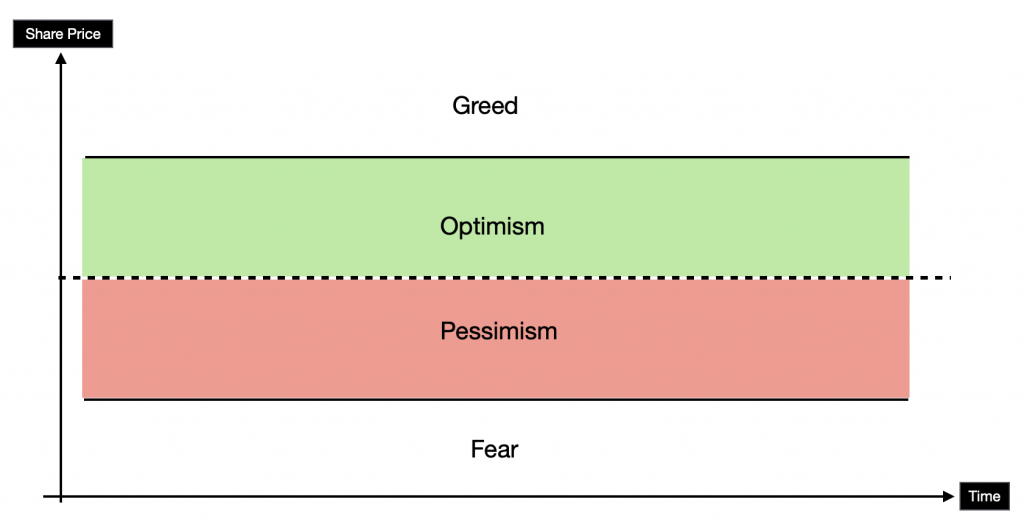

There are 4 general emotional states when investing in stocks, they are Greed, Optimism, Pessimism, and fear. These four emotional state affects our perception in terms of how well our stocks are performing. Usually, when the market is less volatile, our emotional states will alternate between optimism and pessimism as the daily fluctuations do not deviate too much. However, in recent weeks, the markets have become more volatile due to the US elections, this has caused higher trade volumes and increases volatility. As such, stock prices and markets have gone beyond the usual boundaries of optimism and pessimism into greed and fear territories, causing investors to feel overwhelmed and indecisive. In response to that, this week’s post will be centered on the emotional state of investors and how should we self-evaluate our own emotional state to prevent making impulsive decisions.

The 4 emotional states of investors

The simple model above shows how we view our stock performance at any given time. When the stock price goes above the entry price, investors will usually feel optimistic about their investments, however, this changes quickly when it goes below the entry price. Beyond that, the emotional state of the investor would have gone into fear or greed when prices dip or spike. Even though we can all agree that these four emotions are valid, it is still too simplistic because our portfolios are normally made of multiple counters and prices do not always go up or down simultaneously. That is why investors usually have mixed feelings about their portfolios. One common advice from experienced investors is to ignore emotions when investing in stocks because the daily fluctuations are only temporal but it is still hard to deny that certain price movements might throw us off from time to time.

Emotional states are relative and sometimes illogical

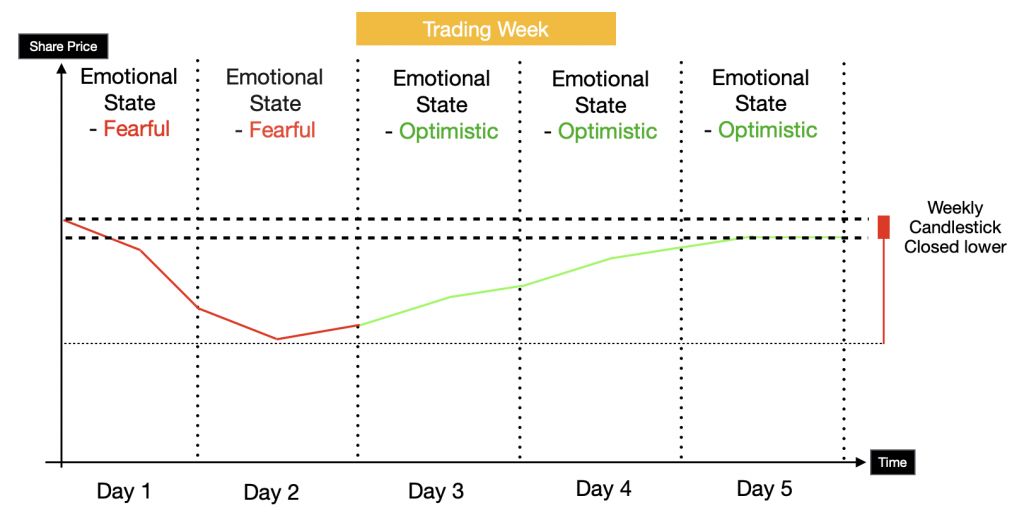

As much as some of us want to think that we are persistently logical and immune to investment anxiety, we are still subjected to laws of relativity. In this case, we can refer to the example above which shows a 5 days chart that closed lower than day one’s price. The scenario above resulted in the investor feeling optimistic for the last three days despite the slight dip at the end of the week. Such scenarios are common for many experienced investors as we quickly adapt to gains and losses. That said, it would still be hard to omit all effects of price movements so it is necessary to remind ourselves to stay objective.

Ideal emotional state for investors

It is easier said than done but the best emotional state of investors is actually to stay calm and spot opportunities in every scenario. When the market is trending in an illogical way, the best thing to do might be to sell parts of your holdings and make small profits (relative) whenever possible. Alternatively, there is also another option for the investor to just accumulate stocks during turbulent times and hold for higher dividend yields or capital gains in the long run.

Closing Thoughts

Whatever happens, stay calm and think before making a move even if it means losing a couple of bucks. When investing, it is almost impossible to predict the trough and peak, therefore, it is never a wrong move to take a step back when you are overwhelmed by emotions. From experience, try to evaluate the situation based on both market and industry conditions. For example, in the case of a pandemic, do not assume that the peak of a stock is akin to pre-COVID times but at the same time, do not overly underestimate it as well. Chances are that it will be way more profitable to hold in the case of an industry or market-wide crisis until the recovery is fairly priced in. On the other hand, if you are trading for short term profits, set realistic absolute profit targets and execute your orders accordingly.