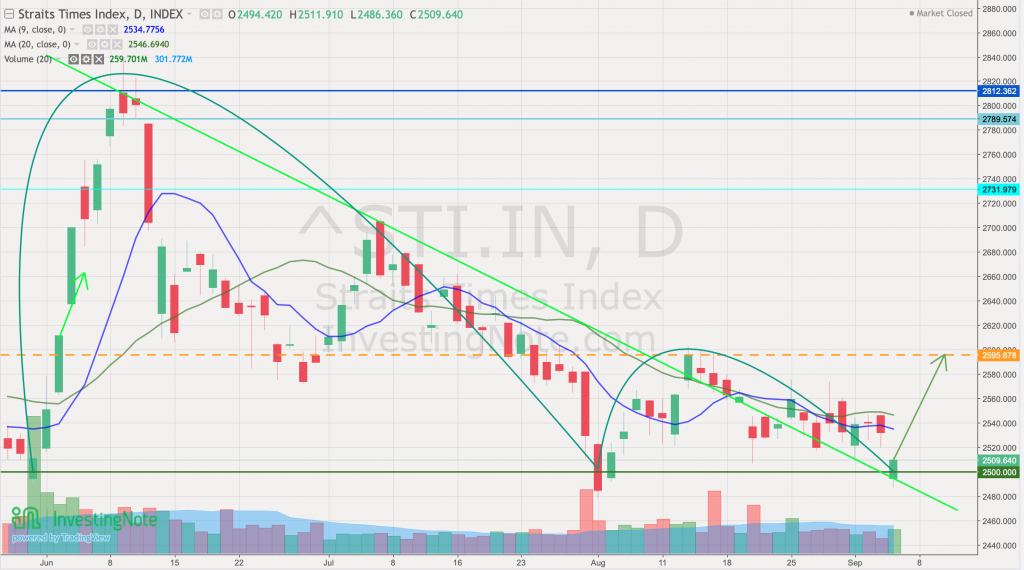

Triple Bottom Formation Signals Bullish trend

US indices dipped and STI opened with a gap down. This led to significant price movements on Friday morning, but during the day investors started to react defensively and pushed the STI back above 2500 points and closed at 2509. No doubt there wasn’t a massive volume traded to show strong rejection of the breaking of 2500 support levels, we can expect STI to be supported by 2500 levels in the interim. However, if US corrections continue (as of Friday closing the US closed slightly lower albeit much higher), we should expect more weakness ahead and rely on the weekly chart instead.

STI – Updated Daily Chart

STI closed above 2500 support levels formed in April 2020. At the moment, STI should be one of the more realistic indexes in the global economy. Our sideways consolidation is justified by the weakened global economy in addition to the pandemic. Therefore we should expect STI to stay around this level unless there is further bad news within the country since the country is still very much reserved.

STI – Updated Weekly Chart

As shown on the weekly chart, STI is still hovering around the yellow band of the fibo retracement channel. As of last week, STI nearly hit the support level of 2491 but it quickly returned to the 2500 level. Nevertheless, STI still closed on the red and the downtrend and consolidation continue. Look out for change in daily volume for bullish signals.

Special Feature – Singtel (Z74)

Singtel’s weakness is based on the lack of confidence on the recovery of this telecom giant however, we need to understand that Singtel is not well-positioned in the interim for massive support from the Govt because SIA’s difficulties are prioritized by the Govt. that said, Singtel remains to be a good counter to accumulate for the long term before 5G kicks in full force for Singtel and its subsidiaries to get a spike in 5G revenue.

Author’s Call as of 6th September 2020

- US Market correction led to STI’s stumble on Friday but STI closed above 2500 support on Friday (without volume support)

- Singapore market is still showing no significant signs of recovery but is still holding steady at the moment

- Triple bottom formation signals bullish price action

- The further downside in STI is possible but several clue chip counters are already undervalued

Author’s Call as of 30th August 2020

- US market is making the world nervous because FANGS are defying all odds on its continued growth (perhaps related to the US election)

- STI has not given up on a sideways consolidation trend and investors are not showing interest to hold for longer-term

- Short term interest in STI components continue to dominate the index (frequent profit-taking)

- Value is surfacing for domestic counters involving transport such as SBSTransit (S61) and ComfortDelgro (C52)