We are back on Track for the uptrend (parallel channel marked)

STI is showing early signs of a trend reversal in recent weeks as there is a consistent rebound from around 2520 to 2533. As Singapore is heading towards phase 3 in the coming weeks, many companies will benefit from the increasing number of international visitors and tourists. As for Singapore businesses, revenues have largely stabilized however many businesses will not be reporting Q3 performance therefore the market might be less excited. Another possible reason why the markets are not recovering as fast as we would like it to is that dividends distributions are reduced drastically due to the state of the economy. Lastly, in anticipation of the US elections, we will continue to expect high volatility in the coming weeks before 3rd Nov.

STI – Updated Daily Chart

I have decided to mark out a new parallel channel since there is a consistent uptrend support line created by the trough in March and recent daily lows. This uptrend parallel channel will be tested in the coming weeks and I will continue to monitor my holdings in relation to horizontal resistance levels. As the index is led primarily by banks, we should compare the index performance with the banks to see if the trend is valid for specific non-bank constituents in STI.

STI – Updated Weekly Chart

STI finally closed about 2533 support level after a volatile week caused by the US elections as well as discussions about the debate about the relief budget between the house and senate, which is primarily a partisan matter. On the weekly chart, we continue to see STI’s resilience but at the moment It is still too early to celebrate.

Special Feature (Nanofilm IPO)

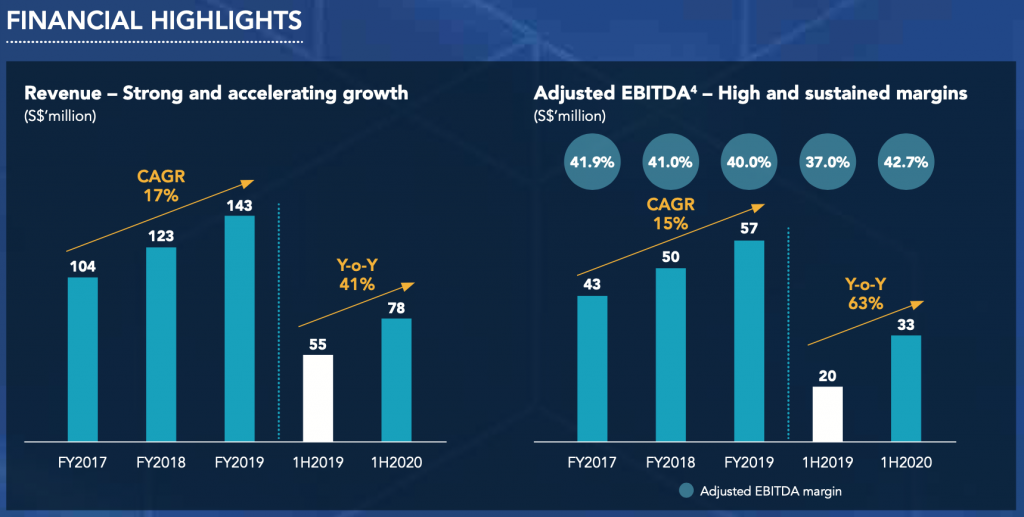

Nanofilm IPO has been in the spotlight for a while now. Needless to say, it is one of the companies that is making strides in the future of smart device technology. I am not an expert in the area of tech but after looking at the product highlight and prospectus, I believe that the above Compound Average Growth Rate (CAGR) is convincing enough to show that this company is doing well in the past years. Furthermore, this company is also well attached to the supply chain of products that are in high demand. My honest opinion is if you are intending to diversify into a tech company that has a relatively long runway, then this IPO presents a possible opportunity.

Author’s Call as of 25th October 2020

- STI closed about 2533 and uptrend support is formed

- The daily chart shows early signs of a trend reversal

- The US elections and discussion on the relief budget continue to cause volatility in the markets

- The weekly chart shows mixed signals as STI closed only marginally higher than last week.

Author’s Call as of 18th October 2020

- The US election continues to increase volatility for the global markets

- STI closed at around the same support level of 2533 similar to last week’s closing

- Inconclusive evidence on STI’s charts to see if there is a trend reversal at the moment from bearish to bullish

- Fund flows are showing signs of trend reversal however buying volume is still close to 0.