This post is not meant to argue whether the buy and hold strategy works better than active trading because I believe that many of us utilize both techniques in reality. The purpose of this post is to explain why making calculated decisions will maximize your capital’s opportunity costs. This topic came up when many people are waiting for their holdings to hit an extremely far off target before selling however, recent events in the market will probably make you question your decision. In today’s post, I will be using three scenarios to explain why taking action can be the best choice when the market is consolidating.

Again, these scenarios do not factor in trading commissions hence you should do some calculations with online calculators before selling to see if the profits are significant enough. Otherwise, you can always choose to add on to your holdings so that the cost of trading will be diminished.

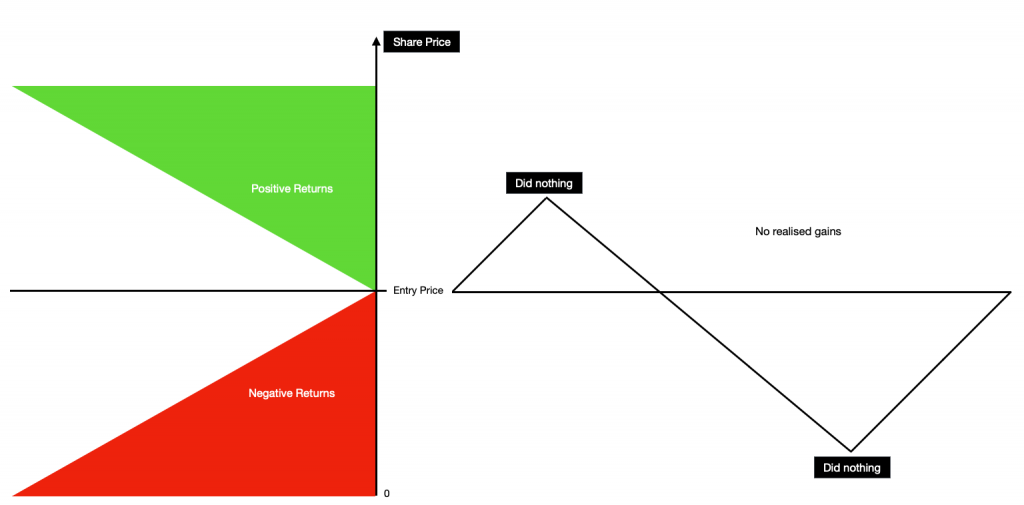

Doing nothing and hoping for the best

Basically, the example above clearly shows the mental model of most investors out there who do not monitor the market. When occasionally looking at their holdings, they will just review their stock’s performances relative to their entry prices. While there are no losses made, we cant clearly see that passive investors are missing out on opportunities as the stock price fluctuates. Some of these investors justify their decisions to buy and hold because they do not have the time to monitor the markets. But over time, this passivity will become a habit and thus lead to stacking “losses” due to opportunity costs.

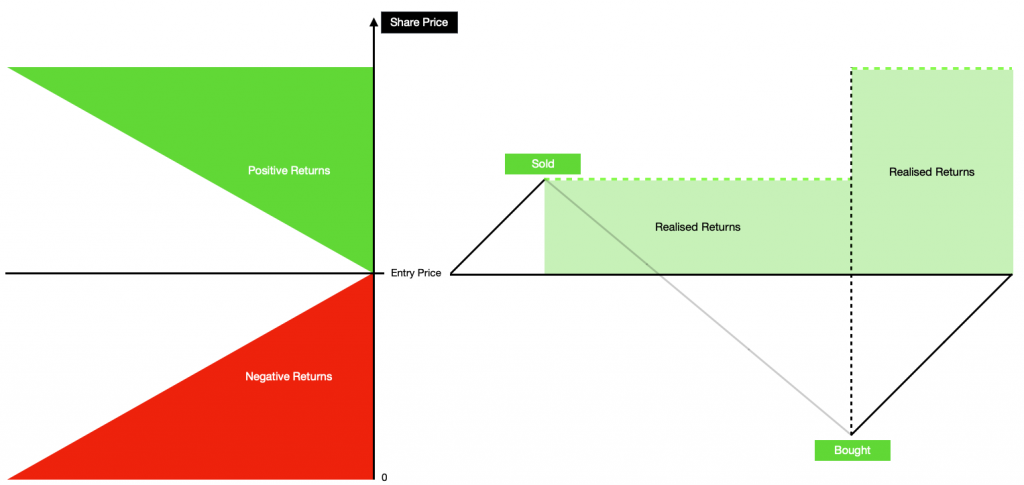

Making one decisions and backing out

Commissions do hurt our profits over time however staying out of the market costs even more. In the above example, the person made a quick profit by selling all of his or her holdings when the price went up. However, since there were no follow-ups, the person will no longer be entitled to any of the happenings in the market. This is one of the common reasons why peopled do not sell because they do not know when they should reenter. My best advice for beginners trying out occasional trading is to buy back at the original entry price. That way, you would have secured the profits you made from the previous exit. You can then add on with lower capital risks if the price goes down further.

Seizing opportunities of price fluctuations

This example above demonstrates the ideal situation of trading and that is to seize every uptrend and exit before every downtrend. Even though it is difficult to catch prices, there is no need to doubt that with sufficient experience and practice, you will be able to benefit from these situations more frequently. As an investor and a trader, my main job is to ensure that there are minimal losses due to opportunity cost. The bottom line is to keep making calculated decisions and continue improving your strategies depending on how much funds you have left.

Closing Thoughts

If you are experienced in investments, you will start to notice the blurring of the divide between investing and trading. The examples shown above shows why we should only be passive by choice rather than feigning ignorance when investing. My best advice is to study the price movements after buying the first tranche and monitoring it to identify potential entry and exit points. Calculate your profits and execute when the price hits. You will always have the opportunity to buy back even if the price continues to climb and still suffer no real losses.