OCBC has been recently under pressure due to its close relationship with China, which is currently still in the midst of trade talks with US. This bank has been innovating really well in Singapore market. From sharing ATMs with competitor UOB, 360 account and awesome service quality, it has succeeded in gaining mindshare and trust in many consumer and businesses.

In this post, I will share my views on how OCBC is still an awesome pick as a growth share for investors. Additionally, I will also be providing near term outlooks, entries and exits.

How should we trade or invest in OCBC Bank?

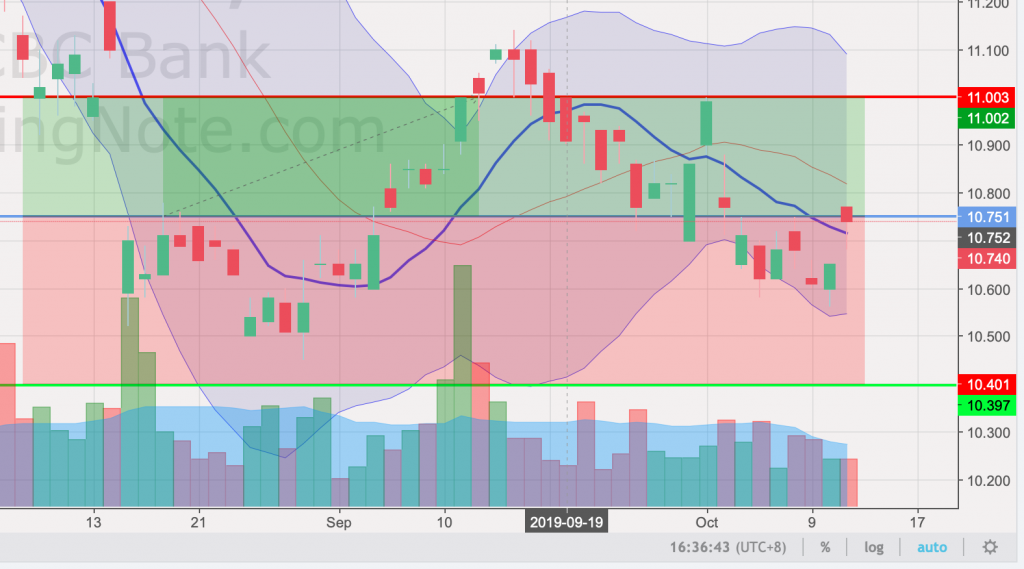

Short term outlook (Using Weekly Chart)

- Range Bound between $10.60 to $11.00

- 9 Days Moving Average currently at $10.72

- Heading towards $11.00 for small profits

Looking at the 2 support and resistance drawn for near term of 1-31 days, entry can be any where from $10.60 to $10.80. Near term wise, do exercise some restrain in terms of amount invested as there is still potential downside, otherwise, you might consider entering with 1000 shares long for a quick profit of $100 to $200. (after comms)

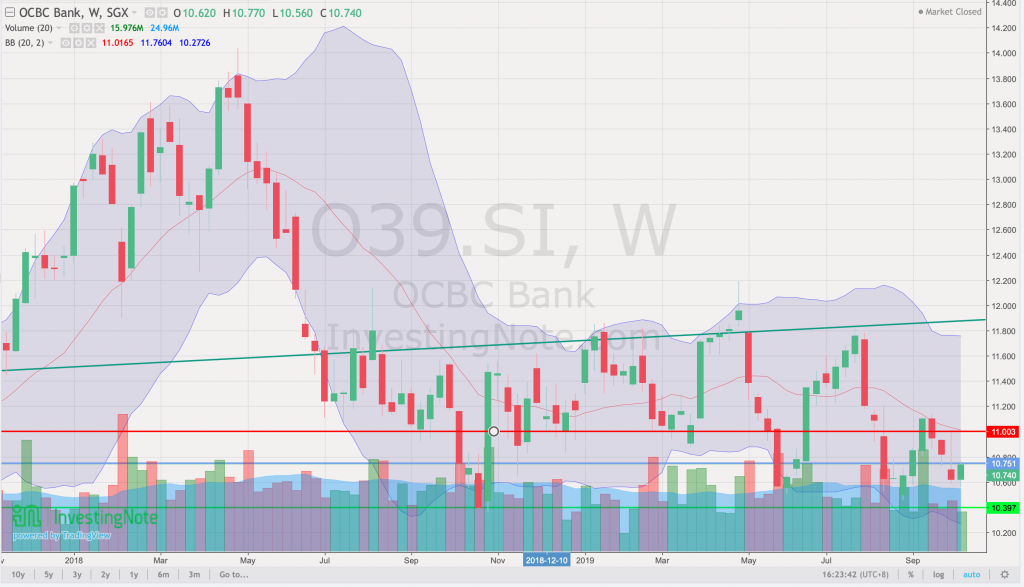

24 weeks outlook (Weekly Chart)

- State of consolidation (after falling from peak of $14.00 in 2018)

- Price ranging around $10.60 to 11.17 to $11.77

- Supported by major horizontal support line of $10.40.

- Trade truce between US and China (Suspend October tariffs)

Take note of Psychological support Line ($11.00) a possible bounce point. If closing of a day or a week is about $11.00 (resistance turn support), do consider to keep for a further rally to $11.17 (up to $11.80). Currently in near term price is guarded by 2 year low of $10.4.

Trade Talks (Bank Context)

Due to the US-China Trade disputes, Fed Rates has depressed a little to stimulate borrowing; however banks usually thrive with higher rates due to increase in Net Interest Margins. That said, slower interest rate growth will also encourage borrowing for greater capital efficiency. I do feel that banks are generally resilient even in the midst of trade tensions.

Author’s Call

- Enter with Caution in near term at around $10.60 to $10.7

- Exit with small profit targets

- Enter for longer term only after recovery above $11.17

- Rallying unlikely unless China and US have come to terms

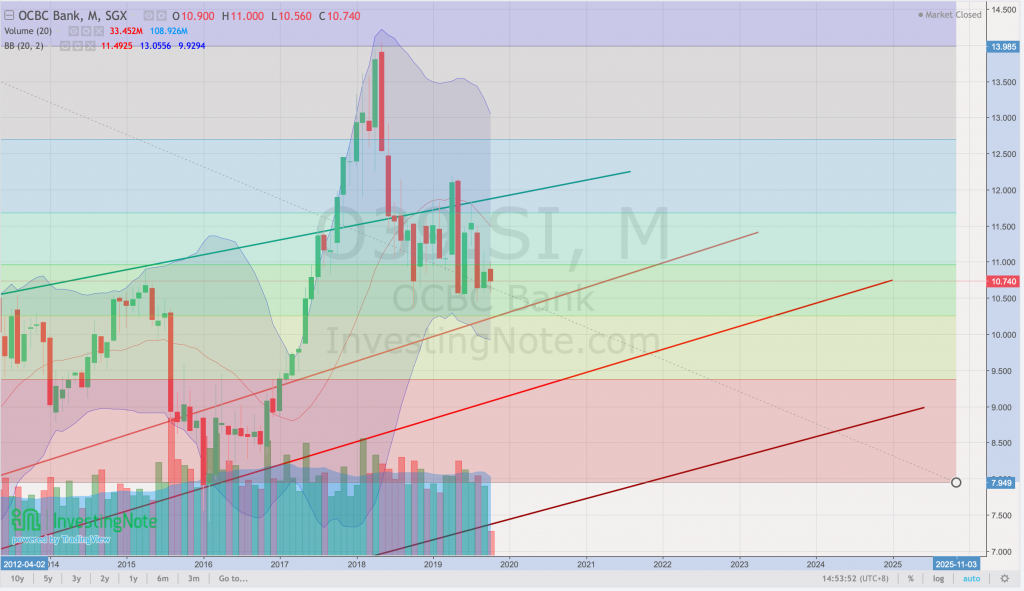

- Long term Uptrend intact

- Strong support at $10.4 (NAV = 1.056)

Look out for future Training ideas and evaluations of Author calls (Click Here)