On the recovery with performance bottoming, and vaccinations

After a rather short week, the STI continues to consolidate sideways as companies start to announce their Q3 and FY financial reports. So far those company YoY performances have been poor but expected. As for the general sentiment, investors are still positive about the overall situation of the economy as we could see aviation-related stocks rebound from their new lows. As vaccination efforts continue in Singapore, we are also demonstrating good strategic planning in vaccinating specific sectors other than just vulnerable age groups and frontline workers. As such, we expect a more aggressive recovery in the coming weeks as more companies report their strategies for the coming year.

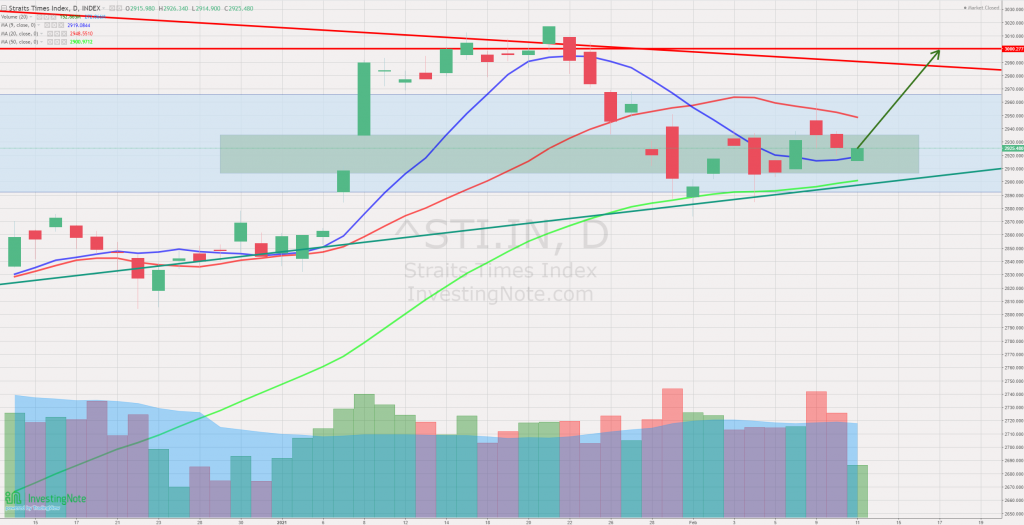

STI – Updated Daily Chart

On the daily chart, the STI is still trapped in the gap formed in January 2021. However, the slight curvature of the 9 days moving average is showing signs of a trend reversal. That said, it was a rather short week right before the holidays hence it is still largely inconclusive using the daily chart.

STI – Updated Monthly Chart

If we zoom out and take a look at the monthly chart, the STI still continues to make modest progress month on month. Furthermore, the index still has room to climb hence we are expecting STI to continue climbing back to around 3000 so long as there are no new triggers for another correction.

Author’s Call as of 14th Feb 2021

- The index is still stuck in the small gap formed in early January 2021

- Company financial reports set the tone and brought a heightened level of realism for investors

- The overall sentiment is positive on the market but the economy still struggles to show clear signs of recovery

- The STI might try to climb back to 3000 levels in the near term to retest the resistance level

Author’s Call as of 7th Feb 2021

- Political stability strengthens around the world as Myanmar’s example reinforces the need for a strong and stable government

- US bill to be cleared soon after being approved by the senate supporting risk assets and markets in general

- STI technical correction might be over but investors are still wary of the timeline before further global recovery from the pandemic

- Financial reports of companies will roll out soon and set the tone for the economy