again)

Look out for future Training ideas and evaluations of Author calls (Click Here)