Market Fallout Sparks Recession Fears

Triggers of market fallouts are often seen as recession triggers. Simply because our minds are able to come up with all sorts of reasons for why a recession might happen. Furthermore, this is exaggerated by dominant media channels such as CNBC and Yahoo Finance. In times like this, always refer to the videos on the same channel days before the fallout, as they will contain more optimistic views signaling that they have always been reporting to maximize viewership. In other words, take what you hear with a pinch of salt cause essentially they are just telling us all possible scenarios that might happen rather than what would happen.

In response to many on social media worried about the capital risk involved when buying shares during a fallout, do ask yourself a simple question, “Is it riskier to buy shares when it is cheaper or more expensive?” You might say the price is relative but it is can also be compared in absolute terms as well.

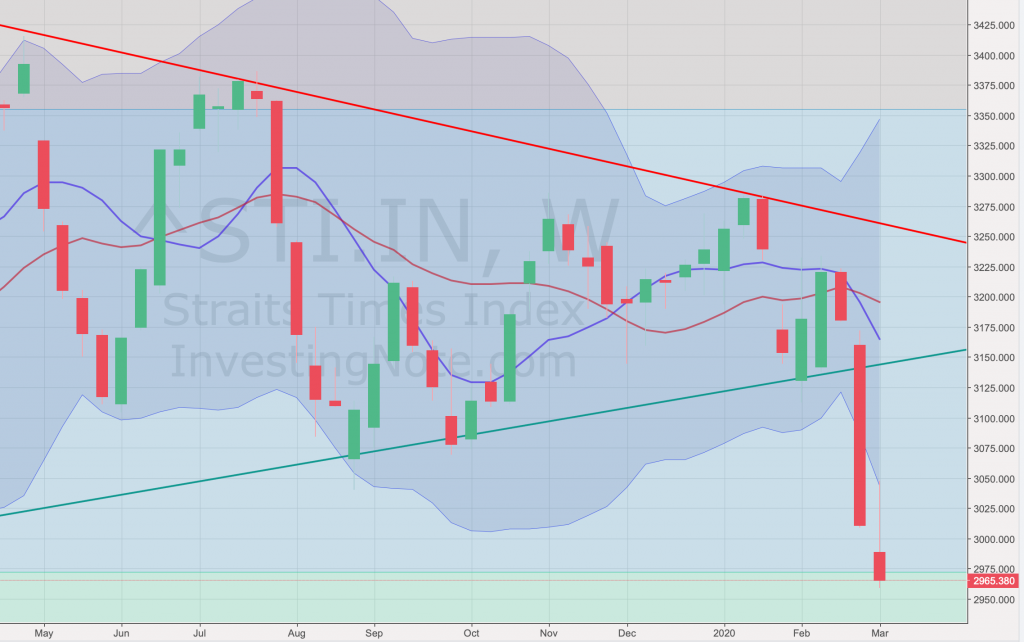

STI – Updated Weekly Chart

Last week’s candle suggests that STI did try to recover as buying pressure did return after the previous week’s selling. However, buyers did not manage to overpower sellers and STI ended slightly below the next fibo retracement levels. This suggests that STI still remains weak and buyers are likely to hold after getting further paper losses when averaging down their holdings for some shares.

Markets are confused with recessionary fears and fed rate cuts

In view of rate cuts, Banks and Reits should be weakened but somehow yield hunters are still accumulating REITs in Singapore. Banks have recently retreated below 2017 breakouts. Most evidently, all three banks are weakened by US fund rate cuts. In the coming week, the Fed might be cutting rates again and banks Net interest income and margins might continue to fall. Therefore, it is time to accumulate when it hits your targets.

Author’s Call as of 08 Mar 2020

- STI continues to weaken, Fed rate cut pushes our biggest STI constituents down (DBS, UOB, OCBC)

- Sellers continue to outweigh buyers last week, awaiting more developments for Covid-19 measures around the world.

- STI next major support levels at 2700 according to fibo retracement levels on the monthly chart

- Accumulation advised for investors with a longer time horizon

- If VIX levels continue to increase, do widen the gaps between each tranche to minimize potential paper losses

Author’s Call as of 01 Mar 2020

- STI has broke its Monthly support levels and has since retreated to 3000 levels

- Next major resistance at 2980 levels. Good time to buy banks as banks are generally doing well and are distributing higher yields 5-6%

- Looking out for news items to substantiate claims of a pandemic in the coming week or weeks to resume BAU in the world

- Great time to pick up shares which have to go on regardless of SG economic performance