As markets return to almost pre-COVID levels, our levels of stress, fear, and greed are also returning to normal. Essentially, investors will start to evaluate stocks at a much higher valuation and a lower level of fear (compared to 2020). As such, we are presented with lower potential upsides and at much lower volatility (harder to hit entry price targets). Why I am writing about this now is because I think it is high time to acknowledge and address these mental struggles we share as investors. I hope that through my sharing and further discussion, we will be able to strengthen our strategies and clarify doubts so that we can continue to maximize our gains and minimize our losses.

The constant battle between Fear and FOMO

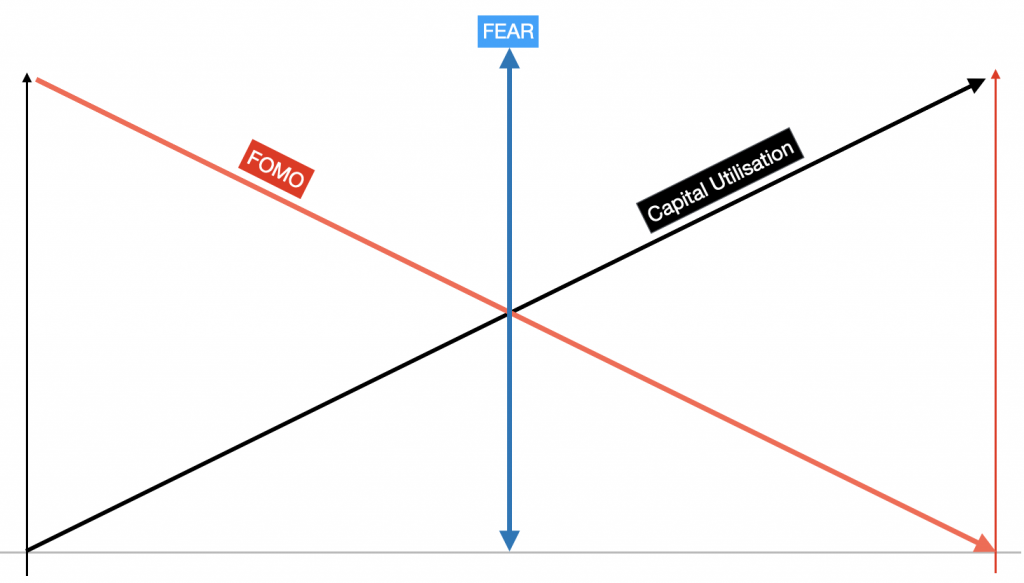

Investing is definitely no joke to many investors. On the outside, we are self-interested individuals deploying capital in hope of getting positive yields from the financial market. In actual fact, investors go through many periods of self-doubt and uncertainties as the markets remain illogical during periods of higher volatility. In particular, I believe that the level of fear and FOMO is constantly opposing one another, thus causing contradictions between our thoughts and actions. At the moment, the markets are near their all-time highs hence, it is hard to forecast the next exit target. Also, there is also a real danger of a sudden steep correction caused by various triggers in the world. This puts us in yet another difficult position where we are unsure of whether to buy, hold or sell our positions.

The level of capital utilization is always contrary to the level of FOMO

The fear of missing out is one of the greatest fear of any investor because failure to take action might cost us a substantial loss in terms of opportunity costs. On the other hand, when more capital has been deployed, investors also risk making higher amounts of paper losses when some stock price dips. Appreciating this situation allows us to fine-tune our strategies to best suit our risk appetite as well as profit targets in the near term. I recall deploying the last tranches of capital during the 2020 financial crisis when there seems to be no bottom as the markets continue to move with sharp turns without warning. At that point, I believe most of us struggled between waiting for lower prices and taking action as valuations are already low enough based on technical or fundamental analysis. Moving forward, I do expect us to experience a somewhat similar dilemma again albeit in the opposite way where we will be tempted to sell and stay on the sidelines to wait for a lower reentry point.

Fear grows as capital utilization increases

Last but not least, the level of fear is always correlated with capital utilization and the obvious reason is that the more percentage of capital vested results in higher absolute paper losses. To appreciate this better, I strongly recommend new investors to check out the post on the real cost of dollar-cost averaging because even with the best strategies, paper losses are unavoidable. Although it is counterintuitive, sometimes the higher the amount of paper losses can be a good thing for one’s investment portfolio so long as the strategy employed is carefully curated to fit one’s risk appetite.

Closing Thoughts

Besides sharing my candid experiences as an investor, I do hope that more veteran investors can engage younger investors to help them in their investment journeys. Being bombarded by modern forms of greed-initiated investment strategies, I sincerely worry for inexperienced traders and investors as they are misled to think that it is easy to achieve high yields so long as they follow the crowd. Honestly speaking, those kinds of beliefs will only lead to an increasing number of market losers over the long run.