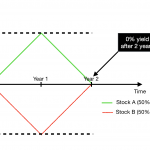

Hopefully this is an interesting topic for you guys because growth as always been one of the main goals for all portfolio managers. At some point in our journey as traders and investors, we will start to question if our strategy to achieve growth for our portfolio is indeed optimal and sustainable. Thats the point for this post, I hope to share ways on how we can decide if we are still achieving growth for our portfolios as well as ourselves as individuals. Generally, we will all consider growth as growth in terms of wealth, as its quantifiable and can be compared against previous years’ performance but what I realise is that some people’s portfolio actually do poorly for a full year. Thus making it hard to determine if they have actually done well at times. That is why, I think it is important to know what is considered growth even during a bad year.

Start by grading yourself and your improved strategies for the year

Assuming that none of us are gamblers interested in only profits, we usually pride ourselves for coming up with and sticking with a specific set of strategies and methods to achieve positive performance regardless of market conditions. If that is the case, then your growth should not be solely based on yields but also how your changes in strategies have impacted your performance for the year. For the past year, I have been trying my best to grow intellectually in addition to the usual goal of growing my portfolio. What I have realised after evaluating my changes in strategy is to always remain humble and admit that our strategies can never be fool proof. That means we must stay reflexive and be ready to change and only deploying capital when it is worth its opportunity cost. This translates to staying vigilant, not be influenced or blocked by fear and staying far away from greedy intentions.

Count the number of trades that were intended

The second point is simple, how efficient were you in your ability to make decisions and submitting orders. If you have made 20% more trades and achieve a 80% intended trade ratio, you can compare it with previous years’ performance to get an immediate measurement of how well you have valued your moves and allocated your capital. That is to say, profit accumulated for the whole year is less important compared to the number of trades you made that were according to plan. Why? It is because the real growth does not come from how much we earn but how we improve as market players when we value assets and negotiate with the market.

How have you changed in valuing everything around you

Forget about what I think, you can always go back to the great investors and see how they succeed in their investments. The most recognised method is to learn how to value things properly. What this means is that you need to constantly refine your ability to value things that you buy as a consumer, investor and as a member of society. What I find most difficult to do most of the time is to value others and their needs more than my own. It’s not really in our nature as individuals to care about the welfare of others or want to supply others with what they need. Instead, we usually care more about ourselves and in most cases, for those of us who are more “successful”, in our excess. Overtime, we might not feel that there is a negative consequence to be self-cantered but I guess getting numbed is never a desirable outcome as a person.

Closing Thoughts

Learning how to measure our growth as traders and investors might be tough because most of us are too focused on the dollar value. True enough, no one is going to be convinced, including yourself, if you consistently achieve negative yields but if you do not learn how to measure growth as a trader or investor, then I can also guarantee that your performance moving forward will also be volatile and inconsistent.