Following last’s week’s correction in the Asian market, many must have felt the burn as the market retreated without warnings. To prevent ourselves from getting burned by corrections, there are ways to circumvent losses due to opportunity cost. On many occasions, investors or even traders set unrealistic price targets even after using multiple indicators and instruments to strengthen their analysis. However, in my experience, the market will always be able to outplay your planning and catch you off guard in both directions. As such, I will be using this week’s post to explain how we can maximize our yields in the market despite unexpected challenges ahead.

How I view the market

If you analyze multiple stocks and indexes, you would have noticed that although individual counters move up and down at different speeds there is usually a general trend that either pushes or goes against most counters. For example, when the market is bearish, you will notice that many counters are unable to climb past its opening gap upwards. On the other hand, when the market is bullish, even weak counters will stay flat or just slightly green throughout the day. As such, if you are prepared to sell at a certain price, you can adjust the selling price slightly by the overall sentiment of the market accordingly.

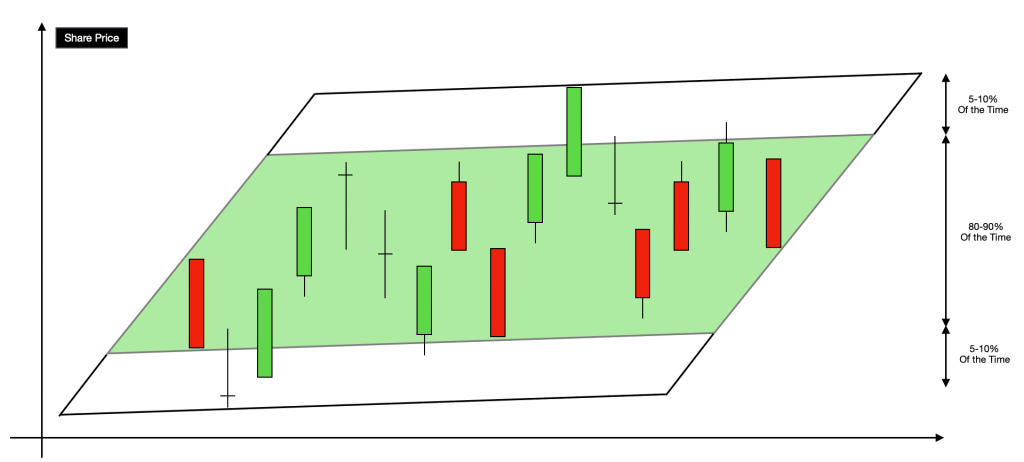

The market spends most of its time in its inner consolidation zone(s)

Many novice investors are usually overly optimistic and pessimistic for their own good. While they might be right 10-20% of the time, that also means that the rest of the time their capital is being tugged around by the market. While this might be fine for a dividend play, I strongly discourage such techniques during turbulent times so long as you are able to exit with significant absolute yields from each trade. If you count the missed opportunities, it is highly likely that it will not be worth holding throughout. The only exceptions are for counters with a seemingly endless potential to climb.

You do not have to sell and buy everything

Humility is the key to successful investing for the long run and losing with proper justification is alright. If your capital is large enough, you can sell portions of your holdings at your first target price. Either way, if you are wrong, you would have still secured some profits before reentering the market after a convincing breakout from the last resistance level. On the other hand, you can still buy back if the stock retraces to a lower price for you to buy it back at a discount. In both scenarios, you will still benefit from your participation in the market as you are simply acknowledging that you are uncertain that the market will retrace or not. After practicing this for a while, it is certainly more rewarding than hoping for a miraculous breakout every time it hits your target price.

Closing Thoughts

Whether you are an investor or a trader, always understand the market as it is and make the best of it. It is necessary to take action when you have planned in advance and always stay humble when you are evaluating your strategy. Lastly, any strategy is worthless if you are reluctant to execute it when the time comes. If you continue to soldier through the literal ups and downs of the market, you will be able to yield maximum returns and reduce your losses over time.