Buying stocks at the right time (otherwise known as timing the market) is arguable difficult or impossible to do therefore some people resort to following trends. In some sense, trend following is akin to making a bet if you do not understand the reason behind the supposed trend. That said, in some cases, following the trend can result in making a profit hence it has been highly debatable whether it is advisable to do so. In this post, we will be finding out the impact of entering the market as a follower as compared to someone who has bought the stock before an apparent trend is spotted. More importantly, we would also like to emphasize the importance of doing advanced planning and making informed choices when investing to minimize losses and maximizing gains.

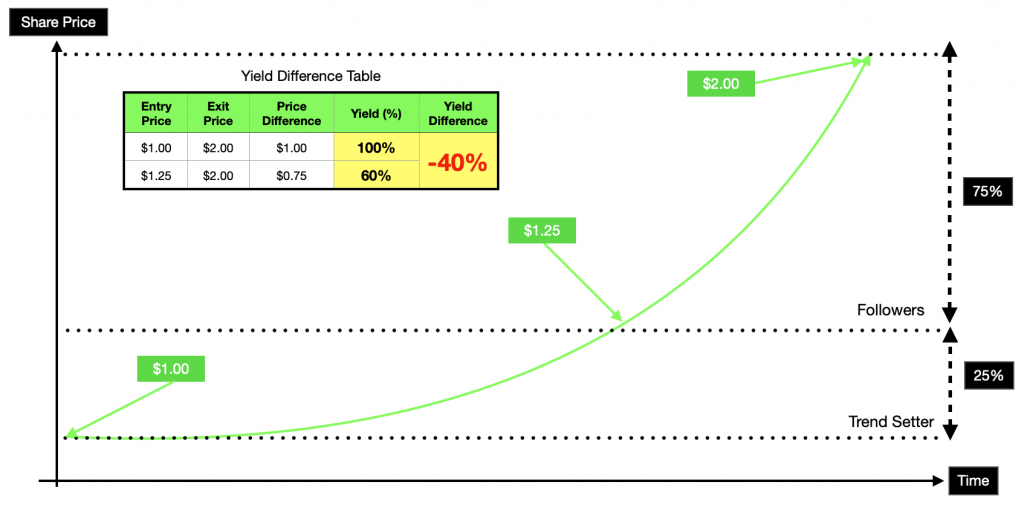

Trend Follower 1 (When things are going well)

Honestly, it is hard to explain my point using the above scenario because both the trendsetter and follower made a healthy yield of 100% and 60% respectively. Hence, I had to exaggerate the price range between both entry and exit points to elucidate the difference in yield. From the above example. The trendsetter who has properly studied the stock and has made calculated risk assessment bought when the trend was not apparent. As a result, that investor made an additional 40% when he exited at the same price of $2.00. No doubt the actual difference is only $0.25 but the relative difference between the follower and trendsetter is 20% ($1.25) and 25% ($1.00) respectively resulting in 40% difference in yield.

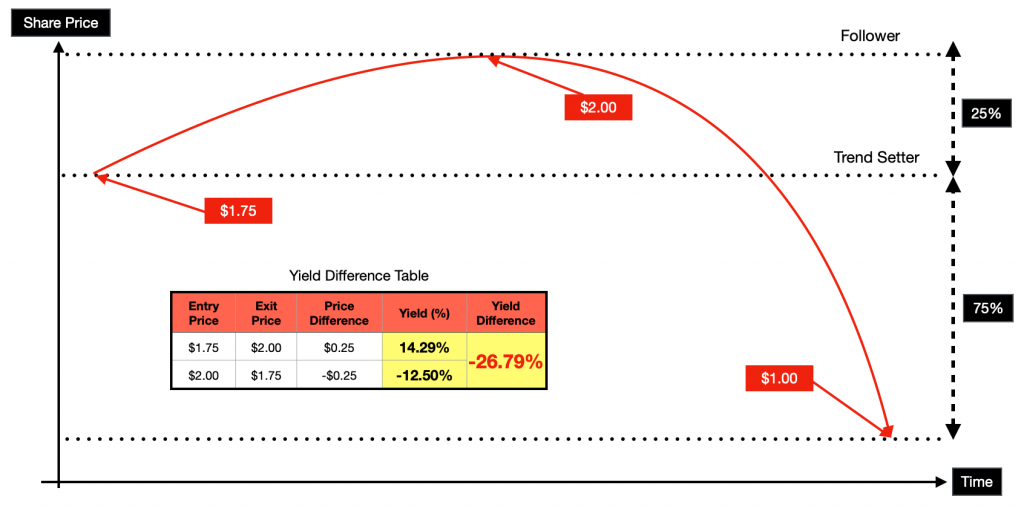

Trend Follower 2 (When things are not going well)

Let’s compare the outcome when things are not going so well. From the above example, the follower assumed that the uptrend would continue but it did not. On the other hand, the trendsetter is able to exit at around $2.00 for a tidy profit of around 12-14% as daily traded volume starts to decrease. From this fabricated example. we learn that followers are not only getting lower yields (from Scenario 1) but also at risk of buying at a hype which may lead to heavy losses. The yield difference of -26.79% for the follower is a clear indication that it was not a wise choice to follow as you might overestimate the lifespan of the uptrend.

Trend followers in general are essentially gamblers

We all agree that the main objective of investing is to make a profit however we need to face the harsh reality that it is not going to be easy to be a successful investor. It always boils down to how we arrive at the moment before pressing the buy or sell button. This consideration process should always include potential downsides, time horizon, and yield potential. At the end of the day, all investors are trying to prevent ourselves from regretting our actions.

Closing Thoughts

In Mandarin, we have a saying, 守株待兔, which means to wait for opportunities to come to you being a bad practice in life. I find that idiom extremely apt to describe some investors, especially those who have profited from such a method before. Or rather, I would like to mention that if it was that easy, then there is absolutely no reason to learn how to invest at all. If we have the time to wait for trends to form, why not spend it on studying and learning more about investments the right way? Loopholes Singapore is committed to investing in your investment journey and providing valuable perspectives in response to the latest discussions about finance and investments.