Trading Ideas for C31, C52, O39, Z74, G13, 573

This list is ranked starting from weaker counters with the higher upsides to stronger counters with lower upsides. I am sharing all counters which I am looking to accumulate in this period of time. I will also be sharing some background, insights and price targets for each counter.

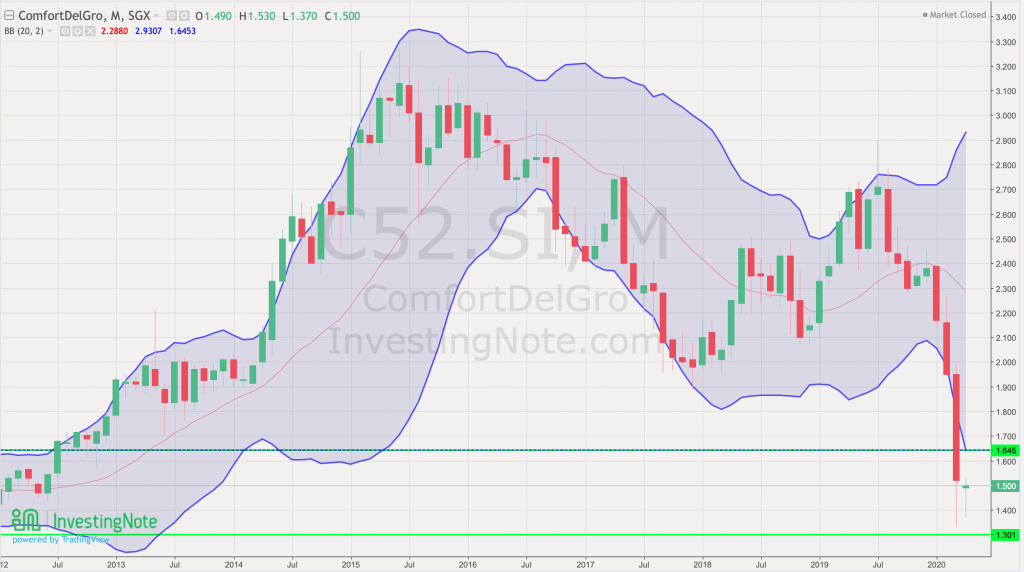

ComfortDelgro (C52) – Public transport company with a heart

Background of company

There is little doubt that CDG is heavily affected by COVID-19 and recent CB measures. Taxi lines have been piling before CB measures kicked in and fewer people are boarding buses and trains since the workforce has been told to work from home. Additionally, with margins falling due to increased track maintenance work, SBS Transit also faces rising costs albeit a fare hike in Dec 2019.

Silver Linings

- Management with a heart (rent rebates and waivers for cabbies, management pay cuts)

- The only publicly listed transport company in SG

- Competitors (Grab and Gojek) burning cash and cutting rewards and discounts

- Strong Economic Moat and diversification in the transport industry

Personal Insights

CDG is a company that has a lot of potential for collaboration and mergers with other players in the industry. Its tightly knitted business in the area of transport includes vehicle maintenance, inspection (Vicom) and public transport networks (SBS Transit). Not to mention that they are also diversified geographically around the world. In the coming years, CDG will also lead the way to create a more eco-friendly business and will be entitled to grants and support from relevant govt agencies.

Author’s Call for ComfortDegro (C52)

- Support at $1.30 is close to NAV at $1.20

- Economic Moat not to be ignored

- Subsidiaries SBS Transit and Vicom will provide support

- Merger opportunities with other industry players if competition is not viable for the long run.

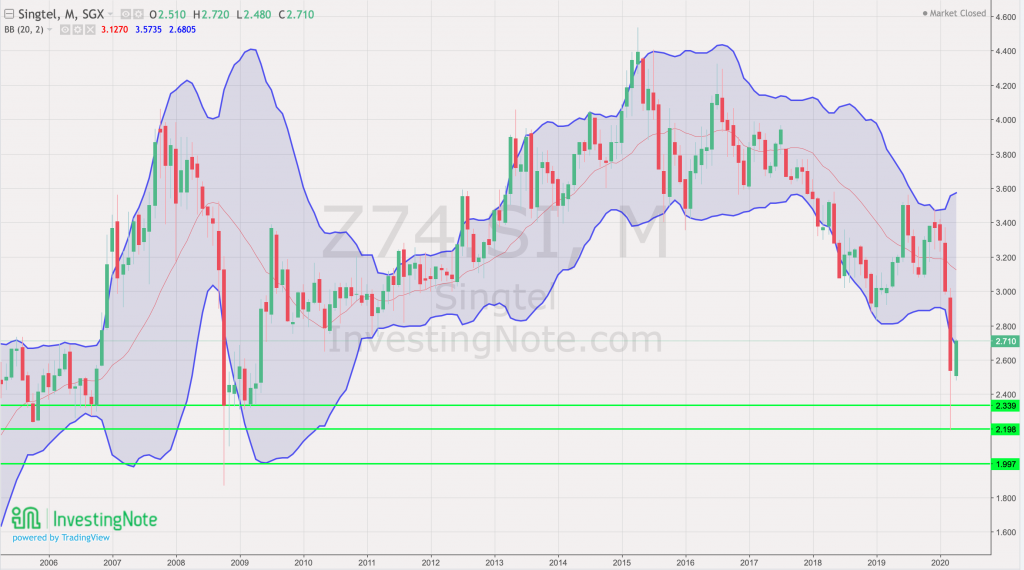

Singtel (Z74) – 5G is the next big thing in Singapore after Covid-19

Background of company

Singtel has been rather resilient before 2020 despite making huge losses in India subsidiary (Airtel) and lawsuits involving Thailand subsidiary (AIS). After COVID-19 struck the shores of our island, Singtel performed expectedly with a huge dive over panic and fears. However, with fear diminishing and some level of optimism returning to the markets, Singtel is currently doing slightly better than other counters that are also trading with huge volumes. With 5G coming soon in Singapore, Singtel has huge potential in terms of government fundings and focus from industry players tapping on 5G.

Silver Linings

- Singtel services are COVID-19 resistant (essential services during the crisis)

- Limited room for consumer services means more focus on other enterprise-level technologies and services

- 5G technology is the technology required to advance SG businesses (Self-driving tech and geographical-decentralization)

- Geographical diversification and strong backing from Temasek and AIG

Personal Insights

Simply put, there is no business or individual in SG who can function effectively without the existence of Singtel. Its long term consolidation provides for a stronger breakout when 5G is available as a consumer and enterprise service in SG. Infrastructure cost will likely come from Government grants hence CapEX is a lot less taxing for the company.

Author’s Call for Singtel (Z74)

- Singtel S1, S2, S3 are identified at $2.33, $2.20, $2.00 respectively

- Temporal weakness is expected and dividend cut will be a painful but necessary move

- Long term outlook remain rosy and essential for Singapore’s upturn and progress

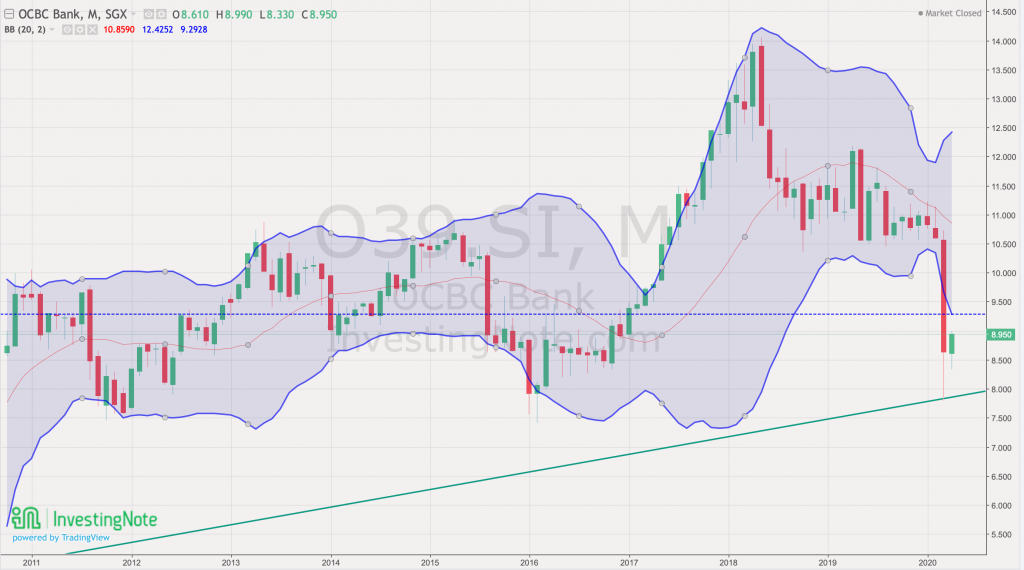

OCBC Bank (O39) – The counter with one of the longest running uptrend since inception

Background of company

Let’s face it, the fed fund rates are back to practically 0 thus net profit margins are bound to fall again in subsequent quarters. This also means that the value of money in the world has also reduced and therefore interest rates are also lessened. Not to mention the recent announcement from Monetary Associating of Singapore preventing banks from buying back shares with newly borrowed capital. However, with the banks functioning as an essential part of Singapore business and Singaporeans’s lives, we can expect a sizable upside albeit lower growth potential in the coming years. That is unless the US pushes the Fed Funds Rates up again in the future. (PS: it is highly unlikely in a large way due to debt levels but who knows?)

Silver Linings

- Short term weakness presented by differing of loans and lower NIM but longer term commitments ensured

- More cash stored in bank during downturn allows banks to also benefit from market weaknesses through investment arm

- Reflexive business models and is a strong competitor in the banking industry

- Diversification in China and Indonesia increases resilience over the long run

Personal Insights

OCBC has been a business that has cared for its customers throughout each crisis. Its business model has also proven innovative and resilient throughout its history. Focus on consumer banking has paid off with its “360 accounts.” Not to mention its diversification into the insurance business Great Eastern.

Author’s Call for OCBC (O39)

- NAV is above $10 hence buying below NAV provides a certain level of assurance

- Loans are less profitable this year with rate cuts and interest payments deferment

- Uptrend support intact and purchases close to $8 is a decent price target

Genting Singapore (G13) – Heavily invested revenue generating machine for Singapore

Background of company

Genting Singapore, the backbone of Sentosa is hard hit by the immediate COVID-19 situation. With the government support in its business, Genting Singapore will survive the CB measures but still suffering loss of revenue for its tenants and businesses. However, understanding the value of the company and importance of tourism in SG, Genting Singapore is definitely a counter that has long term potential for growth.

Silver Linings

- Long term outlook stable and expansion plans are already in placed albeit (put on hold)

- Revenue has been stable and profit margins have been decent (before COVID-19)

- Its owned by Genting Bhd with expertise and influence in the industry in the region

- Tax rebates provided by the SG budget will be helpful to tide past current difficult times

Personal Insights

In recent days, it has hovered around 70 cents and has attempted to go above the lower limit of Bollinger bands however it is likely a pump and dump situation at the moment. Look out for news with regards to restarting the economic engine in Singapore for another aggressive rally for Genting Singapore

Author’s Call for Genting Singapore (G13)

- G13 remains the backbone of tourism industry

- Although hard hit, its rebound will be strong with expansionary plans intact

- Strong resistance at NAV of $0.668 and government support for the industry provides temporal cushion

Challenger (573) – The “Sheng Siong” of consumer Electrics

Background of company

Challenger is a powerful dividend-generating counter since inception. Its high amount of cash in hand is also comforting for many investors. Its business model is consumer-centric and intelligently diversified into online sales and delivery. The Challenger membership program (ValueClub) has also helped retained many consumers in the Singapore Market. Though its stores are temporarily closed due to CB measures, Challenger’s delivery arm Hatchi Tech is still supplying goods to consumers.

Silver Lining

- Strong consumer presence and membership retention

- Balance comforting to investors and overall business sustainability

- Expansion plans are reasonable and reflexive (mini-stores to flagship stores)

- House brands also increase profit margins for essential consumer appliances

Personal Insights

In short, This company functions at a slightly lesser extent to our favorite Sheng Siong counter in Singapore. Although less “essential”, its business will still be a consumer staple whenever there is a need to buy computer appliances and gadgets for many local residents. Its membership privilege (ValueClub) is also attractive and generous. In general, companies that care for their consumers are companies that will stand the test of time and trials.

Author’s Call for Challenger (573)

- Delist price at $0.56 showing a Fair value of around $0.53 with a slight premium of 3 Cents.

- High cash balance and delivery services present to tide past the crisis

- Price at $0.40 is still decent for entry with a 25% upside potential

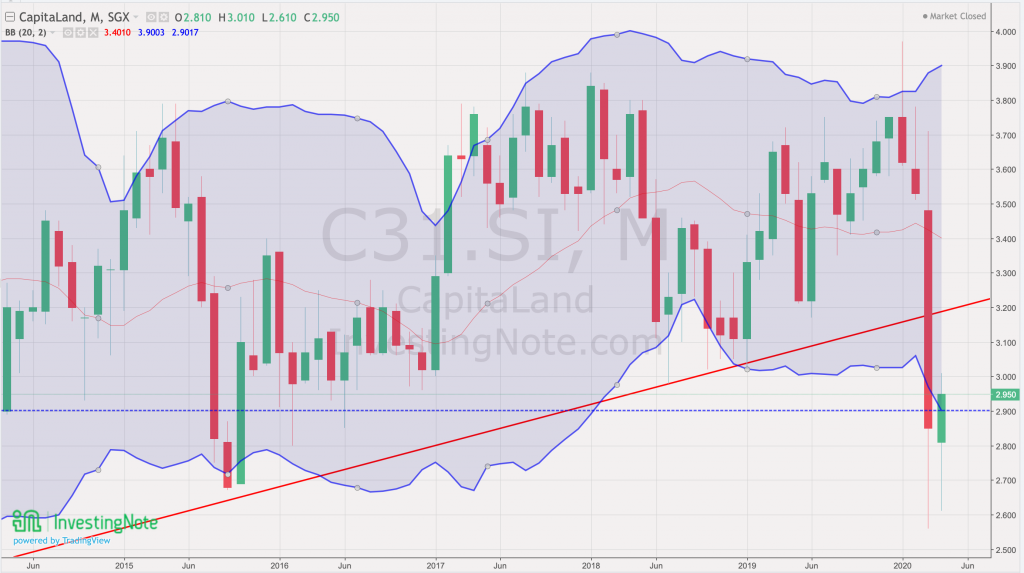

Capitaland (C31) – Diversified Presence in commercial and industrial properties

Background of company

Capitaland is a huge company in the area of real estate development and management. Its global presence has paid off with steady growth in revenue. Coupled with backing from Temasek and its experience and influence gained in the industry, it is a true giant that might fall from time to time but is too big to fail.

Silver Lining

- Capitaland has achieved steady revenue growth and presence in the market

- Dividends have been modest all these years hence there is little fear for dividend cut and panic from investors

- 100% commercial tax rebate helps sustain tenants during CB measures

- Cut and pay freeze in management shows commitment to tide past difficult times

Personal Insights

Capitaland’s high Net Asset Value ($4.62) also provides assurance to value investors. It is seriously experiencing the same phenomena of being “Asset Rich, Moderate Cash flow” as average middle-class Singaporeans. In my humble opinion, buying Capitaland is very similar to buying an HDB as an investment in my opinion.

Author’s Call for Capitaland (C31)

- NAV is at $4.62 and revenue growth has been steady in the past few years

- Buying below $3.00 remains a bargain at the moment

- Price is still within Bollinger Band limits showing the market’s interest in the counter

Closing thoughts

Needless to say, please do your own due diligence and these trading ideas and author calls do not provide any level of certainty for investors to lean on. However, I hope that these short summaries can provide more people with basic insights into companies shared In this post. Right now, I guess we should be planning rather than acting due to the recent hype caused by excessive liquidity in the markets. As a rule, never go all-in into any of the companies you are interested in, always practice discipline in your trades and purchase reasonably sized tranches (depending on your war chest) because it is always better to earn less than lose more in a bear market.