Distraction caused by the China-Taiwan-US relations was good?

The recent China-Taiwan news triggered an interesting response in the world. Basically, people are aware that it might turn into a massive disaster but at the same time, many do not expect any real aggression to occur between the 2. On the market front, the STI climbed for 4 days straight before stopping at a horizontal resistance on Friday at closing. Could this be a new distraction engineered to allow the market to look away from the actual financial turmoil around the world? It is hard to say but all we know now is that the dip if it is coming at all, will be coming abruptly and will most likely be legitimated by the newfound “crisis”.

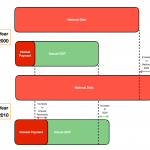

STI – Updated Daily Chart

It is clear that the resistance levels last week were broken after Monday’s sellers fail to negotiate a turnaround. That said, we are now back at another clear resistance level on the daily chart and we will still need clear justification for why the climb can continue before it does.

STI – Updated Weekly Chart

Finally, we are looking at the monthly chart again after several weeks of fixating on the weekly moving averages. From the chart, we can see that STI is back at the mid-support liner and we should be seeing some push back soon from sellers in the coming weeks.

Author’s Call as of 6th August 2022

- The new issue caused by the China-Taiwan-US conflict has distracted the market from real economic problems

- The 4-day rally in the STI has been surprising unless the Singapore market is seen as a clear safe haven with the help of our well-regulated banks

- The monthly chart suggests a potential pushback in the coming week or two as sellers might turn aggressive in view of the main trend support line

- We continue to notice that fund flows are coming back to the Singapore market therefore, we can start selling at a controlled rate

Author’s Call as of 30th July 2022

- The market rebound last week but hit a brick wall at around 3240-3245 level

- The uptrend is still intact but expects near-term weakness if the market has some new bad news to worry about

- The weekly chart showed that the market is still not confident enough to advance past the 20 weeks MA for now

- Suggest investors sell and offload some of the excess baggages now if some of your more recent purchases are already in the green