Sometimes, buying shares can be depressing because the outcome after the purchase is not what we expected. This can be worsened when we bought too many shares right before the share price fell. I will be sharing my method of de-averaging to help those of us out there who feel price trapped and are not confident of a recovery anytime soon. This technique is used to show that there are multiple perspectives to manage our holdings.

Background of Strategy

- Bought too many shares in a single contract/trade

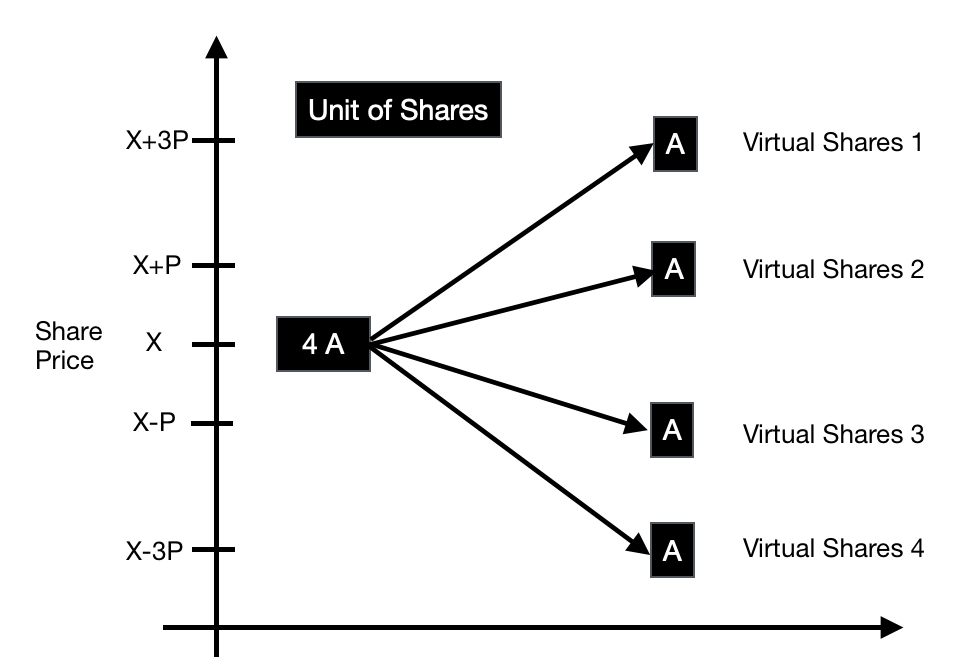

- Dividing the tranche into a suitable number of sub tranches at different prices

- Treat the single tranche as separate tranches for profitable exits

- Profitable exits will help recover capital and average down on your holdings

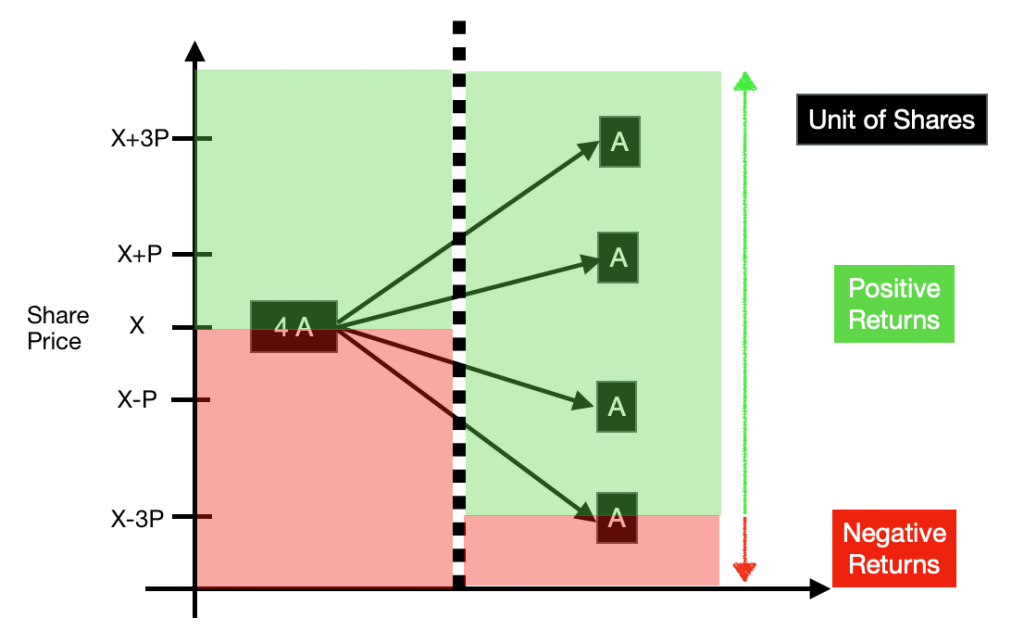

The purpose of separating the single tranche is to deliberately present 4 share prices for easier exits. Suppose you sold Virtual Shares (4) at $(X-P) after factoring commissions. That means that your profits could bring Virtual Shares (1) to Virtual Price (2) levels. This not only averages down your overall capital vested in this company but it also brings down the overall entry price of the share.

As shown in the above chart. Before you separated the single tranche into 4 separate ones, the room for exit is much as less as compared to separating into smaller tranches. The value of using this technique is to provide investors out there with more options to manage their holdings when their holdings are trapped. Additionally, we can also utilize this method when we require liquidity for another investment opportunity and without suffering any losses potentially.

Closing Thoughts

Investing is all about recognizing patterns and techniques so that we will never be out of options. Through these sharings, Loopholes Singapore hopes that more investors will be able to make informed decisions to maximize gains and minimize losses.

We believe that with greater understandings about investments, more people will dare to invest by themselves and save on commissions. Cheers and happy CNY to all.