IS this the Rise of Modern Monetary Policy

The Fed is making the gamble of the century, basically, the Fed is borrowing almost free money to buy securities which will be transferred to investors after the economy recovers. At the moment, the US government is buying securities of every asset classes including junk bonds to treasury notes to stabilize the lowest yield investments. The purpose of these large scale purchases is to subdue panic sellers and stabilizing prices of low yield assets. As a result, those assets will have immunity against defaults and central governments will still be able to rest on the dollar for their own national credit facilities and stabilize their own currency.

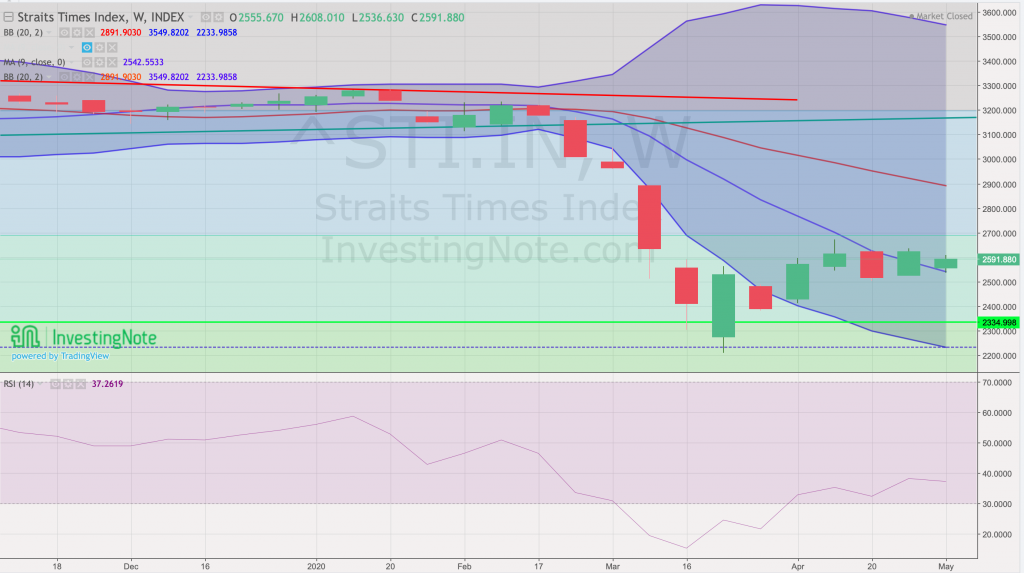

STI – Updated Weekly Chart

Last week’s candle stick opened above 7 week MA and closed above it. Overall price movements are not great but there will be some level of support by the 7 week moving average. On the other hand, do note that the weekly candle stick did close below last week’s weekly candle stick. Therefore, RSI has also recorded a slightly lower score.

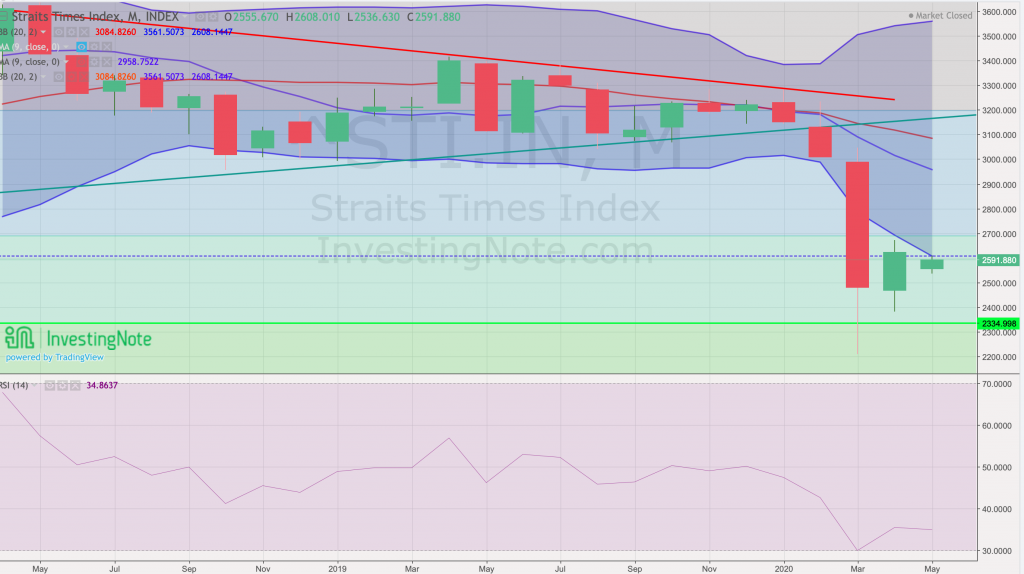

STI – Updated Monthly Chart

Less is more for STI’s monthly chart, so far, we are still limited by the lower Bollinger bands, thus showing the weakness in the market and economy. However, since the monthly candlestick is currently nearer to the lower bands, it also means that we are retesting the resistance soon.

Author’s Call as of 10th May 2020

- Fed’s unlimited QE and 2.3 trillion dollars is working well in stabilizing the global markets (US indices also closed at a month’s high of 2929)

- There is a detachment of economic data and the stock market at the moment

- STI is likely to open with a gap up on 11th May 2020

- As asset prices stabilize no matter how strong bear investors are, bulls will return aggressively

- Averaging up is a reasonable strategy at the moment but do expect VIX to return to 30 points in the coming weeks

Author’s Call as of 3rd May 2020

- Many investors are hopeful because Remdesivir currently being used for some severe cases around the world (one step closers to cure or vaccine)

- US indices closed lower on week’s closing, STI likely to open with a GAP downwards

- Singapore’s economy is showing signs of weakness and investors are unsure if its fully priced in completely or excessively

- US politics are getting increasingly messy again. (Potential conflict with China)

- Money is way too cheap and might be devalued once reality sets in. (Assets might increase in value drastically)