Have STI ran out of steam?

The world has resorted to the last resort and that is to treat the pandemic as an endemic. Markets are all experiencing bullish runs as it seems like the end is near in terms of the fight against COVID-19. That said, there is still an unbearable uneasiness in my heart because I am aware that those who are suffering because of the pandemic will continue to suffer long after the virus becomes a non-matter. Therefore, I am hoping for a rebalancing in the market just in time for investors to at least wake up from their endless yearning for yields and returns. In this week’s market outlook, I think its very telling for investors who stuck with the slow and boring SG market. Regardless of the road ahead, we can safely say that we have persevered in the few markets that still remained sane in the midst all of this madness around the world. So let’s take a look at the story that the STI is telling us at market closing last week.

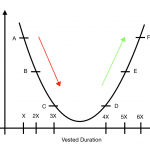

STI – Updated Daily Chart

I got to say that I am very honoured to be a participant in the STI because after all that we have been through in Singapore, it has remained largely free of ridiculous rallies that would probably derail us all to become increasingly greedy and unrealistic. At the moment, the daily chart shows that STI is reaching another resistance which I hope will reflect the true state of the market, that is, we are only starting to feel optimistic but the suffering in Singapore’s businesses is far from its conclusion. Perhaps we might be seeing some push back in the coming week so selling would probably be a good move for some of your holdings.

STI – Updated Weekly Chart

The weekly chart continues to test the confidence of investors with respect to the eventual recovery of the market in Singapore. As mentioned before, our nation is still facing heightened pressures in terms of our healthcare system and frontline/service industries hence, I personally do not feel it is time for the market to have a glorious breakout right now. That said, whatever the outcome, investors will be tested in the coming week whether to bet for or against this breakout.

Author’s Call as of 16th October 2021

- The Singapore market is still not out of the woods but the market is eager to have a breakout as shown by last week’s rally

- The daily chart exposes a downtrend resistance line which come in handy to explain why the market did not end with a solid candle

- Weekly chart also show that we are optimistic but could be in for any cautious run in the market

- As investors continue to deliberate been a positive or negative outcome in the near term, I suggest that investors should consider their own stance and decide if the market should recovery even in the midst of rising number of new infections and deaths

Author’s Call as of 9th October 2021

- Additional measures are introduced to encourage vaccination for the final leg of the race to vaccinate all of the population

- The daily chart shows that there has been premarket purchases by non-retail buyers but buying pressure is still modest at the moment

- The monthly chart shows a decent rebound in October following 2 months of correction and slight decline

- Suggestion right now is to look at accumulating stocks which will benefit from the reopening of borers with countries through the VTL.