US Goldilocks Economy

US indices has hit a new high yet again. The main reason is because its Employment rate is at a 50 year high, inflation below 2% and its wage growth is around 3%. All of these are occurring despite the trade war but how is it actually possible. This post will provide some possible reasons for the market’s sentiments and at the same time link to STI performance for the past week.

US is paying for higher employment and wage increments using corporate tax cuts – unsustainable

At the start of Trumps presidency, many might have remembered that he dropped the corporate tax by a whopping 14%. This actually fuelled growth in many big corporations as they are now better able to hire more employees and increase their wages. However at what cost to the country? Currently US Budget deficit is at a high of a trillion dollars as well. While it is true that money can do wonders, the cost of this current boom is less than worth it.

When Fed chairman’s Powell was at the senators’ hearing, he emphasised on many accounts that his job managing the Fed is to Ensure maximum employment and steady prices. While that might mean that he is responsible and objective in his post. It also hints that he is trying to Ensure that no other failing metrics should be associated with his decision to cut rates 3 times this year. Looking at US’s debt situation and borrowing rate, of course it will be unsustainable overtime. This suggests that as much as the US economy is seemingly doing very well at the moment, it will reach a critical point when it collapses and causing worldwide economy downturns.

How does this link to Singapore’s market and STI?

The Singapore market has a different culture as compared to many other countries. As much as our sovereign funds such as Temasek holding is concerned, the country is currently facing its own domestic Budget concerns and stabilising the economy is paramount for upcoming elections. Overall, I am heartened to se how STI is mellow in spite of the hype in the US.

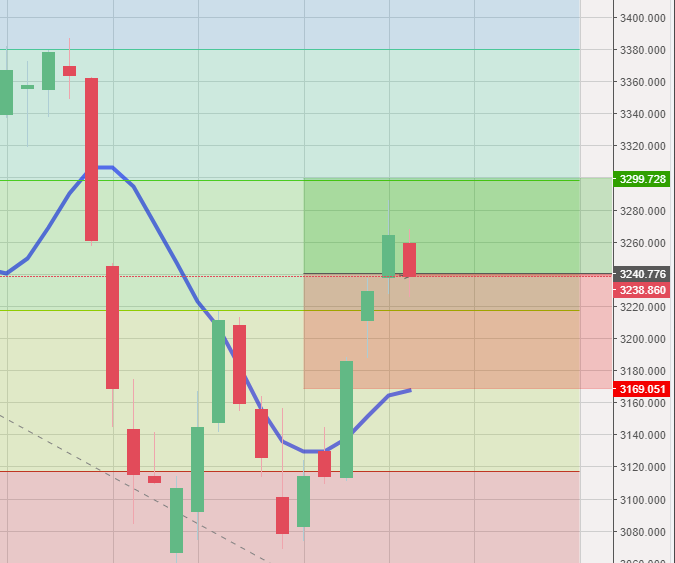

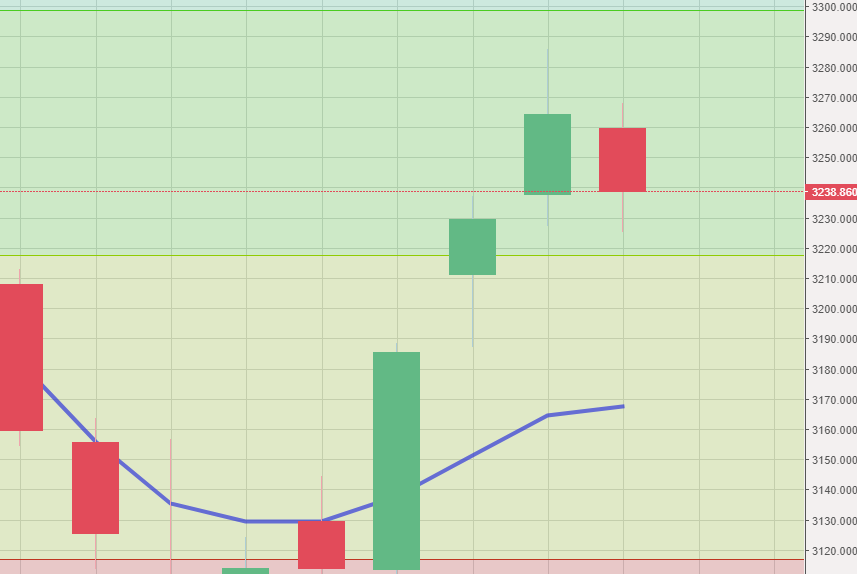

STI – Updated Weekly Chart

Lower limit is currently set at 3170 but has to first break support at around 3220. Currently the 3Q reporting is still underway so there might be further downside despite hype in US market.

As shared in past STI Market Outlooks, the rallying will continue for all markets however at a cautious rate especially for STI. The reason being that since Singapore is depending on trade as its primary revenue, it will be unwise to pump funds back into the market before the trade disputes are over. Otherwise, there will still be some form of consolidation or price actions occurring due to Quarter reports and news.

Author Calls

- STI rallying towards 3320 (Update from 3300) – Missed 3rd Nov Estimates because of many Q3 reporting especially Singtel’s (important STI constituent) 668 mil net loss

- 3220 support will be first line of defence before heading to 9 weeks MA at 3170

- Impending bad news from businesses when next Quarter reports are out (consistent)

- Market conditions are stable for a longer position as of now (Till US Elections)

- STI remains cautious for Trade talks developments between US and China